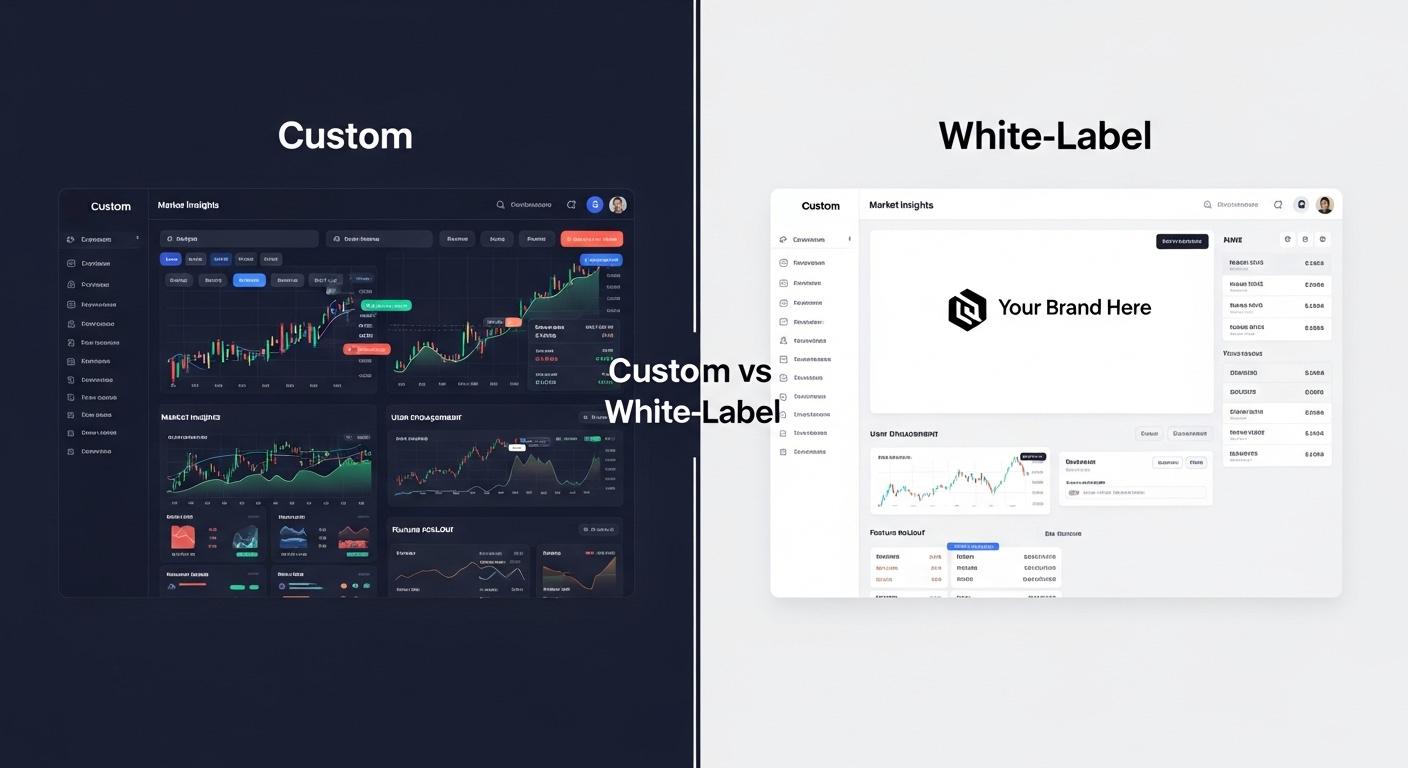

Building a crypto exchange is one of the most strategic decisions for any organization entering the digital asset market. As global interest in cryptocurrencies continues to expand, more businesses are exploring ways to launch trading platforms that deliver security, speed, liquidity, and regulatory compliance. When starting this journey, the first major decision most founders encounter is whether to select a custom platform or a white-label solution.

Both options play important roles in modern crypto exchange development, but they serve different goals, timelines, and operational models. Understanding the strengths and limitations of each approach helps organizations choose a path that aligns with business strategy, budget, regulatory requirements, and long-term scalability.

1. Understanding the Two Approaches

Before evaluating which option is ideal, it’s important to understand what custom and white-label solutions actually provide within crypto exchange platform development.

Custom Crypto Exchange

A custom platform is developed entirely from scratch or built with modular components tailored to specific requirements. It offers:

-

Full control of architecture

-

Ownership of backend logic

-

Custom UI and UX flows

-

Unique trading features

-

Flexible integration with third-party systems

-

Dedicated security and compliance structures

Organizations choose custom development when they require deep personalization and long-term scalability.

White-Label Crypto Exchange

A white-label solution is a pre-built, ready-to-launch platform that can be customized at the branding and configuration level. It offers:

-

Fast launch timelines

-

Lower development costs

-

Pre-tested trading engine

-

Built-in wallet systems

-

Pre-integrated liquidity options

-

Essential security layers

This model appeals to organizations prioritizing time-to-market and cost efficiency.

Both strategies have advantages, and the choice depends heavily on business goals and the intended audience.

2. Time-to-Market Considerations

Time-to-market plays a critical role in the competitiveness of digital platforms. The speed of launch varies drastically between the two models.

White-Label Development

-

Rapid deployment often within weeks

-

Minimal engineering delays

-

Pre-configured features

-

Low barrier to entry

White-label options are popular among startups that want immediate exposure to trading markets.

Custom Development

-

Significantly longer timelines

-

Architecture design, prototyping, security testing, and integration extend development cycles

-

Ideal for founders who prioritize long-term vision over immediate launch

Organizations choosing custom crypto exchange development need a clear roadmap and resources to sustain extended development periods.

3. Cost Differences Between Custom and White-Label Solutions

Costs are one of the most influential factors in crypto exchange development services.

White-Label Solution Costs

-

Typically lower upfront investment

-

Lower maintenance costs

-

Faster ROI path

-

Subscription or licensing models may apply

White-label platforms are financially attractive for early-stage businesses or companies testing digital asset operations.

Custom Solution Costs

-

Higher initial development investment

-

Additional spending for security layers, R&D, and compliance

-

Higher long-term operational expenses

-

Ownership ensures no third-party licensing fees

Enterprises or organizations with complex strategies usually prefer custom cryptocurrency exchange software development despite the higher cost.

4. Level of Customization and Feature Flexibility

Feature flexibility is a major reason businesses choose custom solutions, especially when innovating or targeting niche user needs.

Custom Development Flexibility

-

Build unique trading engines

-

Create niche order types and advanced market analysis tools

-

Integrate multi-chain wallets and cross-chain functionality

-

Add institution-focused modules

-

Implement proprietary algorithms or liquidity logic

-

Full design control

Custom solutions fit businesses wanting to differentiate their platform in a saturated market.

White-Label Flexibility

-

Moderate customization logos, themes, trading pairs, basic modules

-

Limited structural customization

-

Core architecture and matching engine usually fixed

White-label solutions offer reliable functionality but are not ideal for projects that require highly specialized features.

5. Security and Compliance Considerations

Security is a major component in crypto exchange development, regardless of the chosen model.

White-Label Security

Reputable white-label solutions come with:

-

Pre-audited code

-

Established security modules

-

DDoS and anti-phishing protections

-

Integrated KYC/AML systems

However, businesses rely on the vendor’s implementation and may have restricted access to backend modifications.

Custom Security

Custom exchanges allow full control over security implementation, including:

-

Architecture-level hardening

-

Custom wallet infrastructure

-

Proprietary risk and fraud systems

-

Tailored compliance workflows

-

On-demand auditing cycles

Organizations in regulated jurisdictions often prefer custom builds to ensure alignment with local laws.

6. Scalability and Long-Term Growth

An exchange must support high traffic, increased trading volume, expanding blockchain integrations, and global user growth.

White-Label Scalability

-

Suitable for small-to-medium operations

-

May experience performance limitations under extremely high loads

-

Vendor dependency for scaling updates

White-label models suit businesses with modest expansion plans or niche audiences.

Custom Scalability

-

Designed to support unlimited growth

-

High throughput matching engines

-

Modular microservices architecture

-

Scalable wallet frameworks

Custom crypto exchange development is ideal for businesses with long-term visions or enterprise-level plans.

7. Ownership and Intellectual Property Rights

Ownership influences control over logic, future modifications, and platform independence.

White-Label Model

-

Limited or shared ownership

-

Core code owned by the vendor

-

Dependency for updates, fixes, and new features

This can restrict innovation and long-term autonomy.

Custom Development Model

-

Full ownership of codebase

-

Freedom to modify, expand, or integrate new technologies

-

No reliance on vendor roadmaps

Organizations focusing on brand identity and technology leadership prefer custom cryptocurrency exchange software development.

8. Maintenance and Support Requirements

Ongoing maintenance provides security stability and operational efficiency.

White-Label Maintenance

-

Vendor handles patches and upgrades

-

Easier for smaller teams with limited engineering resources

-

Support schedules depend on provider policies

This is suitable for businesses that do not want to manage full-scale technical operations.

Custom Exchange Maintenance

-

Requires internal tech teams or long-term partnerships

-

Involves continuous monitoring, testing, and updates

-

Offers full control but demands significant resources

Companies with technical capabilities or enterprise infrastructure usually choose custom development.

9. Use Cases Where White-Label Exchanges Are Ideal

White-label exchanges are well-suited for:

-

Startups testing new market ideas

-

Businesses needing quick market entry

-

Regional trading platforms

-

Smaller trading communities

-

Organizations seeking basic trading features without innovation requirements

The simplicity and cost-efficiency of white-label systems make them practical for short-term or small-scale goals.

10. Use Cases Where Custom Exchanges Are the Better Option

Custom development is ideal for:

-

Large-scale trading platforms

-

Enterprises requiring long-term scalability

-

Highly regulated markets

-

Platforms focused on unique trading experiences

-

Businesses seeking full ownership of technology

-

Cross-chain or multi-chain ecosystems

A custom crypto exchange development company can build these systems with advanced architectures and specialized trading logic.

Conclusion

Choosing between a custom platform and a white-label solution is one of the most critical decisions in crypto exchange development. Both options provide clear advantages depending on business goals, timeline expectations, regulatory needs, and scalability plans.

White-label solutions offer fast, affordable, and reliable entry into the market, making them ideal for startups and smaller businesses. In contrast, custom cryptocurrency exchange software development provides flexibility, ownership, innovation capacity, and long-term scalability, making it the preferred choice for enterprises and organizations aiming to differentiate their trading ecosystems.

Whether through rapid deployment or long-term strategic development, both approaches play essential roles in the evolving landscape of crypto exchange development services. By understanding the strengths, limitations, and ideal use cases of each model, founders can make informed decisions and build platforms that align with their vision for the future of digital asset trading.