Gold has long been a cornerstone of investment portfolios, offering stability and a hedge against economic uncertainties. Among the various sizes of gold bars available, the 20g gold bar is a versatile and attractive option for both novice and seasoned investors. This article explores the benefits of investing in a 20g gold bar, its unique characteristics, and why it is a valuable addition to any portfolio.

Why Choose a 20g Gold Bar?

The 20g gold bar presents several compelling advantages for investors:

- Affordability: Compared to larger gold bars, the 20g gold bar is more affordable, making it accessible for those with a limited budget. It allows investors to enter the gold market without a significant financial outlay.

- Flexibility: The moderate size of a 20g gold bar provides flexibility in investment, allowing for easier liquidation or trade if needed. It also facilitates gradual accumulation of gold over time.

- Portability: The compact size of a 20g gold bar makes it highly portable, making it easier to store and transport compared to larger bars.

Characteristics of a 20g Gold Bar

Understanding the specific characteristics of a 20g gold bar can help investors make informed decisions:

- Purity: Most 20g gold bars are made from 99.99% pure gold, often referred to as 24-karat gold. This high level of purity ensures the investor is getting nearly pure gold.

- Dimensions: The exact dimensions of a 20g gold bar can vary slightly depending on the manufacturer, but they generally measure around 40mm x 23mm x 1.5mm. This compact size contributes to their portability and ease of storage.

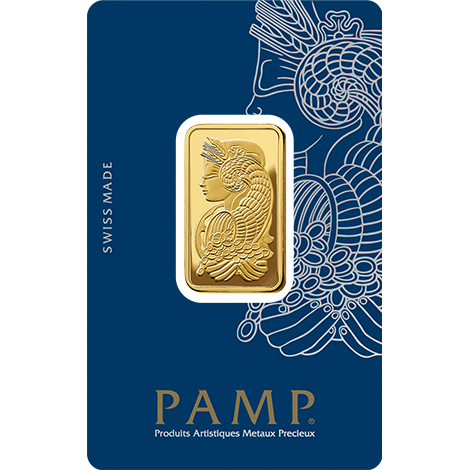

- Markings: Authentic 20g gold bars are typically stamped with important information such as weight, purity, the manufacturer’s logo, and a unique serial number. These markings guarantee the authenticity and traceability of the bar.

Investment Benefits of a 20g Gold Bar

Owning a 20g gold bar offers several investment benefits:

- Wealth Preservation: Gold has a long history of preserving wealth, providing a hedge against inflation and currency fluctuations. A 20g gold bar retains value over time, making it a reliable store of wealth.

- Diversification: Adding a 20g gold bar to an investment portfolio helps diversify risk, particularly during times of economic uncertainty when other asset classes may underperform.

- Tangible Asset: Unlike digital or paper investments, a gold bar is a tangible asset that can be held, providing a sense of security and physical ownership.

How to Purchase a 20g Gold Bar

To ensure a successful purchase of a 20g gold bar, follow these steps:

- Research: Educate yourself about the gold market, current prices, and reputable dealers. This knowledge will help you make an informed decision.

- Choose a Reputable Dealer: Select a dealer with a solid reputation and positive reviews. Check for accreditations from recognized organizations to ensure credibility.

- Verify Authenticity: Ensure the gold bar comes with proper certification and markings, including the weight, purity, and a unique serial number.

- Compare Prices: Compare prices from multiple dealers to ensure you are getting a fair deal. Keep in mind that prices can vary based on market conditions and dealer premiums.

- Secure Storage: Once purchased, store your 20g gold bar in a secure location, such as a home safe, bank vault, or professional storage service.

Conclusion

The 20g gold bar is a versatile and valuable investment choice, offering affordability, flexibility, and portability. Its high purity and compact size make it an attractive option for both novice and experienced investors. By understanding its characteristics and following best practices for purchase and storage, investors can confidently add a 20g gold bar to their portfolio. Whether you're looking to preserve wealth, diversify your investments, or secure a tangible asset, the 20g gold bar provides a reliable and rewarding investment opportunity.