When making plans for mobile products in 2025 and the past, it’s important to recognize not simply user options but also improvement economics. Depending on complexity and platform, usual 2025 app improvement charges vary from $5,000–$20,000 for fundamental apps, $20,000–$100,000 for mid-level apps, and $100,000+ for large, advanced apps with custom backends or AI capabilities. These estimates provide builders and groups a benchmark as Android and iOS continue to form their ecosystems.

In this blog, we dive into the most comprehensive worldwide stats, revenue figures, and marketplace percentage comparisons between iOS and Android in 2026, organized for clear insights and decision‑making.

1. Market Dominance: Android’s Global Reign

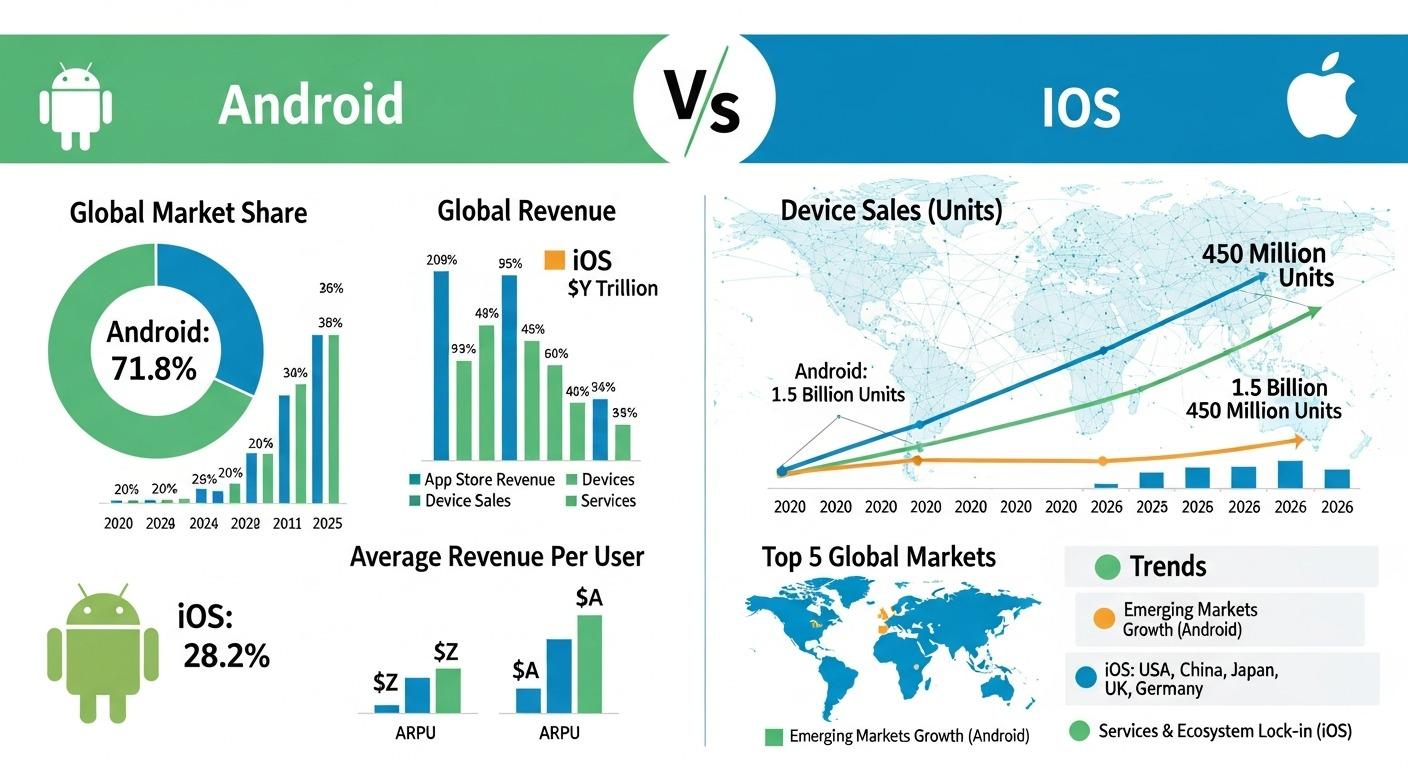

On a global scale, Android holds a commanding lead in the running gadget marketplace. As of late 2025, Android accounted for roughly 72–73% of all smartphones globally, with projections indicating that it'll hold this dominance in 2026.

This full-size adoption stems from the considerable sort onumberdroid devices available at exceptional rate factors, from low-priced telephones to high-end fashions. As a result, Android’s success in emerging markets like Asia, Africa, and Latin America remains exceptional, making it the default platform for global scale.

