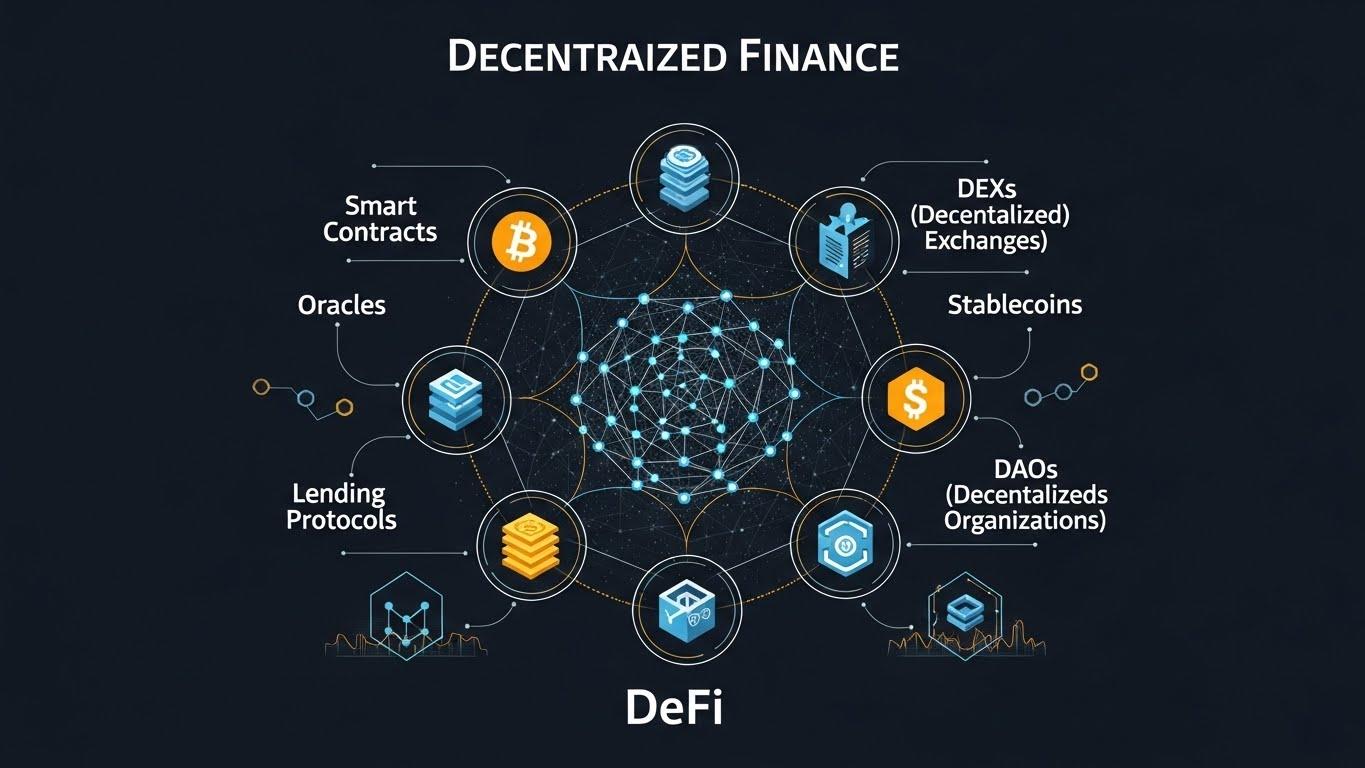

Decentralized finance continues to reshape the future of digital asset operations by delivering transparent, permissionless, and programmable financial environments. The growing adoption of blockchain has encouraged investors, institutions, and enterprises to shift toward systems that offer direct ownership and reduced dependency on central authorities. Through smart contracts, tokenized assets, and cross-chain networks, DeFi unlocks greater accessibility and improved efficiency for managing various forms of digital value. With specialized firms such as a defi development company supporting this transition, organizations can now build advanced platforms tailored to portfolio management, liquidity automation, and seamless asset mobility.

Decentralized Control and Transparent Asset Management

The transition from traditional centralized systems to decentralized frameworks has significantly influenced how digital assets are managed. DeFi introduces user-controlled financial environments where transparency and verifiability become fundamental features instead of optional benefits. This shift has allowed individuals and businesses to supervise their funds without relying on banks or custodial intermediaries. Such independence not only enhances security but also provides a clearer view of every transaction and action performed with digital assets. As decentralized protocols continue to advance, they are becoming essential for anyone seeking greater control, improved oversight, and consistent accuracy in daily financial processes.

