IMARC Group has recently released a new research study titled “United States Business Process Management Market Size, Share, Trends and Forecast by Deployment Type, Component, Business Function, Organization Size, Vertical, and Region, 2025-2033” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

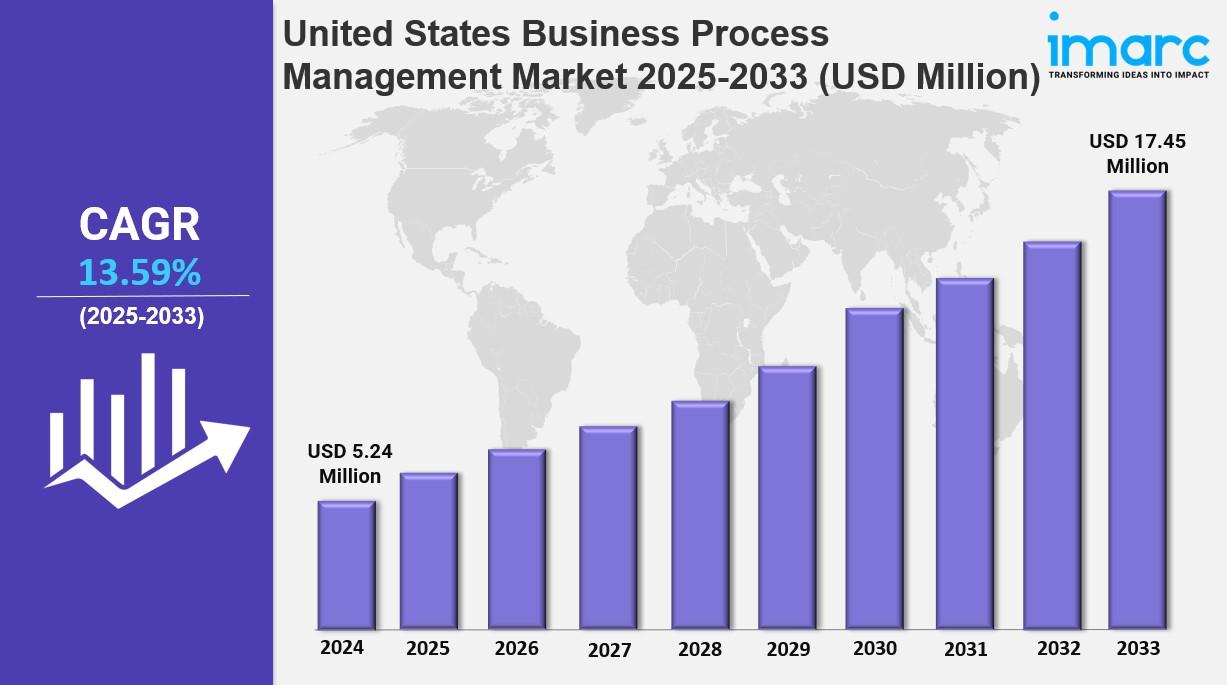

The United States business process management market size was valued at USD 5.24 Million in 2024 and is anticipated to reach USD 17.45 Million by 2033, growing at a CAGR of 13.59% during the forecast period 2025-2033. Driven by digital transformation, AI, automation, and cloud-based solutions, the market is expanding as companies seek operational efficiency, cost reduction, and streamlined workflows across industries.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

United States Business Process Management Market Key Takeaways

- Current Market Size: USD 5.24 Million (2024)

- CAGR: 13.59%

- Forecast Period: 2025-2033

- The Southern United States leads the market with a significant share in 2024.

- Cloud deployment holds about 63.5% market share in 2024 due to scalability and cost-effectiveness.

- Large enterprises dominate with approximately 73.2% market share in 2024.

- IT and Telecom vertical holds approximately 18.9% share in 2024.

- Key market drivers include increasing demand for operational efficiency, cost reduction, automation, and adoption of cloud and AI technologies.