2. IOS’s Strong Second Place

While Android leads in sheer numbers, iOS secures a stable approx 27–28% slice of the worldwide OS market.

This Displays Apple’s strategic consciousness on top-rate-of-return, logo loyalty, and tightly integrated ecosystem stories. In key rich markets, together with America, iOS regularly outpaces Android in market share, showcasing a sturdy local market.

Unlike Android’s extensive device range, Apple’s iPhone lineup targets consumers looking for top-class capabilities, exceptional constrconstructionlengthy‑time period software prograsupport balance sustains iOS’s solid market proportion even amid Android’s international growth.

3. Developer Focus: Android App Development Trends

Developers planning for the future need to weigh worldwide attainability against revenue ability. Android app development opens get entry to to billions of gadgets worldwide, especially for apps relying on massive install bases, along with social, utility, and local offerings. With Google Play hosting millions of apps and downloads regularly exceeding the onthoseS, Android offers unequalled reach.

However, monetization metrics vary throughout platforms. While Android’s massive user base drives downloads, in keeping with user engagement tends to be lower compared to iOS, an important consideration for revenue‑centered ventures.

4. Revenue Realities: iOS Leads Consumer Spend

Despite Android’s dominant marketplace proportion, iOS generates substantially more from app income and in‑app purchases. Across global app shops, iOS captures roughly thirdsthirderall patron spend, dwarfing Android’s share.

This trend reflects variations in user behavior: iOS customers are often more inclined to purchase top-class subscriptions and virtual content. Consequently, builders focused on monetization, mainly via cltop-classng, subscriptions, and in‑app purchases, may additionally prioritize iOS or adopt a pass‑platform method that places early emphasis on Apple’s surroundings.

5. Regional Patterns: US and Emerging Markets

Android’s international dominance masks putting differences. In areas like Asia, Africa, and Latin America, Android captures a high market share (frequently north of 80%). Emerging markets generally tend to embody Android due to affordability and a much wider variety of device models.

In contrast, iOS keeps or leads market share in excessexcessive-profit such as the United States, where approximately 58% of gadgets run on iOS.

This split influences enterprise strategies: concentrating on prosperous regions regularly justifies launching on iOS first, whereas gaining global user scale might also begin with Android.

6. IOS App Development: Revenue and Engagement Powerhouse

When comparing platforms, iOS app development remains attractive due to better average sales per user (ARPU). Many popular subscription and premium apps, spanning health, producproductivityleisure, and travel on Apple’s ecosystem. In sectors such as cell gaming, iOS customers disproportionately make contributions to worldwide in‑app profits.

Though Android attracts extra average downloads, iOS often leads in common engagement and spend, which could offset a smaller user base.

7. Ecosystem Dynamics: Apps, Updates, and Adoption

Both platforms continue to innovate swiftly. Android’s open atmosphere permits enormous customization and 0.33‑birthday party integrations, while iOS prioritizes cohesive user stories and longer tool guide cycles. Software replacement tends to vary: iOS customers quickly adopt new versions, whereas Android fragmentation across multiple tool makers can slow universal updates.

Developers have to channel these dynamics into release strategies to optimize performance, security, and consumer enjoyment on both platforms.

8. App Store Strategies & Monetization Models

Each platform supports a variety of monetization models, paid downloads, freemium enhancements, subscriptions, and in‑app advertising and marketing. IOS historically shows stronger overall performance in subscription and top rate fashion, Android’s broader person base favors ad‑pushed or freemium fashions in many emerging markets because of local pricing expectations.

Hybrid or move‑platform processes are increasingly more common; companies are seeking to combo combineattain with different revenue streams.

9. Innovation Frontiers: AI, UX & Next-Gen Features

Looking beforeahead26, both Android and iOS are actively integrating AI and superior features into middle structures, improving consumer stories. Android’s integration of Google’s AI offerings improves contextual search, voice help, and on‑device intelligence. At the same Apple keeps refining its gadget mastery and privacy-centric features within iOS.

These improvements are extra bells and whistles; they form how customers engage with apps, influencing engagement and retention.

10. Balancing Reach and Revenue

In choosing between Android and iOS, agencies face predominant trade-offs: attain (Android) versus monetization (iOS). A mixed strategy often yields the fine effects, supported via pass‑platform gear that streamline improvement and broaden marketplace get admission to.

Whether focused on billions of world customers or premium spenders in affluent economies, knowledge nuanceof d worldwide stats and sales styles equips developers and agencies for fulfillment.

Final Thoughts

In the 2026 panorama, Android and iOS each have wonderful blessings, Android for unparalleled global scale and iOS for concentrated revenue energy. As Mobile app development continues evolving, builders must balance attain, revenue potential, nearby developments, and innovation priorities to supply apps that resonate with users throughout both ecosystems.