Aliphatic Hydrocarbon Solvents & Thinners Market Overview:

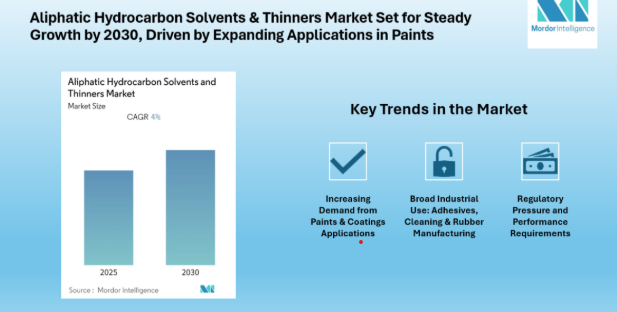

The global Aliphatic Hydrocarbon Solvents & Thinners Market is projected to expand steadily between 2025 and 2030, recording a Compound Annual Growth Rate (CAGR) of nearly 4.0% during the forecast period. Growth is fueled by rising demand across a wide range of applications, including paints & coatings, adhesives, cleaning & degreasing, and rubber manufacturing. Among all regions, Asia-Pacific stands out as the largest consumer today and is expected to remain the fastest-growing market through 2030.

Explore the full report for in-depth insights and market forecasts: https://www.mordorintelligence.com/industry-reports/aliphatic-hydrocarbon-solvents-and-thinners-market?utm_source=gracebook

Aliphatic Hydrocarbon Solvents & Thinners Market Trends

Increasing Demand from Paints & Coatings Applications

One of the most important factors pushing growth is the expanding use of aliphatic hydrocarbon solvents & thinners in the paints & coatings industry. As urbanization and construction projects increase in countries like China and India, demand for architectural, industrial, and automotive coatings is rising. These solvents are used as diluents and thinners to adjust viscosity, improve application, and assist drying. Additionally, automotive manufacturing continues to use these solvents for coating and surface finishing.

Broad Industrial Use: Adhesives, Cleaning & Rubber Manufacturing

Beyond paints & coatings, aliphatic hydrocarbon solvents and thinners are finding growing roles in other sectors:

- Rubber manufacturing: Needed for processing of rubber compounds, particularly in automotive tires and industrial rubber, where solvent characteristics (evaporation rate, solvency for resins/waxes etc.) matter.

- Cleaning & degreasing: Industrial cleaning operations, machinery maintenance, and degreasing processes are increasingly using them, owing to their ability to dissolve nonpolar substances like oils and waxes.

- Adhesives: The adhesives sector is another rising user, especially where bonding strength, dry time, and solvent compatibility influence product performance.

Regulatory Pressure and Performance Requirements

Environmental regulations, particularly those targeting Volatile Organic Compounds (VOCs), are influencing formulation choices. Manufacturers are under pressure to lower emissions, improve safety, and maintain or improve solvent performance. This means more R&D investment into cleaner grades of aliphatic solvents and improved processing to reduce impurities.

Regional Momentum: Asia-Pacific Leading

Asia-Pacific stands out as the fastest-growing and currently largest region in terms of consumption of aliphatic hydrocarbon solvents & thinners. Countries such as China, India, Japan, and South Korea are contributing strongly. Growth in construction, automotive, and manufacturing sectors in these countries underpin demand. India is often cited as possibly having growth rates of around 6 % during some sub-periods.

Access the full report and stay informed with real-time updates tailored to your region-including Japan-specific trends: https://www.mordorintelligence.com/ja/industry-reports/aliphatic-hydrocarbon-solvents-and-thinners-market?utm_source_gracebook

Aliphatic Hydrocarbon Solvents & Thinners Market Segmentation Analysis:

The market can be broken down by several dimensions, each giving insight into what drives demand and where opportunities lie.

By Solvent Type

- Mineral Spirits -the largest share by solvent type, due to its versatility in dissolving many types of oils, waxes, and varnishes, plus relatively moderate evaporation rates.

- Heptane -one of the fastest-growing segments, valued for quick evaporation and use in coatings and cleaning.

- Hexane, Gasoline, Others -serving more specialized applications (oil extraction, degreasing, etc.).

By Application

Main application segments are:

- Paints & Coatings -the dominant segment in value share.

- Rubber Manufacturing -rising steadily.

- Cleaning & Degreasing -stable demand, particularly in industrial settings.

- Adhesives -growing usage due to packaging, construction, automotive sectors.

- Others -miscellaneous uses, including in specialized industrial processes, where solvent properties are critical.

Get Full Details from Chemicals and Materials Industry Research: https://www.mordorintelligence.com/market-analysis/chemicals-materials?utm_source_gracebook

By Geography

Geographically, the market is split roughly into:

- Asia-Pacific, with sub-regions such as China, India, Japan, South Korea, etc.

- North America, mainly the United States, Canada, Mexico

- Europe, including Germany, UK, France, Italy, others.

- South America, and Middle East & Africa, which are smaller in share but showing potential especially where infrastructure and industrialization are increasing.

Aliphatic Hydrocarbon Solvents & Thinners Key Players Overview:

Several established firms dominate the aliphatic hydrocarbon solvents & thinners market. These companies compete mainly on their solvent quality, ability to meet regulatory standards, global distribution networks, and capability to innovate. Some of the major players are:

- Royal Dutch Shell

- Hunt Refining Company

- Recochem Inc

- Phillips 66

- Gadiv Petrochemical Industries Ltd

These companies are investing in capacity expansions, improving product purity, and enhancing their product portfolios to address environmental and regulatory demands.

Conclusion

In summary, the Aliphatic Hydrocarbon Solvents & Thinners Market is set to grow from its current base through 2030 at a CAGR of about 4 %, reaching approximately USD 6.06 billion by then. Strong demand from paint & coatings, rubber manufacturing, adhesives, and cleaning & degreasing sectors, coupled with regulatory pressure to reduce emissions and improve safety, are shaping market dynamics. The Asia-Pacific region is leading both in market size and growth. Established players with strong R&D, regulatory compliance capabilities, and regional footprints are likely to benefit most. As the market moves forward, innovations that reduce environmental impact, improve safety, and maintain performance will become ever more important for companies aiming to retain or expand their shares.