Sample Request Link: https://www.imarcgroup.com/united-states-business-process-management-market/requestsample

To get more information on this market, Request Sample

United States Business Process Management Market Growth Factors

The United States business process management (BPM) market is primarily propelled by the rising need for enhanced operational efficiency and cost minimization. Businesses across various sectors implement BPM solutions to optimize workflows, automate routine tasks, and improve overall process efficiency. BPM systems enable better resource utilization, reduce manual errors, and improve service delivery. These factors make BPM integral for organizations aiming for competitive advantage and improved performance.

Another significant growth factor is the surging adoption of digital transformation initiatives and cloud-based platforms. Companies are moving away from traditional legacy systems, embracing scalable and flexible AI and cloud-based BPM solutions. For example, the partnership between Brand Engagement Network (BEN) and Provana in April 2024 to integrate AI assistants into contact center solutions demonstrates how advanced conversational AI is enhancing compliance and BPM across sectors including health insurance and legal services.

The market also benefits from the increasing integration of automation and artificial intelligence (AI), such as AI-driven tools and robotic process automation (RPA). These technologies automate routine tasks, reduce human errors, and maximize operational effectiveness. The May 2025 collaboration between Boomi and AWS, introducing AI agent management with Amazon Bedrock integration, exemplifies how businesses are scaling AI initiatives securely. This trend drives BPM growth as companies seek efficient, data-driven, and intelligent process management.

United States Business Process Management Market Segmentation

Breakup by Deployment Type:

- On-premises

- Cloud

Cloud deployment leads with 63.5% market share in 2024, favored for its scalability, flexibility, cost-effectiveness, seamless integration, and remote accessibility.

Breakup by Component:

- IT Solution

- Process Improvement

- Automation

- Content and Document Management

- Integration

- Monitoring and Optimization

- IT Service

- System Integration

- Consulting

- Training and Education

IT solutions dominate due to integration of advanced technologies like AI, automation, and cloud computing, enabling operational optimization and enhanced decision-making.

Breakup by Business Function:

- Human Resource

- Accounting and Finance

- Sales and Marketing

- Manufacturing

- Supply Chain Management

- Operation and Support

- Others

Each function focuses on automating and optimizing key business processes for efficiency, error reduction, improved customer engagement, and cost savings.

Breakup by Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises hold 73.2% market share in 2024, investing in comprehensive BPM solutions integrating AI, automation, and analytics.

Breakup by Vertical:

- Government and Defense

- BFSI

- IT and Telecom

- Healthcare

- Retail

- Manufacturing

- Others

IT and Telecom leads with 18.9% market share in 2024, leveraging BPM for automation, efficiency, and real-time data management.

Regional Insights

The Southern United States dominates the BPM market due to a strong presence of industries like manufacturing, healthcare, and logistics. The region benefits from growing digital transformation investments and BPM adoption for operational efficiency and supply chain optimization, positioning it as the leading US market segment in 2024.

Speak to an Analyst: https://www.imarcgroup.com/request?type=report&id=20527&flag=C

Recent Developments & News

- April 2025: Slingshot and Pronto BPO merged strategically to expand BPO services in the US and Europe, focusing on software development, telemarketing, virtual assistance, and tech support.

- March 2025: ResultsCX acquired Aucera, adding 1,200 employees and enhancing customer experience management in healthcare, BFSI, and utilities.

- February 2025: FBSPL launched Licensed Account Management Services in North America to streamline insurance operations, reducing administrative workload by 40%.

- January 2025: OPEXUS and Casepoint merged with investment from Thoma Bravo, serving 100,000 government users with workflow automation and compliance solutions.

- August 2024: WNS partnered with Pacific International Lines to enhance shipping network process automation using Malkom.ai platform.

Key Players

- Brand Engagement Network (BEN)

- Provana

- Boomi

- AWS

- Informatica

- Slingshot

- Pronto BPO

- ResultsCX

- Aucera

- FBSPL

- OPEXUS

- Casepoint

- WNS

- Pacific International Lines (PIL)

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302