MARKET OVERVIEW

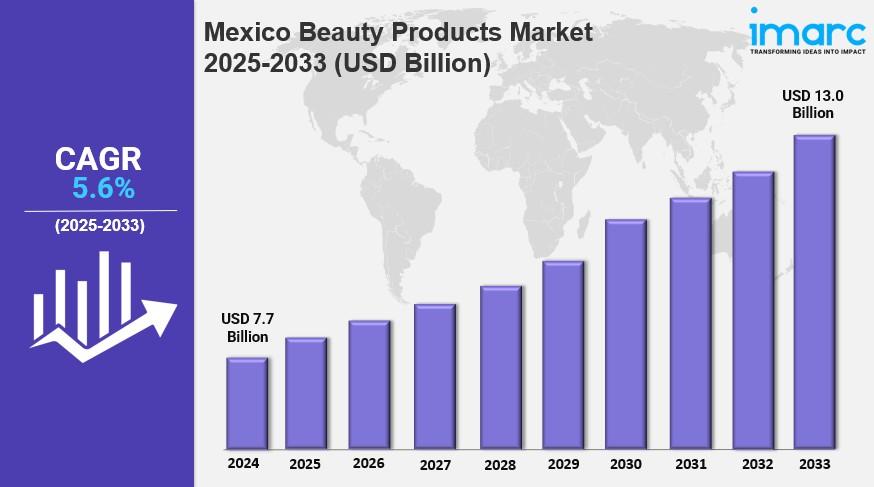

The Mexico beauty products market size was valued at USD 7.7 Billion in 2024 and is projected to reach USD 13.0 Billion by 2033, registering a CAGR of 5.6% from 2025 to 2033. The market growth is driven by rising consumer awareness about skincare, increased demand for natural and organic products, a growing middle-class population with higher disposable income, the expansion of e-commerce platforms, and the influence of social media and beauty influencers.

STUDY ASSUMPTION YEARS

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Period: 2025-2033

MEXICO BEAUTY PRODUCTS MARKET KEY TAKEAWAYS

- Current Market Size: USD 7.7 Billion in 2024

- CAGR: 5.6% during 2025-2033

- Forecast Period: 2025-2033

- Rising consumer awareness about skincare and beauty trends drives market demand.

- High demand for natural and organic beauty products encourages product launches by domestic and international brands.

- Expansion of e-commerce and digital marketing fuels industry growth, with a projected e-commerce CAGR of 12.40% (2024-2032).

- Urbanization leads to increased personal grooming and wellness, with 87.9% of Mexico's population living in urban areas in 2025.

- Social media influencers critically shape purchasing decisions and product discovery.

Sample Request Link: https://www.imarcgroup.com/mexico-beauty-products-market/requestsample

MARKET GROWTH FACTORS

Organic and natural products are the leading demand drivers in the Mexico beauty products market. Domestic and foreign players are launching a variety of natural beauty products to meet the demand of consumers in Mexico. Beauty and personal care online shopping should grow in the e-commerce market with a CAGR of 12.40% from 2024 to 2032. Increasing internet penetration supports this, and smartphone penetration supports it too. Convenience supports the growth, and various discounts and offers support it.

International beauty brands enter the market through partnerships with local retailers and region-wide product launches. An urban lifestyle also increases in popularity. The population lives in urban areas with 87.9% as of 2025. Global beauty trends influence consumers, along with increasing use of skincare and cosmetics.

Market growth is driven by the demand for custom beauty products for specific skin types, tones, and hair textures, with brands also offering custom formulas for different skin tones, complexions and hair types. A large contributor to the growing market has been the increasing individualism and self-care of Mexican youth.

As women enter the workforce and people embrace a work-life balance, multitasking products such as tinted moisturizers and long-wear/long-lasting products became desirable as of 2024. At this time, women comprise 51.7% of the workforce, and changing demographics provide more opportunities in order to open up the market for further diversity.

Social media platforms including Instagram, YouTube, and TikTok have become tools for beauty influencers in order to influence consumer behavior through collaboration, including recommending beauty products and publicizing beauty tutorials. Social media aids consumers in new beauty product discovery plus idea discovery and improves consumer confidence. Additionally, social media creates a demand for new products.

MARKET SEGMENTATION

By Type:

- Facial Care: Holds the majority market share due to rising skincare routine awareness; includes cleansers, moisturizers, serums, and masks targeting anti-aging, acne, and pigmentation.

- Makeup-remover: Rapidly growing segment driven by consumers seeking deep skin cleansing with products like Micellar water, wipes, and oil.

- Hand care: Experiences high growth from increased hygiene awareness; includes creams, sanitizers, and lotions to protect, nourish, and hydrate hands.

- Depilatories: Not provided in source.

- Skin Care Products: Not provided in source.

- Hair Care Products: Not provided in source.

- Makeup and Perfume: Not provided in source.

By Distribution Channel:

- Online: Expanding rapidly due to ease of shopping, variety, reviews, social media and influencer marketing, and promotions.

- Offline:

- Supermarket and Hypermarket: Not provided in source.

- Specialty Stores: Not provided in source.

- Drug Stores: Not provided in source.

By Region:

- Northern Mexico: Significant market share due to proximity to the US, high-income consumers, and demand for premium and international products.

- Central Mexico: Largest demand volume, economic and cultural hub, increased wellness and self-care trends driving skincare, haircare, and makeup sales.

- Southern Mexico: Gradual growth with increasing awareness and preference for affordable beauty products; urbanization in cities like Oaxaca and Chiapas fuels consumption.

- Others: Not provided in source.

REGIONAL INSIGHTS

Northern Mexico dominates with a significant market share driven by its proximity to the United States, affluent consumer base, and preference for premium beauty products. Central Mexico is the largest market hub, encompassing the country's economic and cultural center, which experiences diverse and high demand across all beauty product categories due to wellness and self-care trends among the growing middle class. Southern Mexico shows gradual growth due to rising skincare awareness and urban youth engagement, despite lower overall consumer spending.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=22155&flag=C

RECENT DEVELOPMENTS & NEWS

- December 9, 2024: Brazilian cosmetics brand Natura & Co. plans to expand into Mexico in 2025 via a franchise model, aiming to boost sales in the region.

- November 28, 2024: Givaudan opened a renovated manufacturing facility in Pedro Escobedo, Mexico, as part of its 2025 growth strategy to strengthen its Latin American market position.

- October 9, 2024: e.l.f. Cosmetics launched in Mexico for the first time through Sephora Mexico's online and physical stores, offering vegan, clean, cruelty-free, and certified products.

- March 19, 2024: Ulta Beauty partnered with Grupo Axo to expand internationally and enter Mexico's market in 2025 with an asset-light approach.

- February 4, 2024: Glow Recipe debuted in Mexico, launching a 26-product collection across 38 Sephora locations including app, website, and stores.

KEY PLAYERS

- Natura & Co.

- Givaudan

- l.f. Cosmetics

- Ulta Beauty

- Glow Recipe

ABOUT US

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

CONTACT US

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302