IMARC Group has recently released a new research study titled “Mexico Pet Food Market Size, Share, Trends and Forecast by Pet Type, Product Type, Pricing Type, Ingredient Type, Distribution Channel, and Region, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

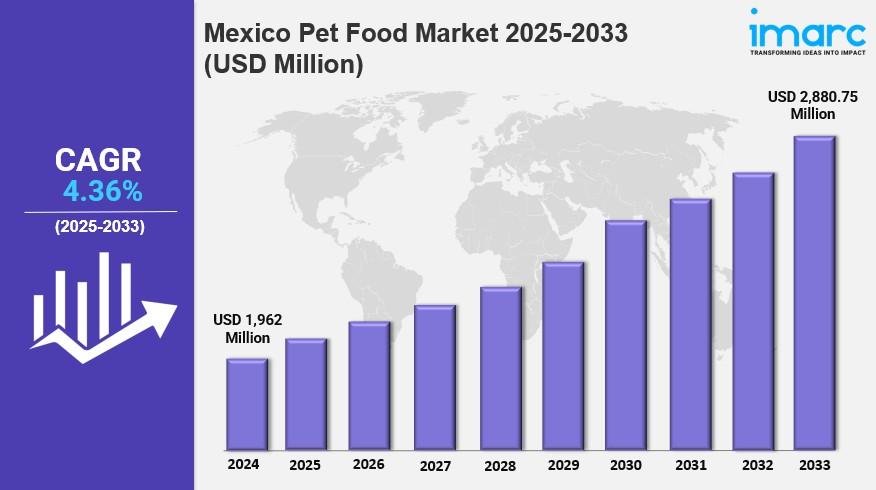

The Mexico pet food market size reached USD 1,962 Million in 2024 and is projected to reach USD 2,880.75 Million by 2033, growing at a CAGR of 4.36% during the forecast period 2025-2033. Growth is driven by increasing pet parentship, premium and nutritionally balanced product demand, strategic manufacturing expansions by key companies like Nestlé Purina, and expanding e-commerce and diversified retail channels. The market benefits from rising middle-class incomes and evolving preferences towards quality pet nutrition.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Period: 2025-2033

Mexico Pet Food Market Key Takeaways

- Current Market Size: USD 1,962 Million in 2024

- CAGR: 4.36%

- Forecast Period: 2025-2033

- The humanization of pets is fueling demand for premium and nutritionally balanced pet foods, driven especially by millennials prioritizing sustainability and animal welfare.

- Strategic manufacturing expansions, including a CHF 200 million investment by Nestlé Purina in Mexico, enhance local production and supply chain efficiencies.

- E-commerce and specialty retail channels are growing rapidly, complementing traditional supermarkets, hypermarkets, and veterinary clinics.

- The cat population growth in urban Mexico is influencing product development and retail assortments.

- Middle-class income growth is enabling consumers to spend more on high-quality pet nutrition.

Sample Request Link: https://www.imarcgroup.com/mexico-pet-food-market/requestsample

Market Growth Factors

The Mexico pet food market is growing fueled by the humanization trend where pets are considered family members deserving high-quality nutrition. This shift has boosted demand for premium, nutritionally balanced pet foods incorporating natural ingredients, functional benefits, and specialized formulations. Additionally, the middle-class income growth enables pet owners to purchase beyond mass-market products, with cats showing remarkable population growth especially in urban areas. Millennials push premiumization by choosing brands aligned with values like sustainability and animal welfare, reflecting a lifestyle and values transformation driving market expansion.

In May 2024, Nestlé Purina invested CHF 200 million to expand its Silao plant in Mexico, making it Latin America’s largest pet food facility. The expansion added wet and dry product lines and reinforced Mexico’s strategic role as Purina’s regional market comprising 45% of sales. These investments exemplify a wider industry move towards localization to minimize import dependency, reduce logistics costs, tailor products to regional preferences, and enhance supply chain resilience. Local manufacturing creates jobs and strengthens government relations, signaling long-term confidence in Mexico’s pet food market and manufacturing potential.

The Mexico pet food market is evolving as ecommerce gains popularity among digital-native consumers seeking convenience, wider product variety, and competitive pricing. Traditional supermarkets remain dominant for mass-market products, while specialty stores like Petco offer experiential shopping with expert staff and premium assortments attractive to discerning pet parents. Hartz Mountain’s 2024 launch of Delectables at Petco marks a strategic market entry through retail partnerships. Neighborhood stores and veterinary clinics remain important in rural and smaller urban areas, sustaining distribution diversity. This mix allows targeted distribution strategies, optimizing coverage across income groups and regions in Mexico.

To get more information on this market Request Sample

Market Segmentation

Breakup by Pet Type:

- Dog Food: Includes various dog food products catered to Mexico's pet population.

- Cat Food: Encompasses the growing range of cat food products, influenced by increasing cat ownership.

- Others: Other pet food categories present in the market.

Breakup by Product Type:

- Dry Pet Food: Includes pellet and kibble forms of pet food.

- Wet and Canned Pet Food: Moist and canned pet food products.

- Snacks and Treats: Pet snacks and treat items for dogs and cats.

Breakup by Pricing Type:

- Mass Products: Economical pet food options for broad consumers.

- Premium Products: Higher-priced, premium quality pet food formulations.

Breakup by Ingredient Type:

- Animal Derived: Pet foods formulated primarily with animal-sourced ingredients.

- Plant Derived: Products based mainly on plant-sourced ingredients.

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets: Major retail chains distributing pet foods.

- Specialty Stores: Dedicated pet stores offering premium and varied selections.

- Online Stores: E-commerce platforms selling pet food.

- Others: Includes veterinary clinics, neighborhood stores, and other smaller retail outlets.

Regional Insights

Northern Mexico, Central Mexico, Southern Mexico, and Others comprise the key regions analyzed. The report does not specify which region is dominant nor includes specific market share or CAGR statistics per region. The regional segmentation allows understanding of varied demand patterns and supply dynamics across Mexico's geography.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=43464&flag=C

Recent Developments & News

- May 2025: Kimberly-Clark de México entered the pet food market with a dual-brand launch targeting value and premium segments, leveraging its strong wholesale and traditional retail presence.

- March 2025: ADM inaugurated its first wet pet food manufacturing plant in Yecapixtla, Morelos, following a USD 39 million investment. This facility aims to produce at least half of Mexico's wet food demand locally by the end of 2025.

Key Players

- Nestlé Purina

- Kimberly-Clark de México

- ADM

- Hartz Mountain

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302