Market Overview

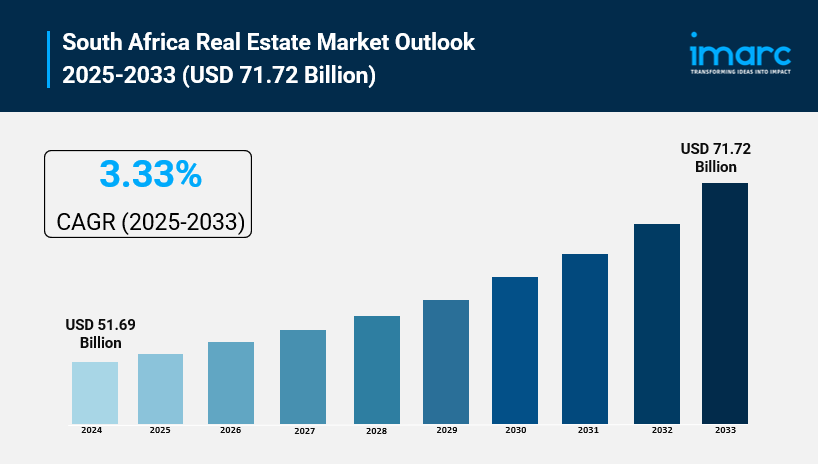

The South Africa real estate market reached a size of USD 51.69 Billion in 2024 and is forecasted to grow to USD 71.72 Billion by 2033. The market is expected to grow at a CAGR of 3.33% during the forecast period of 2025-2033. Key growth drivers include rapid urbanization, economic factors such as GDP growth and interest rates, and government policies including land reforms and housing subsidies. These factors together influence property demand, affordability, and investor confidence, especially in major cities.

How AI is Reshaping the Future of South Africa Real Estate Market:

- AI-powered property valuation models increase pricing accuracy, aiding buyers and sellers in decision-making influenced by precise market data.

- Government housing schemes like RDP can benefit from AI-driven planning tools, optimizing affordable housing placement and resource allocation.

- AI-enhanced property management platforms improve rental operations, tenant screening, and maintenance scheduling, boosting the efficiency of the rental sector.

- AI-driven market analytics enable investors to identify emerging suburban and peri-urban opportunities caused by urban sprawl with greater precision.

- Recent company actions such as Ata Terra's acquisition of logistics properties aided by AI-driven risk assessments highlight AI's role in investment diversification.

- Smart city initiatives integrated with AI enhance infrastructure planning around economic zones, raising nearby property values and supporting urban renewal.

Grab a sample PDF of this report: https://www.imarcgroup.com/south-africa-real-estate-market/requestsample

Market Growth Factors

Urbanization and Population Growth are primary growth drivers, with cities like Johannesburg, Cape Town, and Durban attracting individuals seeking employment, education, and a better lifestyle. This migration fuels demand for affordable housing, rentals, and mixed-use developments. Urban renewal projects and infrastructure upgrades supported by government initiatives further enhance city life and stimulate residential and commercial property investments. Additionally, the rising middle class demands improved housing and lifestyle-focused community planning, while urban sprawl fosters growth in suburban and peri-urban markets, expanding opportunities for investors targeting emerging urban populations.

Economic Performance and Interest Rates significantly impact the real estate sector. Economic instability, load shedding, and unemployment negatively affect consumer confidence and purchasing power, reducing property demand. Conversely, periods of economic stability and lower interest rates improve property financing accessibility, benefiting both homebuyers and commercial investors. The South African Reserve Bank’s interest rate decisions directly influence mortgage affordability, homeownership, and rental trends. A healthy economy boosts business growth, increasing space demand across retail, office, and industrial sectors. The confidence of foreign investors, tied to economic performance, also affects capital inflow and market sentiment.

Government Policy and Land Reform present crucial trends shaping the market. Land reform issues, especially uncertainties around expropriation without compensation, affect investor sentiment, particularly in agriculture and undeveloped land. Positive government interventions include housing schemes such as the Reconstruction and Development Programme (RDP) and subsidies for first-time buyers that foster affordable housing development and renovation of low-income areas. Zoning laws, building codes, and environmental regulations influence property supply and pricing. Large public infrastructure projects like highway expansions and special economic zones enhance property values and open new development avenues, underscoring the importance of policy clarity and urban planning in driving market growth.

The market report offers a comprehensive analysis of the segments, highlighting those with the largest South Africa real estate market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Market Segmentation

Property Insights:

- Residential

- Commercial

- Industrial

- Land

Business Insights:

- Sales

- Rental

Mode Insights:

- Online

- Offline

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

Recent Developement & News

- November 2025: AI chatbots and virtual assistants enable 24/7 personalized property support, boosting accessibility and professionalism across South African agencies.

- November 2025: FATF grey list removal cuts perceived investment risk, driving renewed foreign capital into real estate with office vacancy rates dropping to 6.8% in prime spaces.

- October 2025: Urban precinct developments integrate residential, retail, and cultural elements, addressing housing shortages while fostering mixed-use communities in high-demand cities.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302