IMARC Group has recently released a new research study titled “U.S. Pet Insurance Market Size, Share, Trends and Forecast by Policy, Animal, Provider, and Region, 2025-2033” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

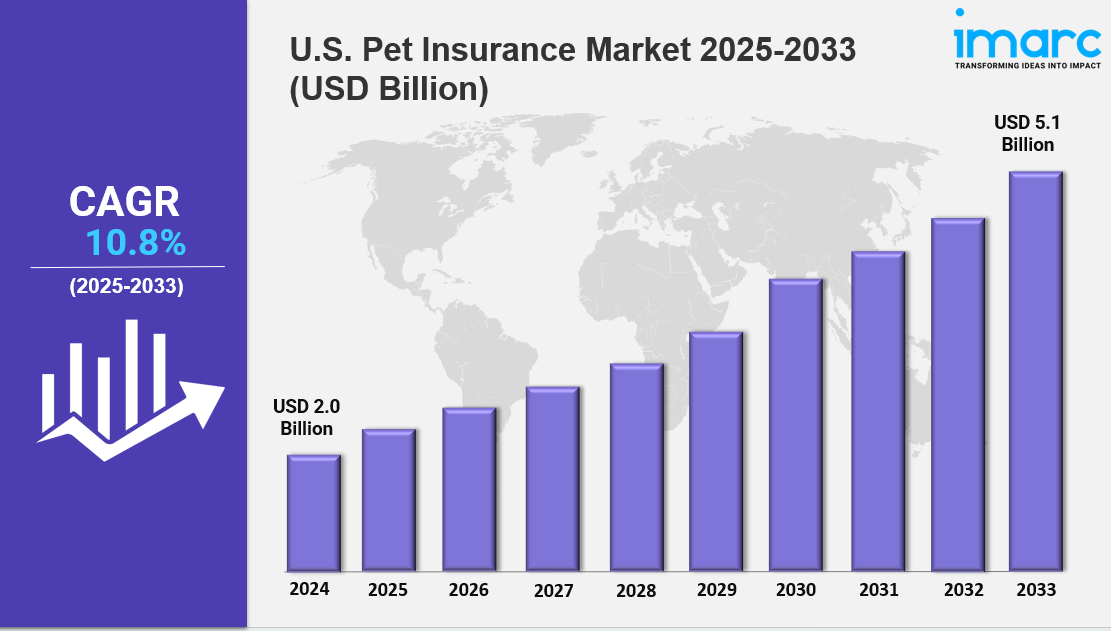

The U.S. Pet Insurance Market Size was valued at USD 2.0 billion in 2024 and is projected to reach USD 5.1 billion by 2033. The market is expected to grow at a CAGR of 10.8% during the forecast period of 2025 to 2033. This growth is driven primarily by rising pet ownership, increasing veterinary costs, and greater awareness of pet health, supported by product customization and digital integration.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

U.S. Pet Insurance Market Key Takeaways

- Current Market Size: USD 2.0 Billion in 2024

- CAGR: 10.8%

- Forecast Period: 2025-2033

- Increasing pet ownership with 66% of U.S. households owning pets in 2024, including 65.1 million dogs and 46.5 million cats.

- Industry focus on expanding coverage options through digital platforms and customizable plans.

- Rising veterinary costs encourage investment in insurance, especially for advanced surgeries and chronic conditions.

- Strategic partnerships between insurers and veterinary clinics enhance market adoption.

- Post-pandemic pet adoption rates and preventive care emphasis support ongoing demand growth.

Sample Request Link: https://www.imarcgroup.com/united-states-pet-insurance-market/requestsample

U.S. Pet Insurance Market Growth Factors:

The US pet insurance industry is growing quickly, as pet ownership and concern for pet health grows. As of 2024, 66% of US households (86.9 million) own pets, led by a bachelor ownership rate of 33% among millennials. As pets have become more like a member of the family, pet owners also want to protect themselves from surprise veterinarian bills. As the cost of a basic veterinarian visit rose to $214 for dogs and $138 for cats in 2024, pet health insurance can appeal to owners.

The market's growth is driven by product variation. Insurers offer accident-only policies, illness coverage, and full wellness plans that allow policyholders to adjust their coverage in various ways. Their own plans offered add-on benefits for dental care, alternative therapies, and more. Nationwide partnered with Unum to offer Unum Pet Insurance, a policy covering accidents, illnesses and wellness, in May 2024 to help employers connect with employees through voluntary benefits offerings.

Digital tools and partnerships with veterinary clinics and pet service providers have lowered market entry barriers. In October 2024, Synchrony launched a tool to simplify reimbursing claims. In January 2024, Petco made a partnership with Nationwide to create co-branded pet insurance, offering plans that can be changed and benefits which include veterinary service discounts. These partnerships support complete pet health management through customer loyalty.

U.S. Pet Insurance Market Segmentation:

Analysis by Policy:

- Illnesses and Accidents: Covers diagnostics, treatments, surgeries, and medications for diseases like cancer, infections, and hereditary disorders, with customizable deductible and reimbursement options. This coverage is vital due to rising treatment complexity and costs.

- Chronic Conditions: Provides ongoing management for long-term diseases such as diabetes, arthritis, and kidney disease, including continuous medication and therapy, with provisions for renewing despite pre-existing conditions.

- Others: Not explicitly detailed in source.

Analysis by Animal:

- Dog: Offers comprehensive coverage including hereditary conditions and special needs based on breed. Covers injuries related to active or working dogs with customizable plans.

- Cat: Growing segment with lower premiums than dogs, covering common feline issues like kidney disease and hyperthyroidism, including routine wellness care and vaccinations.

- Others: Not explicitly detailed in source.

Analysis by Provider:

- Public: Limited involvement, mostly non-profit or shelter assistance for low-income owners, offering financial support rather than full insurance.

- Private: Dominant sector offering diverse, customizable policies with digital tools for claims and policy management, fostering innovation and customer service.

Regional Insights

The Northeast region dominates the U.S. pet insurance market, driven by high pet ownership and disposable income, especially in urban centers like New York City and Boston. Major providers such as Nationwide and Trupanion leverage local partnerships to offer comprehensive coverage including preventive care and chronic condition management, meeting the sophisticated needs of pet owners in this area.

Ask an Analyst: https://www.imarcgroup.com/request?type=report&id=20400&flag=C

Recent Developments & News

- April 2024: Chubb acquired Healthy Paws, strengthening its U.S. pet insurance market presence.

- September 2024: Trupanion launched pet insurance products in Germany and Switzerland with lifetime coverage and no breed or age restrictions.

- May 2024: Mylo entered the U.S. market partnering with Safeco for customizable dog and cat insurance with no age-related termination.

- March 2024: Independence Pet Holdings, Inc. acquired Pets Best Insurance Services from Synchrony to expand and innovate pet insurance offerings.

Key Players

- Nationwide

- Trupanion

- Petplan

- ASPCA Pet Health Insurance

- Synchrony

- Chubb

- Healthy Paws

- Mylo

- Safeco

- Independence Pet Holdings, Inc. (IPH)

- Pets Best Insurance Services

Customization Note:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302