Introduction: Jet Fuel Market Overview

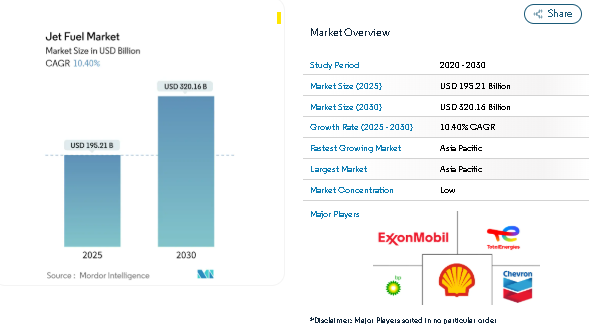

The market is projected to increase from USD 195.21 billion in 2025 to USD 320.16 billion by 2030, reflecting a CAGR of 10.4%. The global jet fuel market is supported by a strong rebound in commercial aviation, rising fuel consumption in emerging economies, and the expansion of low-cost carriers. Growth is further influenced by sustained e-commerce–driven freighter demand and increasing traffic at Middle Eastern mega-hubs. Airlines are optimizing procurement to meet post-pandemic travel recovery, while the shift toward sustainable aviation fuels (SAF) is reshaping supply strategies and refinery operations.

Market Drivers & Insights Shaping the Jet Fuel Market

Post-Pandemic Travel Surge in Asia-Pacific

Domestic air traffic in China, India, and Southeast Asia has surpassed pre-pandemic levels, while international routes are approaching 90% recovery. Airlines are maximizing aircraft utilization due to delayed deliveries, increasing per-aircraft fuel consumption. Refinery maintenance in Singapore and South Korea has tightened spot markets, providing premium pricing opportunities for refineries with high kerosene yields.

Expansion of Low-Cost Carriers in Africa and ASEAN

Budget airlines are opening new routes in Nigeria, Kenya, Thailand, and Vietnam, increasing jet fuel requirements at secondary airports previously outside major supply chains. Investments in fuel farms at Lagos, Nairobi, and Phuket enhance operational reliability. Direct airline-supplier contracts are streamlining fuel distribution, creating volume opportunities for suppliers while compressing margins

Rise in Wide-Body Freighter Operations on Trans-Pacific Routes

Chinese e-commerce growth is driving demand for express cargo flights, often exceeding pre-pandemic belly-hold capacity. Freighter operators like DHL Express and Atlas Air are adding Boeing 777Fs, consuming significant quantities of jet fuel on long-haul flights. Year-round cargo operations smooth seasonal fluctuations and generate consistent fuel demand at key storage hubs along the U.S.

Middle-East Mega-Hub Expansion

Fuel farm investments in Dubai, Abu Dhabi, and Doha, with capacities exceeding 10 million barrels, support long-haul aviation connectivity. Emirates and other Gulf carriers leverage scale to secure cost advantages, while SAF commitments by Qatar and other regional players position the Middle East as a key hub for intercontinental aviation.

Impact of European Carbon Regulations

Phase-IV of the EU Emissions Trading System (EU-ETS) removes free allowances by 2026, adding compliance costs that could reduce leisure travel by up to 5% by 2030. Airlines are adjusting routes and capacity, redirecting some flights through North African or Middle Eastern gateways.

Fleet Modernization Reducing Per-Flight Fuel Use

Airlines are introducing fuel-efficient aircraft such as the A350-900 and A320neo, cutting per-flight fuel consumption by 20-25% compared to older models. While overall

Get a Sample Report of jet fuel market Forecast - https://www.mordorintelligence.com/industry-reports/jet-fuel-market?utm_source=gracebook

Market Drivers & Insights of jet fuel market

By Fuel Type:

- Jet A-1: Dominates commercial aviation and military fleets with 72.5% market share due to favorable properties.

- Jet A: Primarily used in North America, supporting conventional operations.

- Jet B and Others: Serve niche environments; SAF adoption is growing at a 17.5% CAGR, driven by EU blend mandates and voluntary airline commitments.

By Application:

- Commercial Aviation: Largest segment, accounting for 77.5% of market share, with projected CAGR of 11%.

- Defense Aviation: Provides stable demand via multi-year contracts, particularly for JP-8 fuel.

- General Aviation: Smaller segment but growing, supported by private jets and charter services.

By Distribution Channel:

- Into-Plane Services: Represent 87.5% of volumes, offering turnkey solutions and faster turnaround.

- Bulk Supply to FBOs: Critical for secondary airports and general aviation, enabling access to emerging markets.

By Geography:

- Asia-Pacific: Largest market at 36% share, projected 11.5% CAGR through 2030.

- North America: Moderate growth due to efficiency gains offsetting additional capacity.

- Europe: Mixed outlook due to carbon surcharges; demand growth partially offset by route adjustments.

- Middle East: Benefiting from hub expansions and long-haul network growth.

- Africa & Latin America: Growing off a smaller base with new low-cost carriers and hub investments.

Explore in-depth insights and regional perspectives, including localized editions like the Japanese market version - https://www.mordorintelligence.com/ja/industry-reports/jet-fuel-market?utm_source=gracebook

Leading Companies in the Jet Fuel Market

The global jet fuel market is moderately concentrated. Leading integrated oil majors such as Shell, ExxonMobil, BP, Chevron, and TotalEnergies dominate refining and distribution, leveraging economies of scale and feedstock flexibility.

Sustainable aviation fuel producers are gaining prominence. TotalEnergies aims to supply 1.5 million tons of SAF annually by 2030. Boeing’s collaboration with Norsk e-Fuel to scale Power-to-Liquids technology highlights industry moves toward compliance-driven demand. Regional suppliers like ADNOC Distribution leverage strategic locations and hub networks to meet diverse customer needs. Military aviation further creates high-margin opportunities for specialty refiners producing JP-8.

Conclusion

The jet fuel market is experiencing robust growth, led by commercial aviation recovery, the rise of low-cost carriers, and increasing freight demand in Asia-Pacific and other emerging regions. Fuel-efficient aircraft and SAF mandates are introducing shifts in demand patterns, but overall market expansion remains strong. Strategic refinery capabilities, infrastructure investments, and long-term supply agreements are shaping the competitive landscape.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals. With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries, please contact: