IMARC Group, a leading market research company, has recently released a report titled "Meat Substitutes Market Size, Share, Trends and Forecast by Type, Source, Category, Distribution Channel, and Region, 2025-2033" The study provides a detailed analysis of the industry, including the global meat substitutes market size, share, growth, trends, and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Meat Substitutes Market Overview

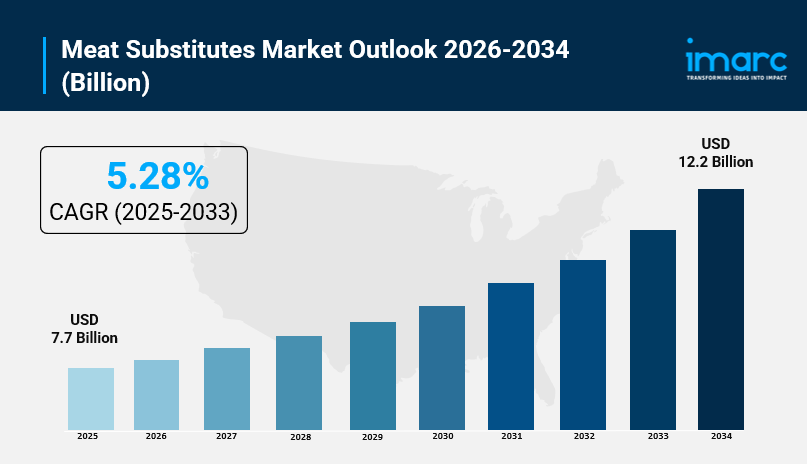

The global meat substitutes market was valued at USD 7.29 Billion in 2024 and is expected to reach USD 11.92 Billion by 2033, growing at a CAGR of 5.56% during 2025-2033. This growth is driven by increasing health consciousness, demand for sustainable and ethical food options, and advancements in food technology improving taste and texture. Europe leads the market with over 36.5% market share in 2024.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Meat Substitutes Market Key Takeaways

- Current Market Size: USD 7.29 Billion in 2024

- CAGR: 5.56% during 2025-2033

- Forecast Period: 2025-2033

- Europe holds the largest market share, accounting for over 36.5% in 2024, due to strong adoption of flexitarian, vegetarian, and vegan diets.

- The key growth drivers include rising health and nutrition awareness, ethical considerations related to animal welfare, and environmental concerns.

- The U.S. dominates North America with 83.7% revenue share in 2024, fueled by health and sustainability trends.

- Asia Pacific growth is supported by rising chronic disease awareness and cultural vegetarian practices, particularly in India.

- Enhanced product taste, texture, nutritional content, and expanded retail availability are boosting consumer acceptance.

Request Your Free “Meat Substitutes Market” Insights Sample PDF: https://www.imarcgroup.com/meat-substitutes-market/requestsample

Market Growth Factors

Awareness of health principally drives the global meat substitutes market. Around the world, people know the health hazards of a diet based on meat. Excess meat-based food in a diet causes cholesterol levels to build which contributes to cardiovascular disease. Heart disease leads to death in Europe. It causes over 42.5% of total deaths each year. Many of these products offer protein alternatives with less cholesterol or saturated fat, along with vitamins, minerals, and amino acids. Beyond Meat announced the launch of two plant-based proteins during April 2023: Beyond Pepperoni and Beyond Chicken Fillet are meat alternatives with the intent to keep up with the health trend.

Ethical issues also concern consumer preference for non-animal-based meat, and many consumers seek cruelty-free or sustainable substitutes. In a survey of Indian consumers, nearly 50% of respondents strongly preferred alternative meat products over conventional meat. Other vegetarian products are produced for the growing ethical and sustainability market by companies such as CCL (Continental Greenbird). These products are made from pea protein and chickpeas and also promote animal welfare and healthy eating.

Other factors contributing to market growth include the environmental impact of animal farming. Deforestation and greenhouse gas emissions from livestock farming contribute up to 17% of global GHG emissions in total. Producing plant-based replacements proves more sustainable in effect. In May 2024, Singaporean pea protein company Jiro-Meat increased production of its meat made from recycled soy pulp before commercialization, to meet demand for ecofriendly and climate-friendly products. This matches global efforts like the COP28 action plan with over 150 countries focused on agriculture.

Market Segmentation

Breakup by Type:

- Tofu & Tofu Ingredients: Largest segment in 2024 (37.9%), valued for essential amino acids, vitamins, minerals, and low fat/calorie content. Widely available in grocery and specialty stores.

- Tempeh

- Textured Vegetable Protein (TVP)

- Seitan

- Quorn

- Others

Breakup by Source:

- Soy: Market leader with around 39.0% share in 2024; contains all nine essential amino acids, used in forms like TVP, tempeh, and tofu. Nestlé's launch of Maggi soya chunks in December 2023 expanded access in Central and West Africa.

- Wheat

- Mycoprotein

- Others

Breakup by Category:

- Frozen: Leading category with 61.6% share in 2024; benefits include longer shelf life and preservation of taste and nutrition through advanced freezing techniques.

- Refrigerated

- Shelf-Stable

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets: Largest channel with 50.6% market share in 2024; offers broad product availability and convenient shopping experience.

- Health and Food Stores

- Convenience Stores

- Others

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Europe is the dominant region in the meat substitutes market, accounting for over 36.5% market share in 2024. This dominance is attributed to increasing adoption of flexitarian, vegetarian, and vegan diets driven by health and environmental awareness. Europe's strong retail infrastructure, including supermarkets, specialty health food stores, and online platforms, enhances product accessibility. Leading players are expanding product offerings to capture the broad consumer base, supporting continued market growth in the region.

Recent Developments & News

- December 2024: UK-based THIS introduced hyper-realistic meat substitutes, THIS™ Isn’t Chicken Kyiv and THIS™ Isn’t Chicken Wings, crafted from soy and fava protein with plant-based wild garlic butter inside.

- December 2024: Veggy, Turkey’s first plant-based meat alternatives producer, launched Veggy Kids, a line of kid-friendly vegetable-based meatballs, nuggets, and burgers.

- November 2024: Renegade Foods from the Bay Area expanded their European-style vegan salami range with three new products inspired by French and Hungarian cuisine.

- November 2024: Mind Blown Plant Based Seafood Co. unveiled Crispy, Crunchy Fried Shrimp, a plant-based seafood option mimicking classic fried shrimp, available exclusively online for a limited time.

Key Players

- The Nisshin Oillio Group

- Dupont

- Archer Daniels Midland

- Amy's Kitchen

- Conagra Brands

- Quorn Foods

- Cauldron Foods

- Campbell Soup Company

- VBites

- Blue Chip Group

- Field Roast

- Garden Protein International

- LightLife

- Sweet Earth Foods

- MGP Ingredients

- Tofurky

- Meatless

- Sonic Biochem Limited

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=1582&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302