QKS Group’s latest Network Detection and Response (NDR) market research presents an in-depth analysis of the global landscape, highlighting emerging technology trends, evolving market dynamics, vendor positioning, and future outlook. As cyber threats become increasingly sophisticated, distributed, and stealthy, NDR solutions have emerged as a critical pillar in modern security architectures.

This comprehensive research equips technology vendors with strategic insights to refine product roadmaps and competitive positioning, while enabling enterprise users to assess vendor capabilities, differentiation, and maturity. Central to the study is the proprietary SPARK Matrix™, which ranks and evaluates leading NDR vendors with global market influence.

According to Aiyaz Ahmed, Analyst at QKS Group, NDR continues to evolve rapidly in 2024, driven by advancements in behavioral analytics, machine learning, and real-time packet analysis. As organizations shift to hybrid, distributed, and Zero Trust environments, the role of NDR in detecting lateral movement, data exfiltration, stealthy command-and-control communication, and sophisticated ransomware attacks becomes indispensable.

Market Dynamics and Overview

The NDR market is experiencing strong growth, propelled by:

- Increasing Threat Sophistication

Modern attackers leverage evasion techniques that bypass legacy security tools. NDR’s behavioral analytics and ML-driven anomaly detection help identify subtle deviations in network activity.

- Expansion of Hybrid and Multi-Cloud Environments

Organizations are distributing workloads across on-premises, cloud, and edge environments—making network visibility essential for real-time threat detection.

- Growing Demand for Integrated Security Ecosystems

NDR solutions are being optimized for seamless synergy with XDR, SIEM, SOAR, and identity platforms, improving correlation accuracy and accelerating threat response.

- Zero Trust Adoption

Zero Trust architectures require continuous monitoring of east-west traffic, making NDR a critical component for validating trust boundaries.

- Need for Forensic and Investigative Depth

Advanced packet-level analytics and enriched metadata empower security teams to conduct faster root-cause analysis and post-incident investigations.

Competition Landscape and Analysis

The global NDR market is marked by intense competition and rapid innovation. Vendors are differentiating themselves through capabilities in:

- Encrypted traffic analytics without decryption

- AI-driven anomaly detection

- Cloud-native architecture for scalability

- Real-time packet capture and deep visibility

- Threat hunting and investigation workflows

- Integrations with XDR, SIEM, and cloud security tools

QKS Group’s competitive landscape assessment analyzes each vendor’s strategic focus, technology innovations, product maturity, market presence, and customer value proposition.

Key Competitive Factors and Technology Differentiators

Leading NDR vendors are excelling in several critical areas:

- Behavioral Analytics & Machine Learning

Advanced ML models enable detection of lateral movement, unauthorized access patterns, ransomware propagation, and command-and-control communication.

- Cloud and Hybrid Environment Support

Cloud-native NDR capabilities are now essential as enterprises adopt cloud-first strategies.

- Real-Time Packet Analysis

Deep packet inspection and metadata extraction allow early detection of anomalies and suspicious traffic flows.

- Threat Intelligence Integration

Contextual intelligence enhances detection accuracy and reduces false positives.

- Scalability and Performance

Vendors that deliver high-speed traffic processing and low latency response stand out.

- XDR and SIEM Integration

Open APIs and bi-directional data flows strengthen end-to-end visibility across networks, endpoints, identities, and applications.

- Forensic & Investigative Capabilities

Comprehensive logs, enriched metadata, and automated correlation accelerate investigations.

These differentiators help organizations select the right NDR platform aligned with their security maturity and operational needs.

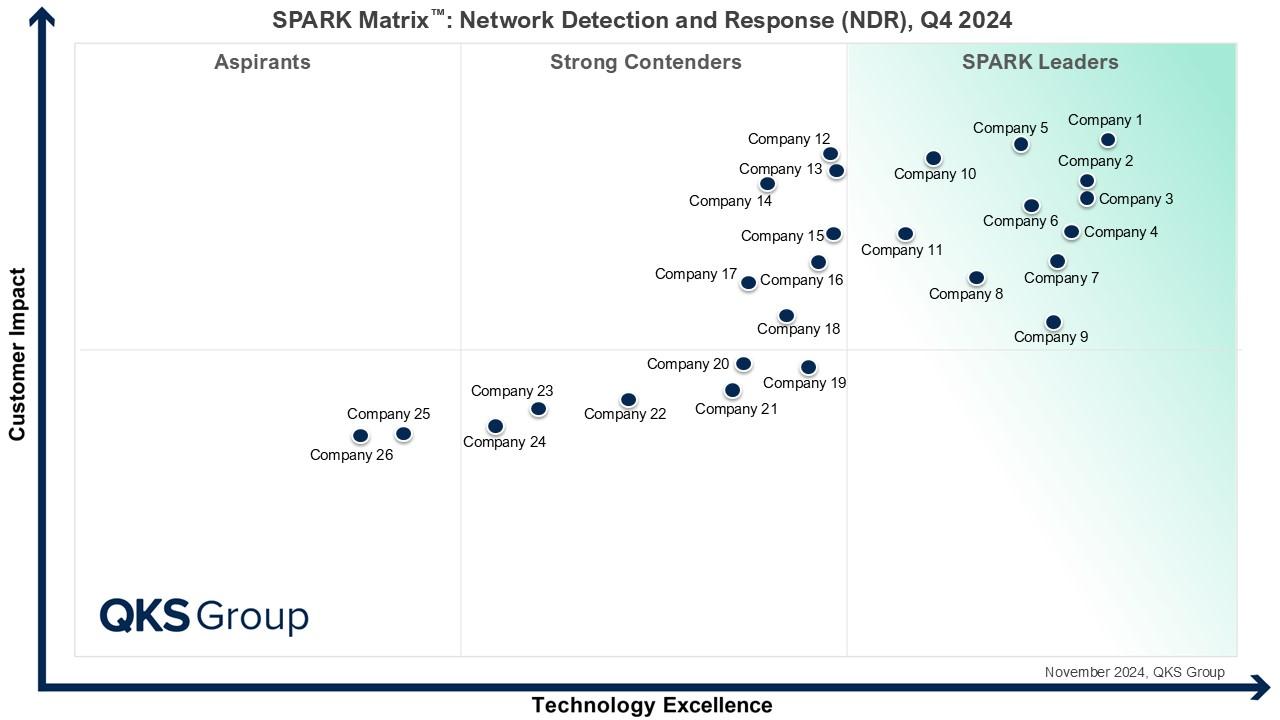

SPARK Matrix™: Network Detection and Response (NDR), Q4 2024

The SPARK Matrix™ provides a detailed evaluation and ranking of globally recognized NDR vendors based on:

- Technology excellence

- Customer impact

- Innovation

- Scalability

- Market presence

The Q4 2024 analysis covers prominent vendors including:

aizoOn, Arista, Cisco, Corelight, cpacket, Cynamics, Darktrace, ExtraHop, Fidelis Cybersecurity, Fortinet, GREYCORTEX, Group-IB, Hillstone Networks, IronNet, Netscout, Netwitness, Progress, Sangfor Technologies, Sophos, Stellar Cyber, ThreatBook, Trellix, Trend Micro, Vectra AI, Vehere, and VMware.

The matrix highlights leaders, challengers, and visionaries shaping the future of the NDR market.

Vendor Profiles

The research also includes detailed profiles of each NDR vendor, covering:

- Company overview

- Product portfolio and key capabilities

- Strategic differentiators

- Technology innovations

- Market positioning

- Strengths and improvement areas

This enables both buyers and vendors to benchmark performance, identify growth opportunities, and understand competitive shifts.