-

Smart contracts reinforce reliability. Automated execution eliminates manual verification steps, ensuring transactions complete exactly as coded.

-

On-chain records strengthen auditability. Every interaction remains visible on a distributed ledger, reducing the possibility of disputes and inaccuracies.

-

Permissionless access widens financial participation. Users can engage with DeFi tools globally, supporting broader inclusion across digital markets.

Asset Tokenization and Enhanced Liquidity

Tokenization has become one of the most effective ways to modernize traditional assets and increase liquidity within digital ecosystems. This method transforms assets—whether digital, financial, or physical—into blockchain-based tokens that can be transferred, traded, or divided with ease. As more industries embrace tokenization, investors gain access to expanded opportunities for diversification and flexible portfolio strategies. Enhanced liquidity, combined with reduced operational complexities, encourages more efficient asset exchange. Platforms developed by a professional defi development company often integrate tokenization features, allowing organizations to streamline ownership models and unlock new revenue channels.

-

Fractional ownership increases accessibility. Investors can purchase smaller asset portions, lowering entry barriers for high-value opportunities.

-

Token-based transfers reduce transaction overhead. Movement between parties becomes quick, simple, and cost-effective through blockchain mechanisms.

-

Decentralized liquidity pools support stable markets. Tokens can be traded continuously, ensuring round-the-clock access to buyers and sellers.

Smart-Contract Powered Automation in Asset Strategies

Automation is one of the most valuable contributions of DeFi to digital asset management. By relying on smart contracts, asset strategies can execute automatically without human involvement, ensuring timely adjustments and improved operational consistency. This technology removes the friction associated with manual processes while providing reliable monitoring capabilities based on predefined rules. For businesses dealing with large volumes of digital transactions, automation can significantly reduce resource requirements and minimize the possibility of oversight errors. As demand increases, the role of automated DeFi protocols is expected to become even more critical for long-term asset growth and efficient portfolio oversight.

-

Automated yield mechanisms optimize returns. Smart contracts rebalance holdings and distribute rewards without user intervention.

-

Error reduction improves strategic outcomes. Automated systems avoid many of the mistakes associated with manual decision-making.

-

Real-time adaptability strengthens performance. Strategies update instantly when market conditions evolve.

Cross-Chain Interoperability for Broader Asset Mobility

Asset ecosystems are no longer limited to a single blockchain, and modern investors often require the flexibility to manage holdings across multiple networks. Cross-chain interoperability addresses this need by enabling assets to move seamlessly between different blockchains, enhancing mobility and expanding user possibilities. This capability allows investors to access specialized opportunities such as lower trading fees, unique staking pools, or advanced liquidity options. It also promotes a more unified DeFi environment where platforms communicate more efficiently. As interoperability improves, digital asset management becomes more versatile, secure, and responsive to evolving market demands.

-

Cross-chain bridges unlock wider utility. Users can shift assets between networks to explore superior financial opportunities.

-

Interconnected platforms encourage innovation. Developers can design applications that function across numerous chains.

-

Asset flexibility improves investment agility. Users can reposition their portfolios quickly in response to market conditions.

Strengthening Security Through Advanced DeFi Risk Frameworks

Security remains one of the most influential elements shaping digital asset management, especially as decentralized platforms continue to expand in functionality and user adoption. The growing complexity of DeFi ecosystems has encouraged developers to introduce rigorous risk frameworks designed to protect user assets, mitigate vulnerabilities, and enhance protocol resilience. These frameworks combine real-time monitoring, automated safeguards, and continuous auditing to ensure stability across various financial activities. Many organizations collaborate with a skilled defi development company to integrate enhanced protection layers that support secure asset operations and preserve long-term trust within decentralized systems.

-

Continuous smart-contract auditing prevents failures. Systematic reviews help identify weaknesses before they impact users.

-

Decentralized security models eliminate central attack points. Distributed systems safeguard data across multiple nodes.

-

Automated risk alerts reinforce proactive asset protection. Protocols monitor irregular activity and respond quickly to potential threats.

Conclusion

DeFi continues to redefine digital asset management through transparency, automation, interoperability, security enhancements, and tokenization. These advancements deliver improved efficiency and greater control to both individual users and organizations. With the support of a capable DeFi development company, businesses can harness DeFi’s full potential through tailored, scalable platforms designed for long-term financial innovation. As decentralized systems gain broader recognition, the future of asset management will rely heavily on open, secure, and user-empowered technologies.