Behavioral Biometrics Market Poised for Rapid Expansion

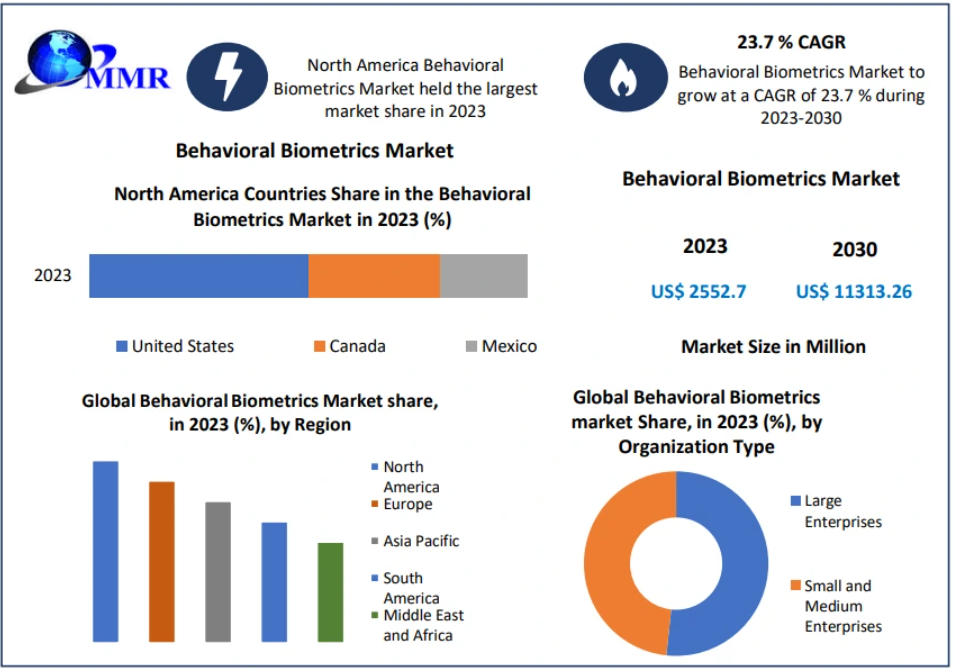

The Global Behavioral Biometrics Market is on a strong growth trajectory, with its market size valued at USD 2,552.7 million in 2023 and expected to reach approximately USD 11,313.26 million by 2030, growing at a CAGR of 23.7%. The market’s growth is being driven by increasing concerns over digital security, identity theft, and fraud, particularly in sectors handling sensitive financial and personal data.

Understanding Behavioral Biometrics

Behavioral biometrics is an innovative authentication technology that analyzes unique human behavioral patterns. These patterns, captured through sensors like accelerometers and gyroscopes in mobile devices, include keystroke dynamics, mouse movements, gait, voice modulation, and touchscreen interactions. Using advanced AI and machine learning algorithms, these behaviors are analyzed to continuously authenticate and verify users, offering a robust security layer beyond traditional passwords or PINs.

The technology is particularly prominent in the banking, financial services, and insurance (BFSI) sector, where the protection of online transactions is critical. With the rising number of online services—from e-banking to e-commerce—traditional authentication methods have become increasingly vulnerable, making behavioral biometrics an essential tool in the fight against identity theft and fraud.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/25576/

Market Drivers

Several factors are fueling the growth of the behavioral biometrics market:

- Rising Security Concerns: The increase in cyberattacks, phishing, and online fraud is driving organizations to adopt more sophisticated authentication methods.

- AI and Machine Learning Advancements: Continuous improvements in AI allow behavioral biometrics systems to detect subtle anomalies, making authentication highly accurate and adaptive.

- IoT Expansion and Mobile Usage: The proliferation of connected devices and mobile applications has created a need for continuous and seamless security solutions.

- Demand for Multi-Layered Security: Financial institutions and enterprises are integrating behavioral biometrics into multi-factor authentication strategies to enhance security.

Challenges

Despite its advantages, implementing behavioral biometrics is not without hurdles:

- Integration Complexity: Organizations face challenges in integrating these systems with existing IT infrastructure.

- Technical Expertise: Deployment requires proficiency in AI, data analytics, and cybersecurity.

- Privacy and Compliance: Adhering to regulations like GDPR and CCPA adds complexity.

- Cost: Initial implementation and ongoing maintenance can be expensive.

Addressing these challenges requires strategic planning, phased deployment, and collaboration with experienced technology providers.

Opportunities in the Market

The intersection of AI, machine learning, and behavioral analytics presents significant growth opportunities. Industries such as finance, healthcare, e-commerce, and government are increasingly adopting behavioral biometrics for continuous authentication, fraud prevention, and risk management. As organizations seek more reliable and seamless security solutions, the market is expected to expand rapidly, offering lucrative prospects for technology providers.

Segment Insights

- Component: The software segment dominates the market, leveraging AI and analytics to interpret behavioral patterns. These solutions offer real-time monitoring, anomaly detection, and adaptive authentication.

- Deployment: Cloud-based solutions are gaining traction due to scalability and ease of integration, while on-premises deployments continue to serve large enterprises with specific regulatory requirements.

- Organization Size: Large enterprises currently lead adoption, but SMEs are rapidly embracing behavioral biometrics to enhance security with minimal operational disruption.

- Application: Key applications include identity proofing, continuous authentication, risk and compliance management, and fraud detection/prevention.

- End-User: BFSI remains the largest adopter, followed by IT & telecom, healthcare, retail & e-commerce, energy, manufacturing, government, and education sectors.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/25576/

Regional Insights

- North America leads the global market, driven by high cybersecurity awareness, robust R&D infrastructure, and stringent regulatory frameworks.

- Europe is seeing adoption growth through startups and tech-driven financial services.

- Asia Pacific is emerging as a high-growth region with increasing digitalization and IoT adoption.

- Middle East, Africa, and South America are gradually adopting behavioral biometrics, focusing on financial security and government applications.

Competitive Landscape

The behavioral biometrics market is highly dynamic, with key players driving innovation through acquisitions, partnerships, and technological advancements. Notable players include:

North America: BioSig-ID, Plurilock, UnifyID, TypingDNA, OneSpan, SecureAuth, IBM, Mastercard, SAS Institute, SecuGen, Aware, Inc.

Europe: BehavioSec, AimBrain, XTN Cognitive Security, Callsign

Asia Pacific: BioCatch, SecuredTouch, NEC Corporation

Leading companies are expanding globally, integrating AI-driven solutions, and collaborating with major financial institutions to strengthen their market positions.

Conclusion

The Behavioral Biometrics Market is set to revolutionize the way organizations secure digital interactions. By combining continuous authentication with AI-powered analysis, behavioral biometrics offers a highly reliable and adaptable security solution. With rising digital adoption, evolving cyber threats, and increased regulatory pressures, the market is poised for robust growth across multiple sectors and regions, making it a pivotal element in the future of cybersecurity.