Running a business today is not just about selling products or services. It’s about financial resilience — managing cash flow, ensuring compliance, scaling efficiently, and preparing for risks before they hit. That’s why more U.S. companies are now switching to Virtual CFO services.

But what’s driving this rapid shift?

Let’s break it down in a clear, conversational way.

What Are Virtual CFO Services?

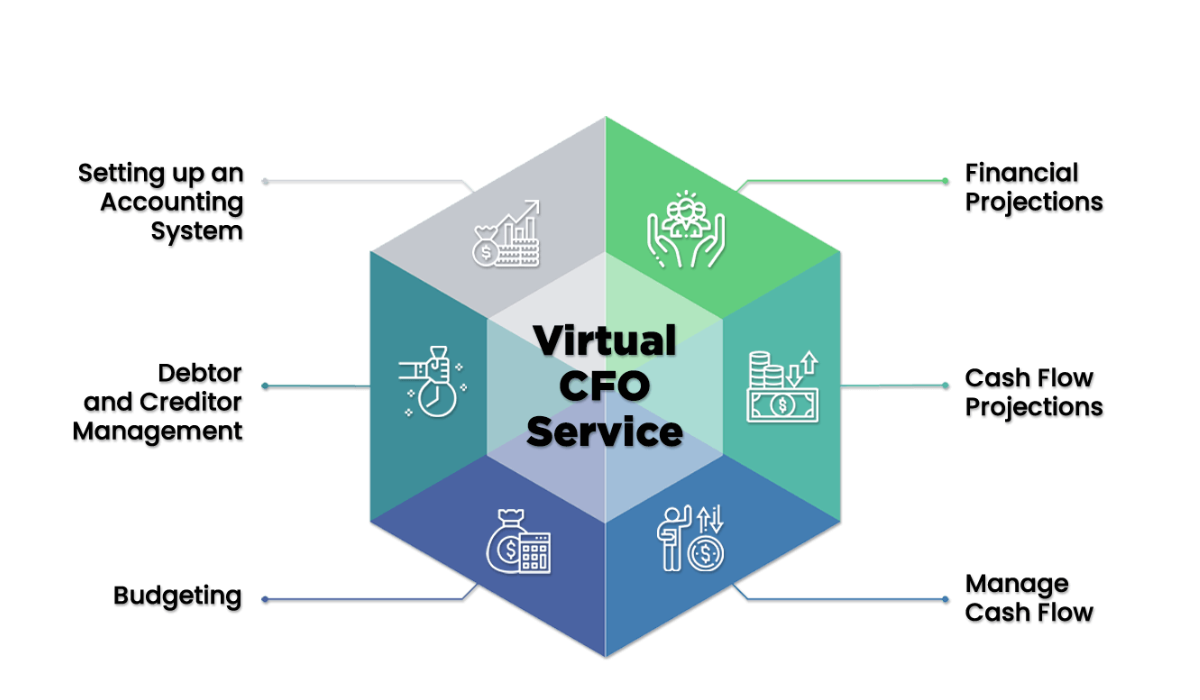

A Virtual CFO provides the same expertise as a full-time Chief Financial Officer but works remotely and at a fraction of the cost. Companies get:

- Financial planning & budgeting

- Cash flow monitoring

- Tax advisory & compliance

- KPI tracking & performance insights

- Forecasting & strategic decision support

- Investor reporting for funding-stage businesses

In short: a real CFO, but flexible and cost-efficient.

Why Are US Businesses Adopting Virtual CFO Services Fast?

1.The Cost Advantage Is Huge

Hiring an in-house CFO in the USA can cost:

- $200,000–$450,000/year including benefits & bonuses

- Plus overhead like office space and administration

A Virtual CFO can cost 60–75% less while delivering the same business value.

📌 Most small and mid-sized businesses can’t justify a full-time CFO until they cross $50M+ revenue — but they still need CFO-level decisions today.

2.On-Demand Expertise That Scales With the Business

Traditional CFOs are full-time regardless of workload.

Virtual CFOs are flexible, allowing businesses to scale support up or down:

3.Better Technology = Better Decision-Making

Virtual CFOs typically work with advanced cloud accounting and analytics tools such as:

- QuickBooks / Xero

- NetSuite / Sage

- Power BI / Tableau

- Bill.com, Gusto, Stripe

These tools provide:

- Real-time dashboards

•Automated reporting

• Accurate forecasting

• Data-driven insights

So leadership teams make faster, more informed decisions.

4.Overcoming Financial Blind Spots

If you are a founder or owner, ask yourself:

- Do I know my real margins by product or service?

- Can I predict revenue dips before they occur?

- Do I have a plan for tax efficiency and cash preservation?

- Is investor confidence strong enough for future rounds?

A Virtual CFO helps answer these questions with:

- Deep industry experience

• Financial controls & risk management

• KPIs tailored to your business model

vCFOs keep your business financially accountable and future-ready.

5.Supporting Compliance and Tax Strategy in a Changing Landscape

With evolving U.S. regulations — SALT rules, sales tax nexus, IRS updates — financial compliance is tougher than ever.

Virtual CFO teams stay on top of:

- Federal and state tax requirements

- GAAP/IFRS compliance

- Audit support & internal controls

- Fraud prevention and cybersecurity measures

They ensure zero compliance blind spots.

Offshore Virtual CFO Models: Why They Work:

Many U.S. companies pair onshore strategy with offshore execution — especially in India — to unlock:

- Cost efficiency

- 24/7 productivity

- Larger talent pool

- Advanced finance automation

This hybrid model ensures:

- U.S. compliance standards

- Top-tier financial expertise

- Global scalability

- Less hiring stress for owners

It’s a win-win setup for modern finance teams.

A Virtual CFO is not a cost — it’s a growth investment.

Final Thought: Why Switch Now?

The financial landscape is moving faster than ever.

Businesses that stay reactive often fall behind.

A Virtual CFO helps companies:

- Gain clarity

• Optimize profitability

• Strengthen resilience

• Scale confidently

If your business is growing — or plans to — then switching to Virtual CFO services could be one of the smartest decisions you make.