IMARC Group has recently released a new research study titled “US Insurtech Market Report by Type (Auto, Business, Health, Home, Specialty, Travel, and Others), Service (Consulting, Support and Maintenance, Managed Services), Technology (Blockchain, Cloud Computing, IoT, Machine Learning, Robo Advisory, and Others), and Region 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

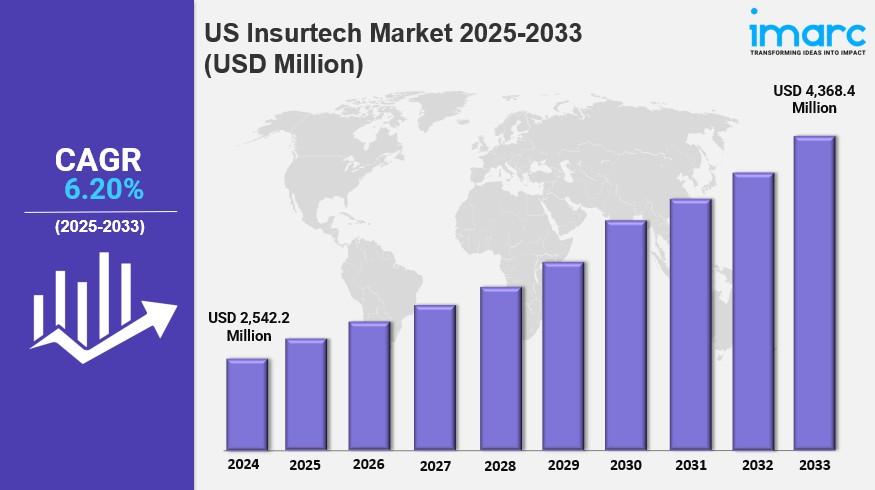

The U.S. insurtech market size reached USD 2,542.2 Million in 2024 and is projected to grow to USD 4,368.4 Million by 2033, at a CAGR of 6.20% during 2025-2033. Rapid developments in technologies such as AI, machine learning, blockchain, and data analytics are driving innovative insurance solutions in the region. The market benefits from venture capital funding, collaboration between startups and insurers, and expanded IoT use for real-time risk assessment.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

U.S. Insurtech Market Key Takeaways

- Current Market Size: USD 2,542.2 Million in 2024

- CAGR: 6.20% during 2025-2033

- Forecast Period: 2025-2033

- The market expansion is driven by increasing venture capital inflows and collaboration between technology startups and traditional insurers.

- Growing adoption of IoT devices enables real-time data capture for improved risk assessment.

- Accelerated innovation in AI, machine learning, and blockchain technologies fuels market growth.

- Regulatory encouragement and digital transformation efforts by legacy insurers are important growth drivers.

- Increasing consumer demand for personalized insurance products supports market expansion.

Sample Request Link: https://www.imarcgroup.com/us-insurtech-market/requestsample

Market Growth Factors

The U.S. insurtech market share is bolstered by the accelerated technological innovation particularly in artificial intelligence (AI), machine learning (ML), and blockchain technologies. These advancements enable automated underwriting, fraud detection, and risk assessment, thus streamlining insurance operations. Additionally, AI-led predictive analytics help insurers proactively identify potential risks, enhancing customer satisfaction and reducing claim frequencies.

Expansion is further supported by digital transformation efforts from legacy insurers and increasing consumer demand for personalized insurance products. Regulatory encouragement plays a significant role in fostering innovation and adoption of new technologies within the insurance sector.

The rising adoption of IoT devices such as home automation, connected car systems, and wearable health trackers allows insurers to gather real-time data. This data facilitates the development of dynamic pricing and usage-based insurance models, which reward positive behaviors and improve risk management. The implementation of blockchain technology also increases security, transparency, and efficiency, enabling quicker claims settlements via smart contracts and reducing fraud risks. These factors collectively drive substantial growth in the U.S. insurtech market.

To get more information on this market: Request Sample

Market Segmentation

Breakup by Type:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

Breakup by Service:

- Consulting: Includes strategic advisory and risk assessment services.

- Support and Maintenance: Encompasses ongoing operational and technical support for insurtech solutions.

- Managed Services: Comprehensive management and outsourcing of insurtech services.

Breakup by Technology:

- Blockchain: Used for smart contracts and secure data transactions.

- Cloud Computing: Supports scalable insurance platforms and services.

- IoT: Enables data collection via connected devices for dynamic underwriting.

- Machine Learning: Powers predictive analytics and automated decision-making.

- Robo Advisory: Uses AI algorithms for automated insurance advice.

- Others: Other emerging insurtech technologies.

Regional Insights

The report covers four major U.S. regions: Northeast, Midwest, South, and West. Specific market share or CAGR by region is not provided in the source. The segmentation indicates comprehensive analysis across these regions, addressing regional market dynamics and opportunities in the U.S. insurtech market.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=22150&flag=C

Recent Developments & News

In September 2025, The Spark, a new insurtech platform backed by Aon, Generali, and QBE Ventures, was launched at Monte Carlo’s annual Rendez-Vous as the "world’s first global prevention lab," aiming to shift insurance focus from claims payment to loss prevention. Insurers representing over $300 billion in premiums participate, with prevention-focused revenue expected to grow from $21.6 billion in 2023 to $49.5 billion by 2030.

In August 2025, Hiscox USA announced the acquisition of Corix Insurance Services LLC and Vouch Insurance Company from Vouch Inc., expanding its U.S. specialty insurance presence and adding broker technology. Vouch Inc. will focus on risk management services. The companies signed a multi-year distribution agreement pending regulatory approval.

Competitive Landscape

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302