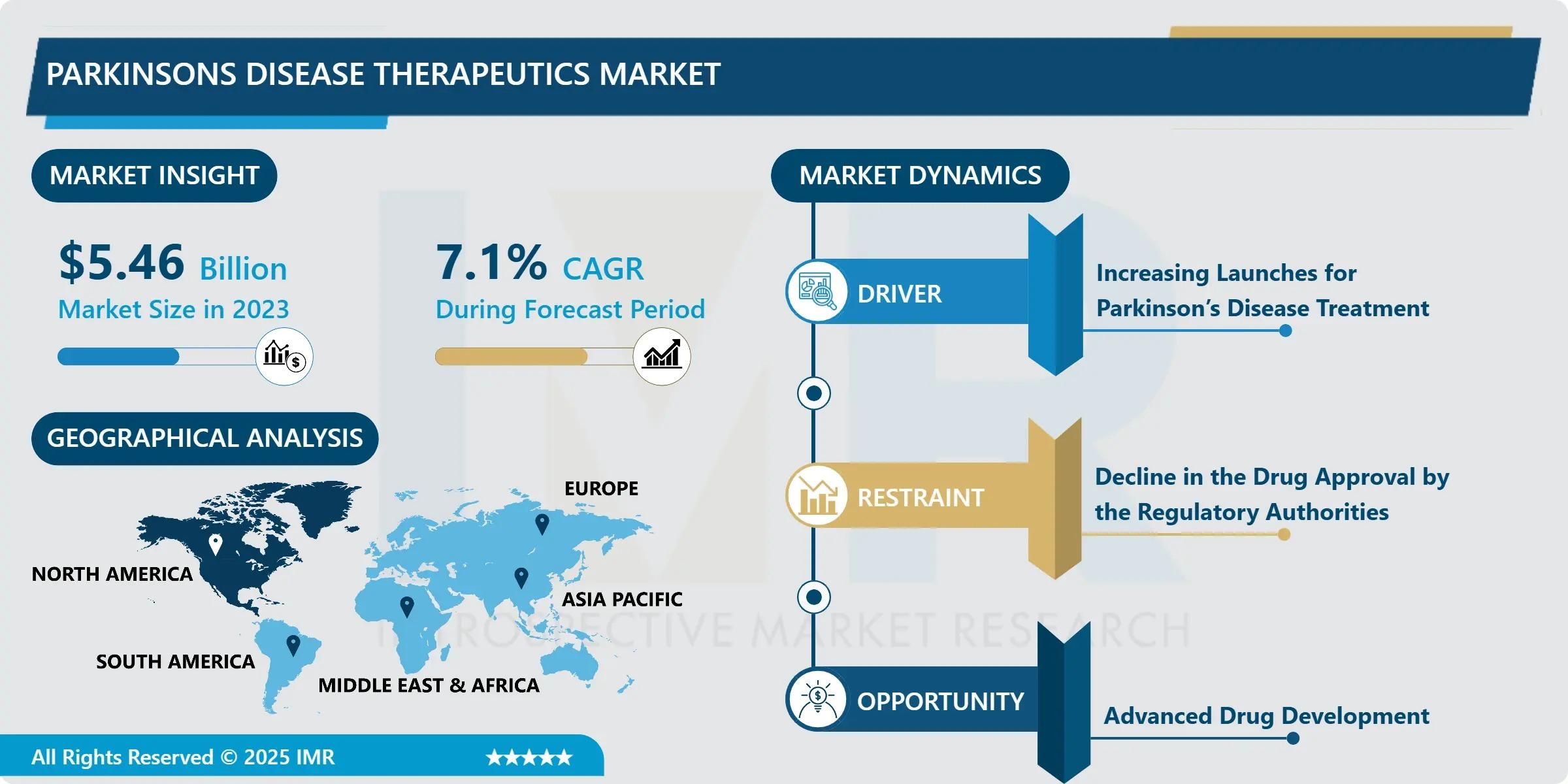

The Global Parkinson’s disease therapeutics market is accelerating into a new era of scientific possibility and patient-centered innovation, with total valuation projected to climb from USD 5.46 Billion in 2023 to USD 10.12 Billion by 2032-a compound annual growth rate (CAGR) of 7.1% over the forecast period. This sustained expansion is driven by the rapidly aging global population, rising disease prevalence, and a paradigm shift from symptomatic management toward disease-modifying interventions that target the underlying neurodegenerative cascade. With over 8.5 million people currently living with Parkinson’s worldwide-and incidence expected to double by 2040-pharmaceutical and biotech innovators are intensifying investments in next-generation modalities, including gene therapy, cell replacement strategies, and precision neurotherapeutics.

While levodopa remains the pharmacological cornerstone, its limitations-including motor fluctuations, dyskinesias, and non-motor symptom inefficacy-are catalyzing a wave of therapeutic diversification. Dopamine agonists, MAO-B inhibitors, and COMT inhibitors continue to gain traction in early- and mid-stage regimens, but the real momentum lies in advanced delivery systems (e.g., subcutaneous apomorphine infusion, inhaled levodopa) and non-dopaminergic pathways, such as alpha-synuclein-targeted immunotherapies, LRRK2 and GBA1 kinase modulators, and neuroinflammation regulators. Deep brain stimulation (DBS) is also evolving beyond hardware upgrades-adaptive closed-loop systems now integrate real-time biomarker feedback (e.g., beta-band oscillations) to deliver on-demand neuromodulation, improving outcomes while reducing side effects by up to 37% in pivotal trials.

Quick Insights: Market Metrics at a Glance

• Market Size (2023): USD 5.46 Billion

• Projected Market Size (2032): USD 10.12 Billion

• CAGR (2024–2032): 7.1%

• Dominant Drug Class: Levodopa (over 42% revenue share)

• Fastest-Growing Segment: Gene & Cell-Based Therapies (CAGR >18%)

• Leading Region: North America (44% share in 2023)

• Top Distribution Channel: Hospital Pharmacies (58% volume)

• Key Route of Administration: Oral (76%), though injectables and transdermal gaining share

• Top Players: AbbVie, Teva Pharmaceutical, Novartis, Biogen, Denali Therapeutics, Voyager Therapeutics

Revenue Forecast by Core Drug Class (2023–2032)

| Drug Class | 2023 Revenue (USD Bn) | 2028E Revenue (USD Bn) | 2032E Revenue (USD Bn) | CAGR |

|---|---|---|---|---|

| Levodopa | 2.29 | 3.82 | 4.63 | 6.2% |

| Dopamine Agonists | 1.31 | 2.24 | 2.81 | 6.7% |

| MAO-B Inhibitors | 0.78 | 1.38 | 1.79 | 7.0% |

| COMT Inhibitors & Amantadine | 0.61 | 1.09 | 1.44 | 6.9% |

| Gene/Cell Therapy & Disease-Modifying Agents | 0.47 | 1.26 | 2.45 | 18.3% |

| Total | 5.46 | 9.79 | 10.12 | 7.1% |

Distribution Channel Breakdown (2023 Share & Strategic Role)

| Channel | 2023 Share | Key Growth Catalysts |

|---|---|---|

| Hospital Pharmacies | 58% | Access to specialty injectables, DBS adjuncts, and clinical trial-linked therapies; integrated neurology centers |

| Retail Pharmacies | 31% | Growth driven by generics, branded oral regimens, and caregiver-managed chronic use |

| Online Pharmacies | 11% | Rising demand for home delivery of maintenance therapy, especially among elderly & rural patients |

Can Disease-Modifying Therapies Finally Alter the Trajectory of Parkinson’s-and Redefine Neurodegenerative Drug Development?

The most transformative frontier in Parkinson’s therapeutics lies beyond dopamine restoration. Pioneering clinical programs are now targeting the root causes of neuronal loss, with several late-stage candidates poised to redefine standard of care:

- Denali Therapeutics’ DNL151 (BIIB122), an oral LRRK2 inhibitor, demonstrated 49% reduction in pathogenic pS129-alpha-synuclein in CSF among LRRK2-mutation carriers in Phase IIb (LIGHTHOUSE trial, 2025), with pivotal Phase III underway.

- Voyager Therapeutics’ VY-AADC01, an AAV2 vector delivering aromatic L-amino acid decarboxylase (AADC) directly to the putamen, showed sustained motor improvement for ≥4 years post-single infusion in RESTORE-1 extension-reducing oral levodopa need by 42%.

- Biogen/Neurocrine’s NPT200-11 (UCB0599), a brain-penetrant alpha-synuclein conformational stabilizer, recently completed Phase II with statistically significant slowing of MDS-UPDRS Part III progression vs. placebo (p=0.038).

- Prevail Therapeutics (Eli Lilly) is advancing PR001A (AAV9-GBA1) in GBA1-associated Parkinson’s, with early data showing improved lysosomal function and reduced CSF neurofilament light chain-a biomarker of axonal degeneration.

Equally compelling are advances in digital phenotyping and remote monitoring: Apple’s Parkinson’s mPower study and Roche’s collaboration with Genetech on wearable sensor algorithms now enable continuous, real-world quantification of tremor, gait, and dyskinesia-accelerating trial recruitment, enriching endpoints, and supporting value-based reimbursement.

Dr. Nathan Roy, Principal Consultant for Neuroscience & Rare Disorders at Introspective Market Research, emphasizes:

“The 7.1% CAGR is anchored in two coexisting realities: the enduring demand for optimized symptomatic control-and the explosive potential of disease modification. Levodopa isn’t going anywhere; it’s being reinvented-via novel formulations, combination regimens, and delivery platforms. But the game-changer is the convergence of genetics, biomarker science, and platform technologies. For the first time, we can stratify Parkinson’s not as one disease, but as molecular subtypes-LRRK2, GBA, SNCA, idiopathic-and match each to mechanism-specific therapies. This precision approach doesn’t just improve efficacy-it reduces trial failure rates, shortens development timelines, and unlocks payer willingness to support premium pricing for therapies that delay nursing home admission by even 12 months.”

Regional Deep Dive: North America Leads, Asia-Pacific Emerges as Strategic Growth Engine

North America commands the largest market share (44% in 2023), underpinned by high diagnosis rates, broad insurance coverage (including Medicare Part D for oral agents and CMS reimbursement for DBS), and a dense network of Movement Disorder Society–certified centers. The U.S. alone hosts over 65% of global Parkinson’s clinical trials, with robust NIH and Michael J. Fox Foundation funding accelerating translational pipelines. Teva’s Austedo® (deutetrabenazine) and AbbVie’s Duopa® (levodopa/carbidopa intestinal gel) exemplify how formulation innovation drives premium pricing and adherence in this mature market.

Western Europe holds 27% share, with Germany, the UK, and France leading in DBS adoption and early access to gene therapies via national HTA pathways (e.g., Germany’s AMNOG early benefit assessments). The EU’s Innovative Medicines Initiative (IMI) continues to fund cross-border consortia like PD-MitoQUANT and Aligning Science Across Parkinson’s (ASAP), fostering open-data collaboration.

Asia-Pacific, while currently at 19% share, is the fastest-growing region (CAGR 8.9%), fueled by rapid aging in Japan and South Korea, expanding neurology infrastructure in India and China, and rising out-of-pocket willingness among middle-class patients. Notably, Sun Pharma and Zydus Cadila have launched low-cost generic rasagiline and safinamide, improving access in price-sensitive markets-while Japan’s regulatory fast-track for orphan neuro indications has enabled early approval of novel MAO-B inhibitors.

Segment Spotlight: Levodopa Dominates, But Gene Therapy Is the Future

The Levodopa segment remains the revenue leader-not through stagnation, but evolution. Fixed-dose combinations with carbidopa/benserazide now dominate (>85% of levodopa prescriptions), while extended-release and dispersible formulations address “wearing-off” and dysphagia. Inhaled levodopa (Inbrija®, Acorda/Abbvie)-approved for OFF-episode rescue-grew 210% in 2024, proving that even legacy molecules can be revitalized with smart delivery engineering.

Meanwhile, the Gene & Cell Therapy segment, though <10% of current revenue, is projected to triple by 2030. Beyond AAV-based approaches, pluripotent stem cell-derived dopaminergic neuron transplants (e.g., BlueRock Therapeutics’ bemdaneprocel) are entering Phase II, with preliminary data showing graft survival and functional integration at 24 months. These therapies aim not for symptom control, but for neural circuit restoration-a vision once deemed science fiction.

Cost Pressures and the Path to Sustainable Access

Despite therapeutic advances, affordability remains a barrier: annual therapy costs range from USD 2,400 (generic levodopa) to over USD 120,000 (DBS implant + programming). To improve cost-efficiency, stakeholders are deploying four key strategies:

- Therapeutic Drug Monitoring (TDM): Personalized dosing via plasma levodopa/carbidopa assays reduces trial-and-error prescribing, cutting waste by 22% (Johns Hopkins pilot, 2024).

- Biosimilar & Generic Competition: Post-patent dopamine agonists (e.g., pramipexole, ropinirole) now cost 60–75% less than branded versions—freeing payer budgets for novel agents.

- Integrated Care Models: Kaiser Permanente’s “Parkinson’s Medical Home” reduced hospitalizations by 34% and ER visits by 41% through coordinated neurology, PT, OT, and telehealth—lowering total cost of care by USD 8,200/patient/year.

- Outcome-Based Contracts: Novartis’ pilot with CMS ties payment for novel disease-modifiers to real-world progression metrics (e.g., time to Hoehn & Yahr Stage 4), aligning incentives across stakeholders.

The societal ROI is compelling: delaying nursing home placement by just 18 months saves USD 62,000 per patient in long-term care costs-while preserving dignity, autonomy, and caregiver productivity.

About the Report

“Parkinsons Disease Therapeutics Market - Comprehensive Analysis & Growth Outlook to 2032” delivers a comprehensive, clinician-informed assessment of the evolving treatment landscape. The report includes granular segmentation by drug class (levodopa, dopamine agonists, MAO-B, COMT, gene therapy), route (oral, injectable, transdermal, inhaled), and distribution channel-with 180+ data tables, 25+ company profiles, and proprietary analysis of 47 pipeline assets across 12 mechanisms of action. It features exclusive interviews with movement disorder specialists, payer policy leads, and patient advocacy leaders, plus modeling of market access scenarios under value-based care frameworks.

Unlock Strategic Foresight in the Next Era of Neurotherapeutics-Access the Full Report Today

Request your complimentary executive summary and data dashboard to benchmark your pipeline, pricing, or market access strategy. Schedule a 1:1 briefing with our neuroscience team to explore custom forecasting, competitive intelligence, or biomarker commercialization pathways.

👉 Download Sample Report: https://introspectivemarketresearch.com/request/20157

About Introspective Market Research

Introspective Market Research(IMR) is a globally recognized leader in neuroscience, rare disease, and precision medicine intelligence. Our team of 90+ analysts-including neurologists, pharmacoeconomists, and former FDA/EMA reviewers-combines clinical depth with commercial acumen to deliver actionable insights for biopharma innovators, investors, and policymakers. Trusted by the Michael J. Fox Foundation, Gates Ventures, and top-10 pharma R&D leaders, we don’t just track markets-we help shape the future of patient care.

Media Contact:

Dr. Lena Torres

Head of Neuroscience Communications

Introspective Market Research

Email: info@introspectivemarketresearch.com

Phone: +91 91753-37569.