Medical Waste Management Market: Global Industry Analysis, Trends, and Forecast (2024–2030)

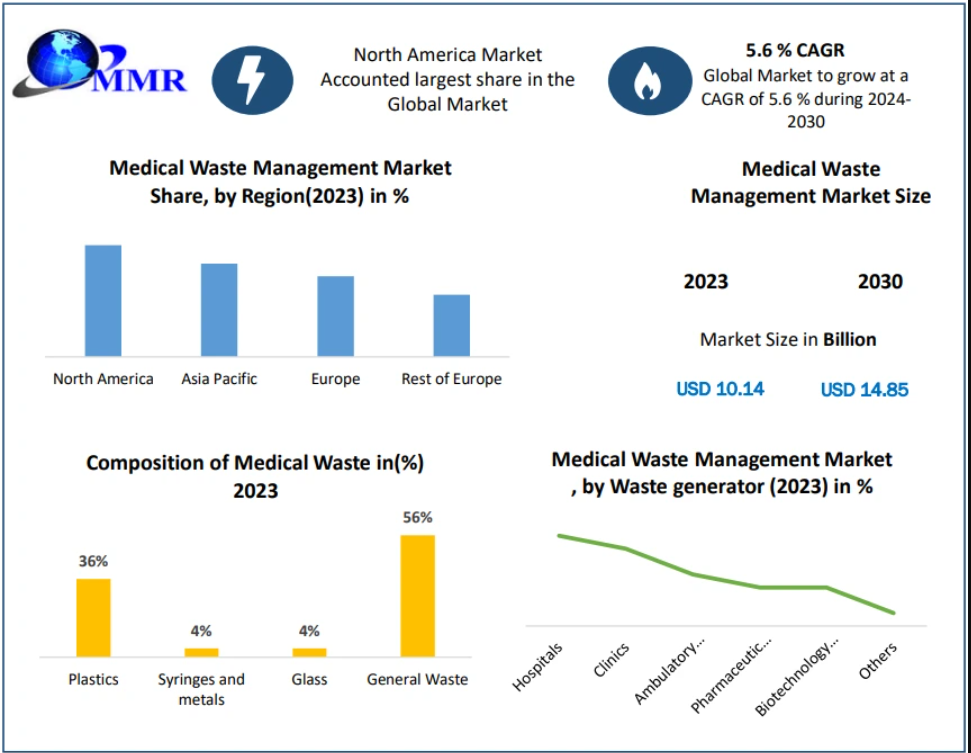

The Medical Waste Management Market was valued at USD 10.14 billion in 2023 and is projected to reach USD 14.85 billion by 2030, expanding at a CAGR of 5.6% during the forecast period. Growth is driven by rising healthcare activities, stringent regulatory frameworks, increasing environmental awareness, and technological advancements in waste treatment.

Market Overview

Medical waste management refers to the collection, segregation, treatment, and disposal of waste produced from hospitals, clinics, diagnostic centers, laboratories, biotechnology firms, and pharmaceutical manufacturing units. This waste—comprising sharps, infectious materials, chemicals, and radioactive substances—poses serious environmental and public health risks if improperly handled.

Growing healthcare infrastructure, rising patient loads, and heightened awareness of infection prevention are fueling demand for efficient and compliant medical waste handling systems.

Click here to claim your free sample report and uncover the most lucrative market segments: https://www.maximizemarketresearch.com/request-sample/21112/

Market Dynamics

- Drivers

✔ Stringent Regulatory Compliance

Governments worldwide enforce strict guidelines on medical waste treatment. Agencies such as the U.S. EPA, OSHA, EU waste directives, and regional environmental authorities mandate safe handling and disposal, compelling healthcare organizations to adopt professional waste management services.

✔ Expansion of Global Healthcare Infrastructure

Increasing numbers of hospitals, diagnostics centers, ambulatory surgical facilities, and pharmaceutical R&D activities significantly elevate medical waste generation, pushing demand for advanced treatment systems.

✔ Rising Environmental & Public Health Awareness

Improper disposal of biohazardous waste can cause infection outbreaks, soil and water contamination, and occupational hazards. The rising focus on sustainability encourages adoption of eco-friendly practices such as:

- recycling,

- non-incineration treatments, and

- waste-to-energy technologies.

