IMARC Group has recently released a new research study titled “North America Pharmaceutical Contract Packaging Market Size, Share, Trends and Forecast by Industry, Type, Packaging, and Country, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

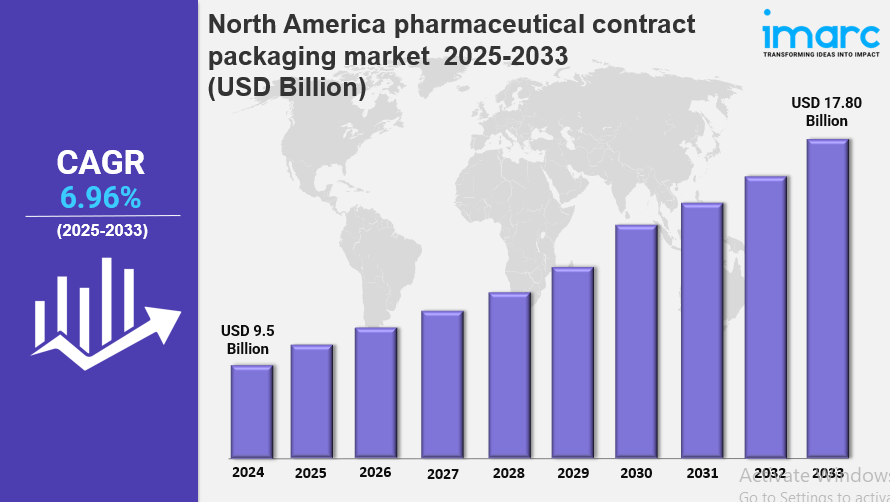

The North America pharmaceutical contract packaging market size was valued at USD 9.5 Billion in 2024 and is projected to reach USD 17.80 Billion by 2033, growing at a CAGR of 6.96% during 2025-2033. Market growth is driven by rising outsourcing trends, stricter regulatory requirements, and increased demand for specialized packaging solutions. Innovations in biologics, increasing pharmaceutical production, and the need for sustainable, cost-effective, and compliant packaging support this expansion. The North America Pharmaceutical Contract Packaging Market is thus poised for significant growth.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

North America Pharmaceutical Contract Packaging Market Key Takeaways

- Current Market Size: USD 9.5 Billion in 2024

- CAGR: 6.96%

- Forecast Period: 2025-2033

- Increasing outsourcing of packaging services by pharmaceutical companies is driving market expansion.

- Regulatory enforcement by FDA and Health Canada necessitates advanced serialization and traceability solutions.

- Growth in chronic diseases and biologics production fuels demand for innovative and secure packaging.

- Adoption of sustainable packaging materials like biodegradable and recyclable plastics is rising.

- Expansion in e-commerce and direct-to-patient distribution increases the requirement for customized, temperature-controlled packaging.

- Patient-centric and specialized packaging for personalized medicines spur market innovations.

Sample Request Link: https://www.imarcgroup.com/north-america-pharmaceutical-contract-packaging-market/requestsample

Market Growth Factors

Growing outsourcing trend in the region factors into the North America pharmaceutical contract packaging market growth. Pharmaceutical companies are focusing on outsourcing packaging services to CPOs within the region that have expertise in packaging, such as blister packs, vials and prefilled syringes. Pharmaceutical production rises and biologics advance. The pharmaceutical industry increasingly demands packaging services that display high compliance and efficient function.

Regulatory requirements imposed by the U.S. Food and Drug Administration (FDA) and Health Canada are important drivers for the market. The US Drug Supply Chain Security Act (DSCSA) of 2013 and similar laws require entities to comply with electronic drug traceability that is interoperable, serialize drugs, and track and trace drugs, among other requirements. They also aim toward preventing counterfeiting and making medicines safer for patients through tamper-obvious, child-resistant and smart packaging solutions.

Environmental and sustainability concerns increase the market more as demand increases for biodegradable, recyclable, and plant-based sustainable solutions because the focus on eco-friendly packaging solutions grows. In the U.S., 30% of buyers favor green products, and 78% practice sustainable consumption. In response, contract packagers have introduced compostable blister packs along with minimalistic packaging of late. These sustainability efforts are in line with regulations and with consumer demand to ensure sector viability.

Market Segmentation

Breakup By Industry:

- Small Molecule: Dominated by liquid dosage and oral solids, favored for cost-effective generics packaging using blister packs, bottles, and pouches. Growth driven by chronic disease treatments and geriatric population.

- Biopharmaceutical: Growing due to demand for biologics and biosimilars requiring custom packaging like vials and prefilled syringes with cold chain logistics, emphasizing sterility and compliance.

- Vaccine: Significant due to immunization and pandemic preparedness, necessitating specialized packaging such as temperature-controlled vials and prefilled syringes with advanced cold chain technologies.

Breakup By Type:

- Sterile: Leading segment powered by regulatory needs for aseptic packaging for biologics and injectables. Heavy investments in cleanroom facilities and cGMP adherence by CPOs.

- Non-Sterile: Driven by nutraceuticals, solid dosages, and over-the-counter medicines with pouches, bottles, and blister packs. Increasing demand for tamper-evident, labeling, and serialization.

Breakup By Packaging:

- Plastic Bottles: Significant due to durability and cost-effectiveness, used for solids and liquids, with growth in child-resistant and sustainable packaging.

- Caps and Closures: Important for safety; demand for tamper-evident, child-resistant, and easy-open types, using advanced and sustainable materials.

- Blister Packs: Dominant for solid-dose drugs, offering moisture and contamination protection, enhanced by serialized and tamper-evident innovations.

- Prefilled Syringes: Rapid growth due to convenience and medication safety, with focus on aseptic filling, advanced materials, and regulatory compliance.

- Parenteral Vials and Ampoules: Essential for injectables, using glass for stability and plastic for break resistance, with innovations in sealing and serialization.

- Others

Regional Insights

The United States commands a dominant share in the North America pharmaceutical contract packaging market, driven by its established pharmaceutical industry and stringent regulations. Growth is fueled by biologics, specialty drugs, personalized medicine advancements, and regulatory policies such as DSCSA. Canada’s market is expanding due to demand for cost-effective, compliant packaging, strong regulatory frameworks by Health Canada, and increased pharmaceutical exports. Sustainability and eco-friendly packaging initiatives also shape growth in both countries.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=1771&flag=C

Recent Developments & News

In December 2024, Gland Pharma received US FDA approval for injectable emulsion packaging in single-dose ampoules, highlighting increased packaging demand in the U.S. In July 2024, AWT Labels & Packaging Inc. acquired American Label Technologies, enhancing RFID capabilities in healthcare packaging. SnapSlide LLC launched child-resistant caps with a two-step opening in April 2024. Also in April 2024, Aptar Pharma expanded its New York plant focusing on ETFE PremiumCoat film-coated stoppers for pharmaceutical products.

Key Players

- Bayer

- PAPACKS

- Gland Pharma

- AWT Labels & Packaging Inc.

- American Label Technologies

- SnapSlide LLC

- Aptar Pharma

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302