Market Overview

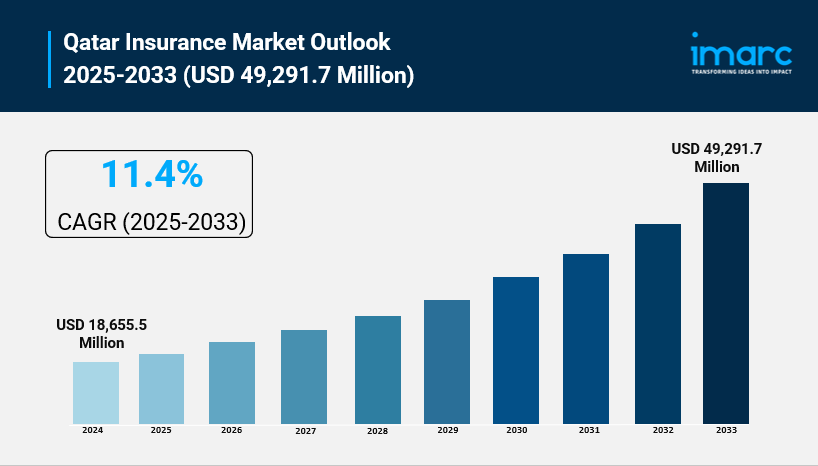

The Qatar insurance market size reached USD 18,655.5 Million in 2024. The market is projected to reach USD 49,291.7 Million by 2033, exhibiting a growth rate (CAGR) of 11.4% during 2025-2033. This growth during the forecast period 2025-2033 is driven by rising demand for health and life coverage along with the integration of ESG-oriented products. Advances in technology enhance operational efficiency and customer engagement, while digital transformation and customized health policies address evolving market needs. These elements collectively support a strengthened Qatar insurance market share and sustainable industry expansion.

How AI is Reshaping the Future of Qatar Insurance Market:

- Insurers in Qatar are leveraging sophisticated digital platforms, AI, and data analytics to optimize claims processing and underwriting, increasing operational efficiency.

- Predictive analytics and automation are significantly improving risk assessment and fraud detection, enabling more accurate premium pricing and effective claim settlements.

- Digitalization is enhancing accessibility, allowing clients to easily acquire tailored insurance solutions, boosting customer satisfaction and engagement.

- Qatar Insurance Company launched a summer travel advisory series in June 2025, reflecting proactive customer service enabled by digital engagement.

- Introduction of personal cyber insurance by Qatar Insurance Company addresses growing online risks, supporting enhanced digital confidence among individuals.

- The launch of innovative insurance products like School Fees Protection Insurance underscores the market's responsiveness to social needs and financial resilience.

Grab a sample PDF of this report: https://www.imarcgroup.com/qatar-insurance-market/requestsample

Market Growth Factors

The growth in the Qatar insurance market is driven by economic diversification, as set out in the Qatar National Vision 2030, continued infrastructure spending, particularly in energy, construction and tourism, compulsory health and motor policies, increasing expatriate population, increasing disposable income, thus greater demand for general, property and liability insurance, government focus, regulatory reforms by the Qatar Central Bank and increasing premium per capita driven by rising per capita income. General insurance's segments are expected to be driven by infrastructure spending and resiliency in the economy through 2025-2026 despite some market challenges.

Digital transformation and technology have helped the Qatar insurance and takaful industry increase, with insurers and takaful providers increasingly utilizing artificial intelligence-driven analytics, data analytics, mobile technology and digital channels to improve claims management, underwrite, and give customer experience. New regulations, with the aim to grow digital insurance and takaful solutions, help issue policies faster and enable insurers and takaful providers to create customized products for tech-savvy and expatriate consumers. Insurtech partners and insurance portals online reduce administrative costs with improvements to risk evaluation. They improve competition plus differentiation within penetration toward under-served markets while underwriting becomes efficient. Insurers are developing and adopting new selling models as demand increases for simple and convenient services, and because of technological innovation and growth of digital channels.

Another major contributor to the demand is the increasing awareness of the need for health and medical insurance driven by government efforts to improve healthcare access, insurers' fulfillment of mandatory coverage requirements including visitors, rising costs due to population growth and the growing expatriate community, and improving awareness of long term financial planning which is driving demand for medical, family takaful and life insurance. Regulatory requirements to have wider coverage in health benefits, product launches that include health benefits and flexible plans as well as government focus on promoting public health and economic growth are expected to support growth and penetration in health insurance products in Qatar.

Market Segmentation

Type of Product Insights:

- Life Insurance

- General Insurance

- Health Insurance

- Motor Insurance

- Home Insurance

- Liability Insurance

- Others

Distribution Channel Insights:

- Online

- Offline

End User Insights:

- Corporate

- Individual

Regional Insights:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

Recent Developement & News

- September 2025: Qatar Insurance Company introduced the country’s first School Fees Protection Insurance, offering comprehensive financial coverage for families facing job loss, disability, or student health challenges. This pioneering product enhances educational continuity and reinforces the company’s commitment to social responsibility and financial resilience.

- May 2025: Qatar Insurance Company launched the nation’s first personal cyber insurance, providing individuals financial protection against online risks such as fraud, identity theft, and cyberattacks. This innovative product supports rising digital confidence and cybersecurity awareness among Qatar's consumers.

- June 2025: Qatar Insurance Company initiated a summer travel advisory series on the QIC Blog, providing Qatar-based travelers guidance on destinations, entry requirements, and insurance for safe and informed trips. This initiative amplifies customer engagement and exemplifies the integration of digital technology for enhanced service delivery.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302