✔ Technological Advancements

Innovations are transforming the industry:

- Autoclaving & microwave treatment

- Advanced chemical disinfection

- Energy-efficient incinerators

- Waste-to-energy solutions

✔ Impact of Global Health Crises

Events such as the COVID-19 pandemic resulted in unprecedented volumes of PPEs, syringes, and lab waste, accelerating investments in scalable and safe waste handling systems.

- Restraints

✘ High Initial Investment

Setting up compliant waste treatment facilities requires large capital for:

- autoclaves,

- incinerators,

- chemical treatment units,

- environmental monitoring systems.

This is a major challenge for small healthcare providers.

✘ High Operating Costs

Energy consumption, trained personnel, regulatory audits, and equipment maintenance make medical waste management expensive.

✘ Regulatory Complexity

Different regions apply varying waste definitions, handling rules, and reporting requirements. Continuous compliance increases administrative burden.

✘ Inadequate Infrastructure in Developing Regions

Rural hospitals and resource-poor regions often lack:

- proper segregation,

- transportation systems,

- certified treatment facilities.

This leads to unsafe disposal and environmental degradation.

Market Segment Analysis

By Service

- Treatment — Dominant Segment (2023)

The treatment segment includes:

- autoclaving

- incineration

- chemical disinfection

- microwave treatment

- waste-to-energy systems

Growth is driven by the need to neutralize pathogens and comply with environmental safety standards.

- Disposal

Includes landfill disposal, secure burial, and off-site treatment support.

- Recycling

Growing due to sustainability initiatives, especially for plastics, metals, and certain non-infectious waste components.

By Type of Medical Waste

✔ Non-Hazardous Waste — Leading Segment (2023)

Includes:

- packaging materials

- office waste

- non-infectious patient items

Though less risky, it requires proper segregation to prevent contamination and reduce treatment costs.

Other Segments:

- Bio-hazardous

- Pharmaceutical

- Radioactive

- Other specialty wastes

Click here to claim your free sample report and uncover the most lucrative market segments: https://www.maximizemarketresearch.com/request-sample/21112/

Regional Insights

📍 North America — Market Leader

North America dominates due to:

- strict compliance enforced by EPA & OSHA

- advanced healthcare infrastructure

- rapid adoption of autoclaving and microwave technologies

- strong focus on environmental sustainability

Major hospitals often outsource waste handling to certified providers for uniform compliance across networks.

📍 Europe

Europe is driven by:

- strong environmental directives

- circular economy initiatives

- advanced waste-to-energy systems

- government-backed sustainability mandates

Countries like Germany, France, and the UK lead the region.

📍 Asia-Pacific

APAC is experiencing rapid growth due to:

- expanding hospitals and diagnostics

- rising health awareness

- government investments in waste management infrastructure

However, fragmented infrastructure and uneven regulation remain challenges.

📍 Middle East & Africa

Growth is driven by:

- increasing hospital capacities

- new waste management regulations

- investment partnerships with global waste management companies

UAE and Saudi Arabia lead adoption of modern treatment technologies.

📍 South America

Brazil dominates the region, while Argentina and Chile contribute to expansion through infrastructure modernization and regulatory updates.

Competitive Landscape

Leading players in the global market include:

North America

- Stericycle, Inc.

- Waste Management, Inc.

- Clean Harbors, Inc.

- BioMedical Waste Solutions

- Republic Services

Europe

- Remondis SE & Co. KG

- Tradebe Healthcare

- Daniels Health

Asia-Pacific

- Sharpsmart Ltd.

- Cleanaway Waste Management

- Various regional providers in India, China, and ASEAN

Global Players

- Veolia Environnement

- Suez SA

- GIC Medical Disposal

These companies compete on service capability, geographic coverage, compliance expertise, and adoption of advanced treatment technologies.

Medical Waste Management Market Outlook (2024–2030)

The market will continue to expand due to:

- rising healthcare investments,

- evolving environmental norms,

- growing emphasis on safe infectious waste handling, and

- increasing adoption of waste-to-energy technologies.

Digital platforms for waste tracking, audit automation, and AI-based waste segregation systems are expected to shape the next phase of industry growth.