Smart Waste Management Market: Transforming Urban Sustainability Through Intelligent Technologies

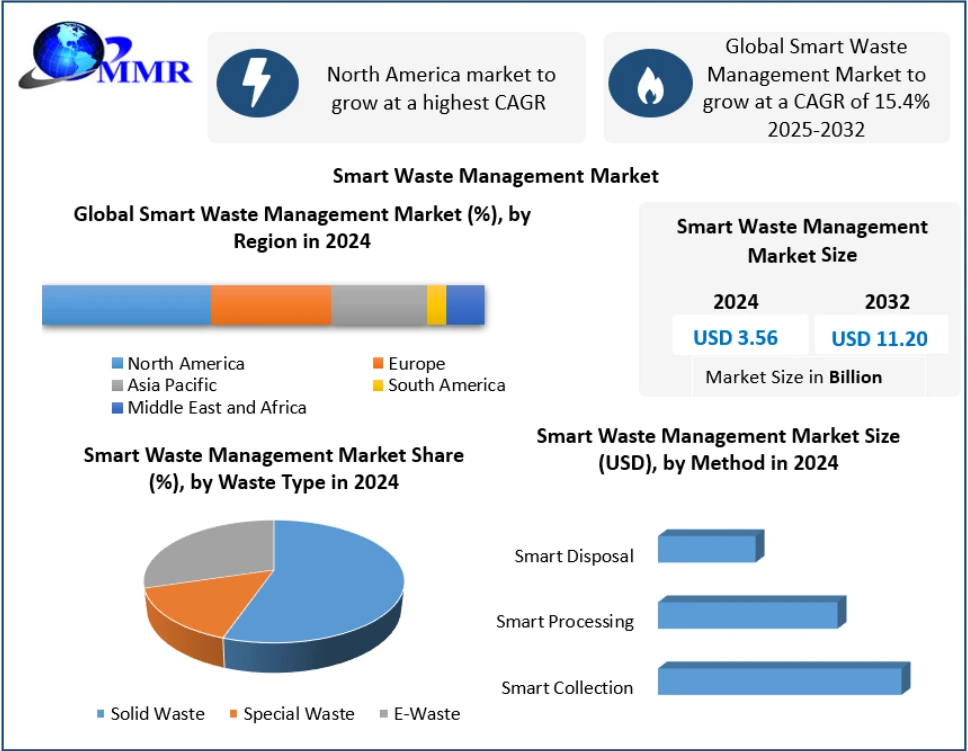

The Global Smart Waste Management Market, valued at USD 3.56 billion in 2024, is poised for rapid expansion as it is expected to grow at a CAGR of 15.4%, reaching USD 11.20 billion by 2032. With urban populations expanding, cities are under pressure to modernize their waste handling approaches. Smart waste systems—powered by IoT, artificial intelligence, advanced sensors, and cloud connectivity—are emerging as the backbone of next-generation sustainable waste ecosystems.

Market Overview: The Digital Evolution of Waste Systems

Smart waste management integrates IoT-enabled sensors, AI-driven analytics, predictive maintenance, GPS-based tracking, and cloud platforms to optimize the complete waste lifecycle—from generation to disposal. These systems help municipalities and enterprises streamline operations while contributing to environmental sustainability by reducing emissions, preventing overflows, and maximizing recyclable recovery.

Growing concerns about overflowing landfills, increasing regulatory pressure for circular economy policies, and a global shift toward smart urban infrastructure are major contributors to rising market demand.

North America currently leads global adoption due to mature smart city programs and high municipal technology readiness. Europe follows closely with strong sustainability regulations, while Asia-Pacific is becoming a dynamic growth region with investments in urban modernization.

Find out where the real opportunities lie! Get your free report sample today by clicking here:https://www.maximizemarketresearch.com/request-sample/53587/

Market Dynamics

1. Government Sustainability Mandates Fueling Adoption

Governments worldwide are legislating stricter waste reduction, extended producer responsibility (EPR), and landfill diversion targets. Initiatives such as waste-to-energy plants, smart recycling stations, biogas programs, and digital waste monitoring platforms are accelerating industry transformation.

These regulatory pushes are compelling municipalities to shift away from traditional labor-intensive systems toward automated waste management ecosystems.

2. Growing Waste Volumes and Urbanization Driving Market Demand

Rapid urbanization adds immense pressure on municipal waste networks. Rising daily waste generation, combined with resource constraints, is pushing governments and private operators to adopt intelligent waste solutions such as:

-

Smart compacting bins

-

Robotic sorters

-

Cloud-based waste analytics platforms

-

Real-time routing systems

These innovations are enabling cities to achieve measurable efficiency gains and sustainability improvements.

