IMARC Group has recently released a new research study titled “US Mutual Fund Market Report by Fund Type (Equity, Bond, Hybrid, Money Market), Investor Type (Households, Institutions), Channel of Purchase (Discount Broker/Mutual Fund Supermarket, Distributed Contribution Retirement Plan, Direct Sales From Mutual Fund Companies, Professional Financial Adviser), and Region 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

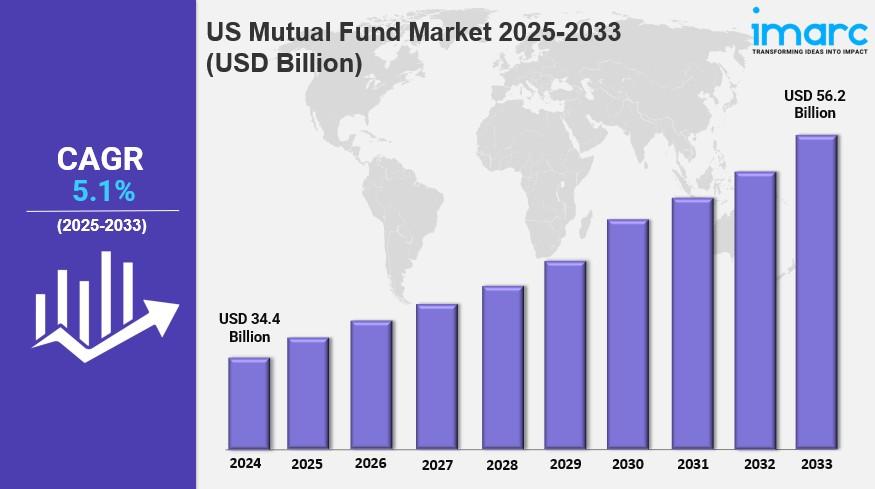

The US mutual fund market size was valued at USD 34.4 Billion in 2024 and is projected to grow to USD 56.2 Billion by 2033, with a CAGR of 5.1% during the forecast period of 2025-2033. Growth is primarily driven by rising demand for online platforms, robo-advisors, and technological innovations that enhance investor access and management of mutual fund investments. The market benefits from a growing retirement planning awareness, supportive regulations, and increased institutional investment.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

US Mutual Fund Market Key Takeaways

- Current Market Size: USD 34.4 Billion in 2024

- CAGR: 5.1% (2025-2033)

- Forecast Period: 2025-2033

- Increasing use of digital investment platforms and robo-advisory services is transforming investor access.

- Millennials’ rising retirement planning awareness is driving higher participation.

- Regime-friendly regulations are facilitating innovations in fund arrangements.

- Institutional investments and pension fund allocations are major growth drivers.

- Technology-enabled personalized investment solutions, including AI, are becoming prevalent.

Sample Request Link: https://www.imarcgroup.com/us-mutual-fund-market/requestsample

Market Growth Factors

The US mutual fund market growth is driven significantly by the increasing adoption of digital investment platforms and robo-advisory services. These innovations are transforming how investors access funds, offering enhanced ease of use and accessibility. Millennials' heightened retirement planning consciousness is increasing participation rates, contributing to market expansion. Regulatory frameworks that are friendly to innovation are accelerating the development of new fund arrangements, enabling more diverse investment products to enter the market.

Institutional investment and pension fund allocations continue to be critical drivers of growth. These entities’ increased focus on allocating capital to mutual funds adds significant scale and stability to the market. The use of technology-enabled personalized investment solutions, boosted by artificial intelligence, enhances portfolio management capabilities. This technological advancement allows better risk evaluation and customized advice, attracting a broader investor base and supporting sustained market growth.

Sustainable investing, focusing on environmental, social, and governance (ESG) criteria, also contributes to market growth as investor awareness around sustainability issues rises. The adoption of ESG-oriented funds increases as investors seek alignment with their values alongside competitive returns. Additionally, competition-induced fee compression is prompting mutual funds to innovate fee structures and improve value offerings, such as tax-loss harvesting and tailored advice, driving further market development.

To get more information on this market: Request Sample

Market Segmentation

Breakup by Fund Type:

- Equity: Funds primarily investing in stocks, offering growth potential.

- Bond: Funds focused on debt securities, providing income and lower risk.

- Hybrid: Mixed asset funds combining equities and bonds to balance risk and return.

- Money Market: Short-term, low-risk funds providing liquidity and capital preservation.

Breakup by Investor Type:

- Households: Individual investors participating through personal savings and retirement funds.

- Institutions: Entities such as pension funds, insurance companies, and endowments investing at scale.

Breakup by Channel of Purchase:

- Discount Broker/Mutual Fund Supermarket: Platforms offering funds at reduced fees.

- Distributed Contribution Retirement Plan: Mutual funds accessed through employer-sponsored retirement plans.

- Direct Sales from Mutual Fund Companies: Investors purchasing directly from fund providers.

- Professional Financial Adviser: Advisory services facilitating mutual fund investments.

Breakup by Region:

- Northeast

- Midwest

- South

- West

Regional Insights

The report covers all major US regions, including Northeast, Midwest, South, and West. Specific market share or CAGR statistics by region are not provided in the source. Overall, regional analysis supports understanding of distinct market dynamics and investment preferences across the United States.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=22121&flag=C

Recent Developments & News

In September 2025, Man Group launched its first standalone ETFs on the NYSE: the Man Active High Yield ETF (MHY) and Man Active Income ETF (MANI). MHY targets high-yield securities, including smaller issuers, aiming for income and growth, managed by Mike Scott. MANI invests in a range of debt instruments using a bottom-up approach, led by Jonathan Golan. These ETFs provide access to Man Group’s $42.7 billion global credit platform.

In June 2025, Stewart Investors launched its first U.S. mutual fund, the Stewart Investors Worldwide Leaders Fund (SWWLX), targeting long-term growth through investment in 30–60 high-quality global firms focused on sustainable development. The fund has a 0.45% management fee and a capped expense ratio.

Key Players

- Man Group

- Stewart Investors

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302