Introduction to Goods and Services Tax

Understanding Goods and Services Tax in India is crucial in today’s economy because GST has completely changed how taxes are collected and managed. Introduced as a unified tax system, GST replaced multiple indirect taxes and created a smoother, more transparent structure. Whether you are a business owner, student, or consumer, understanding Goods and Services Tax in India helps you make informed financial decisions.

Historical Background of GST in India

Before GST, India followed a complex indirect tax system that included VAT, service tax, excise duty, octroi, and more. These taxes often resulted in double taxation and higher costs. After years of discussion, GST was implemented on 1 July 2017 under the guidance of the GST Council, marking one of the biggest tax reforms led by the Government of India.

What Is Goods and Services Tax in India?

Definition and Meaning of GST

Goods and Services Tax is an indirect tax levied on the supply of goods and services. It is a destination-based tax, meaning tax revenue is collected by the state where goods or services are consumed.

Why GST Was Introduced in India

The main purpose was to remove tax cascading, simplify compliance, and create a unified national market. Understanding Goods and Services Tax in India reveals how it supports economic growth and ease of doing business.

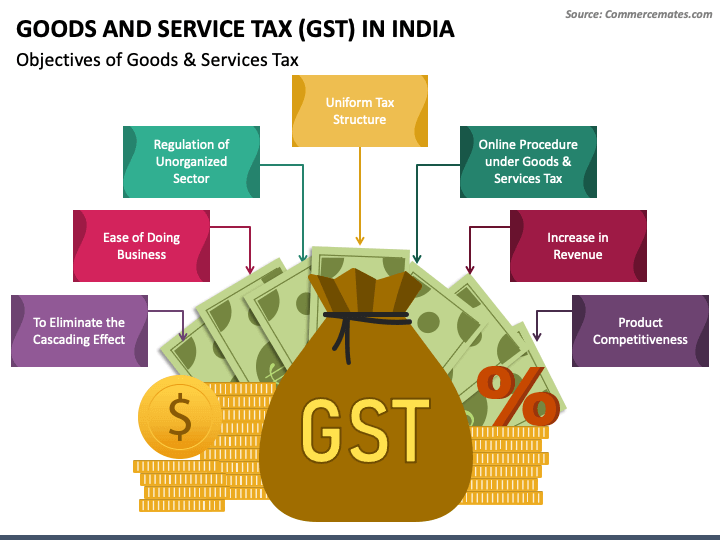

Objectives of Goods and Services Tax

-

Eliminate multiple indirect taxes

-

Reduce tax evasion

-

Improve transparency

-

Boost economic efficiency

-

Create a single national market

Types of GST in India

CGST (Central GST)

Collected by the Central Government on intra-state supplies.

SGST (State GST)

Collected by State Governments on intra-state supplies.

IGST (Integrated GST)

Applied to inter-state transactions and imports.

UTGST (Union Territory GST)

Applicable in Union Territories without legislatures.

GST Slab Rates Explained

India follows a multi-rate GST structure, including:

-

0% – Essential goods

-

5% – Basic necessities

-

12% & 18% – Standard goods and services

-

28% – Luxury and sin goods

This slab system balances affordability and revenue generation.

How GST Works: Step-by-Step Process

-

Seller charges GST on invoice

-

Buyer pays GST

-

Seller deposits tax with the government

-

Input Tax Credit is adjusted

-

Final tax burden falls on the consumer

GST Registration Process in India

Businesses must register for GST if turnover exceeds prescribed limits. Registration is done online through the official GST portal, making compliance faster and simpler.

Input Tax Credit (ITC) Under GST

ITC allows businesses to deduct the tax they already paid on purchases from the tax payable on sales. This prevents double taxation and reduces overall costs.

Advantages of GST in India

-

Simplified tax structure

-

Reduced tax burden

-

Transparent pricing

-

Increased government revenue

-

Boost to startups and MSMEs

Challenges and Limitations of GST

Despite its benefits, GST faces challenges such as:

-

Frequent rule changes

-

Compliance burden for small businesses

-

Technical glitches in filing returns

Impact of GST on Businesses

Understanding Goods and Services Tax in India shows that businesses benefit from easier interstate trade, but must maintain accurate records and timely filings.

Impact of GST on Consumers

Consumers experience uniform pricing across states, though some goods became costlier while others became cheaper.

GST Compliance and Filing Returns

Regular GST returns like GSTR-1 and GSTR-3B must be filed monthly or quarterly, depending on turnover.

Common GST Mistakes to Avoid

-

Late return filing

-

Incorrect ITC claims

-

Invoice mismatches

-

Ignoring compliance deadlines

FAQs on Goods and Services Tax in India

1. Is GST applicable to all goods and services?

No, items like alcohol for human consumption are excluded.

2. Who needs GST registration?

Businesses crossing turnover limits or involved in inter-state trade.

3. What is the GST rate for services?

Most services fall under the 18% slab.

4. Can consumers claim GST refunds?

Generally no, except in special cases like exports.

5. Is GST good for the Indian economy?

Yes, it promotes transparency and economic integration.

6. How often do GST rates change?

Rates may change based on GST Council recommendations.

Conclusion

Understanding Goods and Services Tax in India is essential for navigating India’s modern tax system. While GST has challenges, its long-term benefits outweigh the drawbacks. With better compliance, awareness, and technology, GST continues to strengthen India’s economic framework.