3. Emerging Technologies Creating Market Opportunities

The integration of next-gen technologies is reshaping the waste ecosystem:

-

IoT for real-time waste monitoring

-

AI & ML for automated sorting and predictive fill-level analytics

-

Blockchain for waste traceability

-

Solar-powered compactors improving energy efficiency

-

Robotic sorting enhancing recycling accuracy

These advancements create new revenue opportunities for waste operators and technology providers.

4. Connectivity and Awareness Gaps Pose Challenges

Despite technological advancements, two challenges continue to affect adoption:

Connectivity Limitations

Many IoT solutions depend on stable networks—an issue in remote or underdeveloped regions. Mesh networking strategies are emerging as a solution by enabling self-healing, decentralized communication among sensors.

Low Consumer Awareness

Public understanding of smart waste technologies remains limited. This slows adoption, especially in residential sectors where end-user behaviors significantly impact waste segregation and disposal.

Find out where the real opportunities lie! Get your free report sample today by clicking here:https://www.maximizemarketresearch.com/request-sample/53587/

Segment Analysis

By Waste Type

| Segment | Market Insight |

|---|---|

| Solid Waste | Dominated 2024 with 65%+ share due to rising municipal, commercial, and industrial waste. Toxicity concerns and contamination risks further drive need for smart tracking solutions. |

| Special Waste | Includes hazardous and medical waste requiring strict monitoring. |

| E-Waste | Fast-growing segment driven by rising electronics consumption and disposal. |

By Method

-

Smart Collection (42% in 2024) remains the largest segment. Automated fill-level monitoring and AI route optimization significantly reduce labor and fuel costs.

-

Smart Processing is gaining traction due to robotic sorters and automated material recovery.

-

Smart Disposal solutions include smart landfills, methane capture, and waste-to-energy systems.

Regional Insights

North America — Market Leader (35%+)

Dominance driven by:

-

Smart city investments

-

Active adoption of AI, robotics, and IoT

-

Government focus on illegal dumping prevention

-

High participation of major companies like Waste Management Inc. and Bigbelly

Europe — Strong Regulatory Push

European growth is supported by:

-

Strict CO₂ reduction targets

-

Circular economy legislation

-

Advanced recycling infrastructure

Countries like France, Finland, and Spain are leading with innovative smart waste pilots and standardized waste digitization frameworks.

Asia-Pacific — Fastest Growing Market

Countries such as South Korea, Japan, India, and Singapore are heavily investing in urban modernization. Large populations, rapid urban development, and rising waste volumes are key market accelerators.

Competitive Landscape

The Smart Waste Management market is highly competitive and innovation-driven. Key players include:

North America

-

Waste Management Inc.

-

Bigbelly Inc.

-

Republic Services

-

Compology

-

CleanRobotics

-

RecycleSmart

Europe

-

Veolia Environnement

-

SUEZ

-

Enevo

-

SmartBin

-

Sensoneo

Asia-Pacific

-

Ecube Labs (South Korea)

-

Smart IoT waste bin manufacturers across China and Japan

These companies are leveraging smart infrastructure expansion, ESG commitments, telematics, and AI-enabled devices to strengthen their market presence.

Recent Developments (2025)

-

Waste Management Inc. invested USD 150M in AI-driven smart fleet upgrades across major US cities.

-

Bigbelly Inc. released the SmartSolar™ compacting bin.

-

Veolia & Siemens partnered to build a fully automated robotic sorting facility in Lyon.

-

Ecube Labs launched CleanCUBE Ultra 2.0 with enhanced GPS and AI diagnostics.

-

Sensoneo deployed AI-based smart waste platforms in major DACH-region cities.

Market Scope

-

Base Year: 2024

-

Forecast: 2025–2032

-

2024 Market Size: USD 3.56 Bn

-

2032 Market Forecast: USD 11.20 Bn

-

CAGR: 15.4%

Segments Covered

-

Waste Type: Solid Waste, Special Waste, E-Waste

-

Method: Smart Collection, Smart Processing, Smart Disposal

-

Source: Residential, Commercial, Industrial

Conclusion

The Global Smart Waste Management Market is entering a transformational era as cities shift toward sustainability, efficiency, and data-driven decision-making. With IoT, AI, robotics, and automation at its core, smart waste management is becoming indispensable for modern urban development. As regulatory frameworks tighten and waste volumes surge, investments in smart systems will accelerate, positioning the market for long-term, exponential growth.