Market Overview

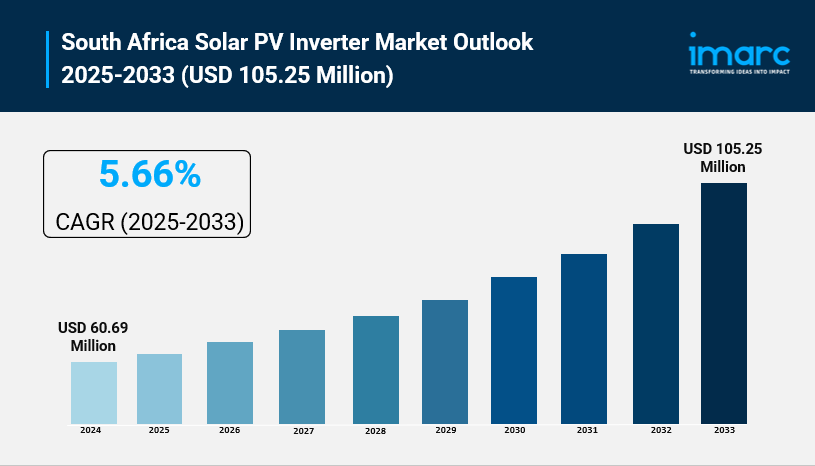

The South Africa solar PV inverter market size reached USD 60.69 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 105.25 Million by 2033, exhibiting a growth rate (CAGR) of 5.66% during 2025-2033. The market expansion is driven by rising demand across residential, commercial, and utility-scale sectors. Key drivers include supportive policies like the REIPPPP program and growing adoption in commercial and industrial segments. For more detailed insights, visit the South Africa Solar PV Inverter Market.

How AI is Reshaping the Future of South Africa Solar Pv Inverter Market:

- AI-powered inverter management and monitoring platforms enable real-time data analytics, improving system efficiency and reliability across solar PV installations.

- Government initiatives such as South Africa’s Just Energy Transition Investment Plan, backed by significant funding (USD 98.7 Billion), encourage innovative clean energy technologies including AI integration.

- Companies like Ginlong (Solis) Technologies leverage AI in product innovation and remote monitoring platforms (SolisCloud), supporting advanced hybrid and utility-scale inverters with efficiencies up to 99%.

- AI-driven predictive maintenance helps reduce downtime in commercial and industrial solar PV applications, essential amid South Africa’s grid instability and load shedding.

- The adoption of AI-enhanced solar-plus-storage solutions for mining and industrial sectors boosts demand for intelligent inverter systems with adaptive load handling.

- AI enhances forecasting and energy management, helping optimize distributed solar systems financed through power purchase agreements (PPAs) in commercial markets.

Grab a sample PDF of this report: https://www.imarcgroup.com/south-africa-solar-pv-inverter-market/requestsample

Market Growth Factors

The South Africa solar PV inverter market is strongly propelled by government policy support and renewable energy initiatives. The Renewable Energy Independent Power Producer Procurement Programme (REIPPPP) has been pivotal in generating demand for solar installations, directly propelling inverter requirements, especially for utility-scale projects. The government’s commitment to carbon emission reductions and energy security has fostered a favorable regulatory environment, including net metering policies and tax incentives for solar power adoption. Moreover, challenges with electricity supply such as load shedding have accelerated support for distributed energy resources, underscoring the importance of reliable inverter technologies. These combined policy drivers ensure sustained market demand across all segments.

Rising commercial and industrial sector adoption is another vital growth factor. Increasing electricity costs and load shedding disruptions have incentivized companies to invest in solar PV systems. Large commercial installations demand advanced inverters capable of managing high power capacities efficiently under varying load conditions. Industrial users, including the energy-intensive mining sector, are deploying solar-plus-storage solutions with sophisticated inverter technologies to reduce dependence on the unstable grid and ensure continuous operation. Facilities like shopping centers and manufacturing plants increasingly seek distributed solar systems with string inverters for operational cost savings and sustainability goals supported by power purchase agreement financing.

Technological advancement and innovation within inverter product offerings continue to drive market growth. Manufacturers are introducing hybrid, off-grid, and utility-scale inverters with efficiencies reaching up to 99%, supported by platforms such as SolisCloud for remote monitoring. The integration of AI and digital solutions in inverter systems facilitates predictive maintenance, enhanced performance monitoring, and optimal energy management. This technology evolution aligns with growing renewable energy targets and the demand for dependable, high-efficiency solar PV inverter solutions in both urban and regional South African markets. These innovations improve system reliability and scalability, expanding the market footprint.

Market Segmentation

Technology Insights:

- Central Inverters

- String Inverters

- Microinverter

- Others

Voltage Insights:

- < 1,000 V

- 1,000 – 1,499 V

- > 1,500 V

Application Insights:

- Utility Scale

- Residential Scale

- Small Commercial Scale

- Large Commercial Scale

- Industrial Scale

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

Recent Developement & News

- September 2025: The European Investment Bank (EIB) and FirstRand Bank launched a joint €400 Million (ZAR 7.9 Billion) renewable energy funding initiative focusing on solar photovoltaic and wind projects in South Africa. This boost in funding is expected to accelerate clean energy supply, job creation, and energy security, complementing South Africa’s Just Energy Transition efforts.

- July 2025: Ginlong (Solis) Technologies expanded its presence in South Africa by enhancing its inverter product portfolio, including hybrid and utility-scale models with efficiencies up to 99%. Its SolisCloud platform now supports remote monitoring and AI-driven analytics, facilitating better system management for local solar PV installations.

- August 2025: Africa added 2.5 GW of solar capacity, increasing total installed solar capacity to 19.2 GW, with utility-scale PV making up 72% of new installations (~1.78 GW). This significant growth highlights the expanding market opportunity for advanced solar PV inverters across the continent, including South Africa.

Customization Note:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302