Europe Gas Market Overview

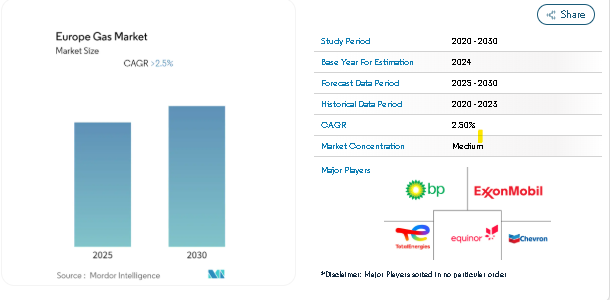

The Europe gas market continues to play a central role in the region’s energy system as countries balance energy security, affordability, and transition goals. According to Mordor Intelligence, the Europe gas market is expected to grow at a CAGR of over 2.5% during the forecast period 2025–2030, measured in terms of production capacity in billion cubic meters. By the end of the forecast timeline, the Europe gas market is projected to exceed 500 billion cubic meters in production capacity, supported mainly by power generation needs and stable upstream output from key producing nations.

Market Drivers & Insights of the Europe Gas Market

Utility Sector Driving Natural Gas Consumption

One of the strongest trends in the Europe gas market is the continued dominance of the utility sector, particularly power generation. As of 2021, natural gas accounted for nearly 23.7% of Europe’s electricity generation, highlighting its importance in the regional power mix. Constraints on rapid expansion of hydroelectric and nuclear power, combined with intermittent renewable output, have reinforced gas-fired generation capacity.

Norway Strengthening Its Position as a Key Supplier

Norway is expected to dominate the European gas market during the forecast period. In 2021, the country produced around 114.3 billion cubic meters of natural gas, making it Europe’s largest supplier. As energy supply chains have shifted, Norway has replaced Russia as the primary gas source for several European Union countries.

Infrastructure and Cross-Border Gas Trade Expansion

Europe continues to invest in cross-border gas infrastructure to improve supply flexibility. Projects such as the Baltic Pipe, connecting Norway, Denmark, and Poland, allow up to 10 billion cubic meters of gas annually to flow into Central and Eastern Europe. These developments reduce dependency on single suppliers and improve regional energy resilience.

Access the complete data-driven outlook on the Europe gas market now - https://www.mordorintelligence.com/industry-reports/europe-gas-market?utm_source=gracebook

Europe Gas Segmentation Overview

By Application

- Utilities

- Largest consuming segment

- Strong use in power generation and grid balancing

- Industrial

- Used in manufacturing, chemicals, and processing industries

- Demand linked to economic output and industrial recovery

- Commercial

- Heating and energy use in offices, retail, and public buildings

- Seasonal demand patterns influence consumption levels

By Geography

- Germany

- Largest gas consumer in Europe

- Strong reliance on gas-fired power plants

- United Kingdom

- Mature gas market with steady residential and power demand

- France

- Gas complements nuclear and renewable generation

- Italy

- High dependence on natural gas for electricity and heating

- Spain

- Growing LNG imports and gas-based power capacity

- Rest of Europe

- Includes Nordic, Eastern, and smaller EU markets with mixed demand profiles

Get the latest global trends, with regional highlights including dedicated insights for Japan - https://www.mordorintelligence.com/ja/industry-reports/europe-gas-market?utm_source=gracebook

Key Players in the Europe Gas Market

- BP Plc

- Equinor ASA

- TotalEnergies SE

- Chevron Corporation

- Exxon Mobil Corporation

Conclusion

The Europe gas market continues to hold an important position in the region’s energy landscape as countries work to balance energy security, affordability, and environmental commitments. Natural gas remains a dependable fuel for electricity generation, industrial operations, and commercial use, particularly where renewable sources alone cannot yet meet demand consistently.

About Mordor Intelligence:

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries, please contact: