IMARC Group has recently released a new research study titled “Mexico HVAC Market Share, Trends and Forecast by Product Type, End User, and Region, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

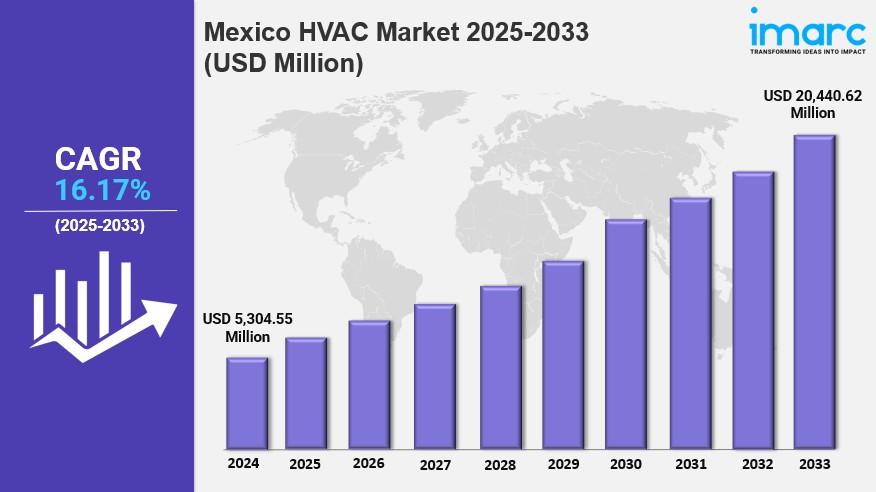

The Mexico HVAC market size was valued at USD 5,304.55 Million in 2024 and is projected to reach USD 20,440.62 Million by 2033, exhibiting a CAGR of 16.17% during the forecast period 2025-2033. The market growth is driven by expanding commercial infrastructure, rising demand for energy-efficient systems, growing industrial manufacturing, and adoption of precision-controlled HVACs. Climate variability across regions and government support for energy efficiency further bolster the market.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Period: 2025-2033

Mexico HVAC Market Key Takeaways

- Current Market Size: USD 5,304.55 Million in 2024

- CAGR: 16.17% during 2025-2033

- Forecast Period: 2025-2033

- The market is fueled by rapid urbanization and increasing construction activities that boost demand for advanced air conditioning and ventilation systems.

- Strong industrial growth, particularly in automotive and electronics sectors supported by nearshoring trends, is elevating HVAC system requirements.

- Government initiatives, including regulations and incentives for energy-efficient HVAC systems, create lucrative opportunities for market expansion.

- Growing consumer preference for smart HVAC systems integrating IoT and automation technologies shapes market trends.

- Investors focus on green building projects and sustainable HVAC solutions to meet environmental standards.

Sample Request Link: https://www.imarcgroup.com/mexico-hvac-market/requestsample

Market Growth Factors

The Mexico HVAC market share is driven by the growing adoption of energy-efficient systems across residential, commercial, and industrial segments. Expansion of commercial infrastructure and rapid urbanization escalate HVAC demand, especially in office complexes, malls, and factories. Investments like Mabe’s USD 668 Million in its factories in 2025 amplify industrial capacity, particularly for home appliances, increasing HVAC system penetration. Government incentives and environmental awareness also boost green HVAC technology uptake.

Industrialization and manufacturing expansion, notably in automotive, electronics, food processing, and pharmaceuticals, further propel demand for precision-controlled HVAC systems to maintain product integrity and safety. The automotive industry's contribution of 4.7% to Mexico's GDP in 2024 signifies a robust market for specialized HVAC fittings. Moreover, 40% of commercial HVAC units sold by U.S. companies like Trane and Carrier are produced in Mexico, supported by tariff benefits under USMCA, enhancing local production and market resilience.

The Mexican government announced a substantial infrastructure investment plan in April 2025, dedicating over MXN 620 billion (about USD 36.7 billion) for energy and transportation upgrades. This initiative drives HVAC installations in logistics, factories, and commercial real estate, where energy-efficient systems meet regulatory and comfort requirements. Smart HVAC systems integrating IoT technologies are increasingly adopted, reflecting the growing middle-class demand for comfort and energy savings. Urban growth in key cities further cements HVAC as fundamental commercial infrastructure.

To get more information on this market Request Sample

Market Segmentation

Analysis by Product Type:

- Direct Expansion Systems: Widely used in residential and small commercial settings for their efficient cooling and easy installation; favored for quick and space-saving solutions.

- Central Air Conditioning Systems: Dominant in larger commercial and high-end residential buildings; provide consistent and energy-efficient large-area cooling with advanced zoning features.

Analysis by End User:

- Residential: Growing due to rising temperatures and middle-class expansion; increased investments in energy-efficient AC systems for urban residences.

- Commercial: Expanding rapidly fueled by commercial infrastructure growth; demand for centralized, energy-efficient and sustainable HVAC solutions in offices, malls, and hotels.

Regional Segmentation:

- Northern Mexico: Largest regional market due to proximity to the U.S., robust industrial and commercial development, and rising temperature-driven demand.

- Central Mexico: Surge in HVAC demand from urbanization and industrial growth; expanding middle class driving residential and commercial HVAC adoption.

- Southern Mexico: Growing market supported by warmer climate and infrastructure development; increased residential and small commercial HVAC applications.

- Others

Regional Insights

Northern Mexico is the dominant region in the Mexico HVAC market, benefiting from its proximity to the U.S. and strong industrial-commercial sectors. This region experiences significant demand driven by higher temperatures and new building construction. Its integration with the U.S. economy and high urbanization rate support increasing adoption of advanced HVAC systems, positioning Northern Mexico as a key growth market within the country.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=34776&flag=C

Recent Developments & News

In September 2025, COMSA secured three new railway contracts in Mexico City worth EUR 35 million, involving upgrades including HVAC system installations, reinforcing its presence in sustainable urban mobility. LG Electronics Mexico delivered a customized HVAC solution for the Cittadela Residential Project featuring 1,414 climate control units with energy-efficient and low-noise systems. March 2024 marked Blue Ridge's entry into Mexican and Latin American markets through an alliance with HARDI LATAM, strengthening HVAC distribution networks. In January 2024, LG Electronics inaugurated a new scroll compressor production line in Monterrey to support low-GWP refrigerant manufacturing aligned with 2025 environmental regulations.

Key Players

- Mabe

- Webasto Americas

- PLC Marine World S.A.

- COMSA

- LG Electronics Mexico

- Blue Ridge

- HARDI LATAM

- Daikin Applied (Alliance Air)

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302