Market Overview:

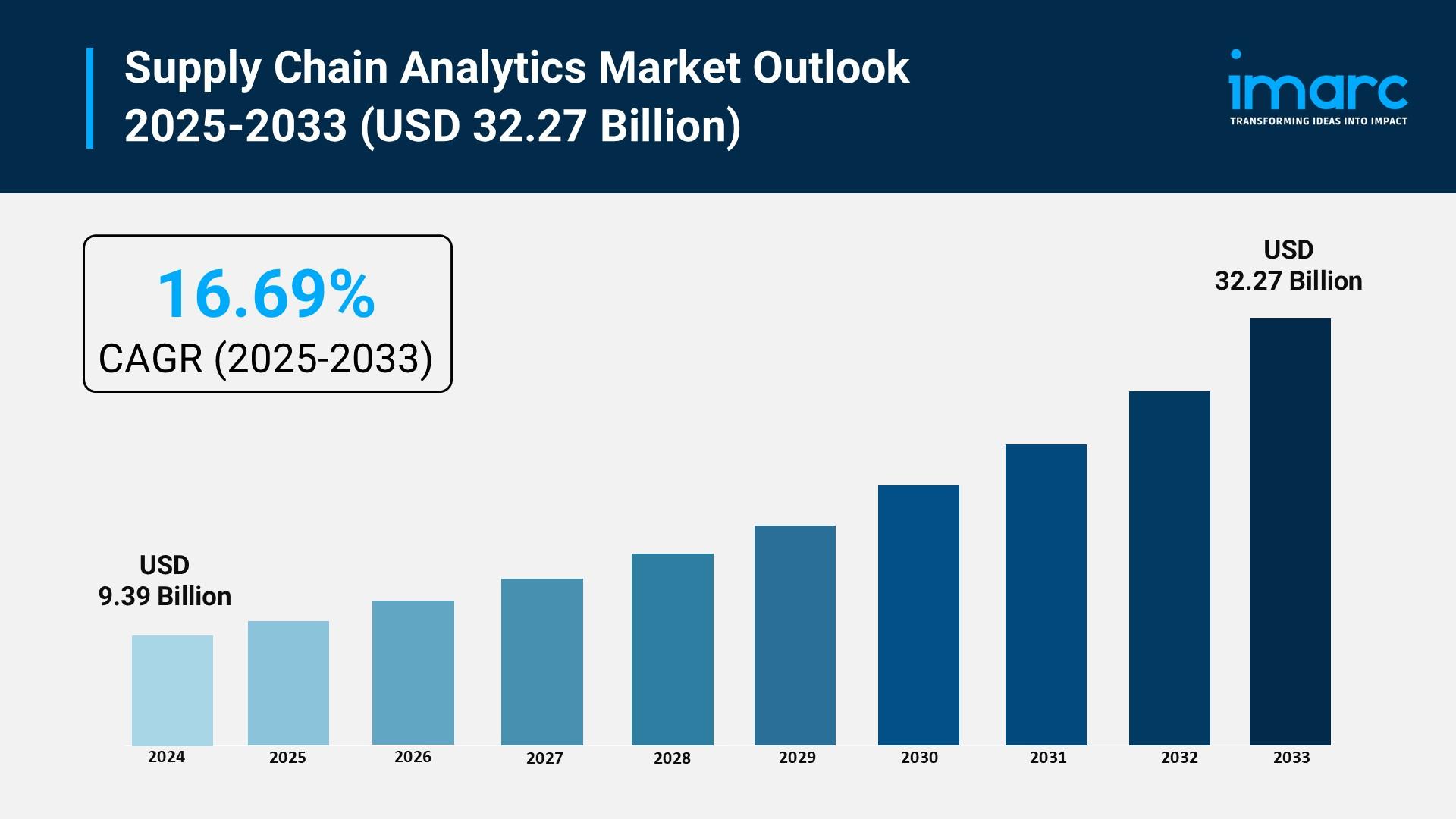

The supply chain analytics market is experiencing rapid growth, driven by escalating geopolitical volatility and risk mitigation, rapid digital transformation and cloud migration, and intensifying e-commerce complexity and consumer expectations. According to IMARC Group’s latest research publication, “Supply Chain Analytics Market Size, Share, Trends and Forecast by Component, Deployment Mode, Enterprise Size, Industry Vertical, and Region, 2025-2033”, the global supply chain analytics market size was valued at USD 9.39 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 32.27 Billion by 2033, exhibiting a CAGR of 16.69% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/supply-chain-analytics-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Supply Chain Analytics Market

- Escalating Geopolitical Volatility and Risk Mitigation

The intensification of global geopolitical tensions and trade policy shifts serves as a primary driver for the supply chain analytics market. Organizations are increasingly moving away from traditional "just-in-time" models toward "just-in-case" strategies to navigate sudden border closures, tariffs, and regional conflicts. A recent industry survey reveals that 91% of supply chain leaders are significantly altering their operational strategies due to changes in international trade policies, while 87% identify geopolitical risk as the leading force behind the transition to more flexible, data-driven operations. This environment necessitates advanced predictive tools that can model the impact of tariffs or identify alternative sourcing hubs in real time. Consequently, the demand for risk-focused analytics software has surged, as these platforms allow companies to simulate multi-tier supplier disruptions and maintain business continuity. By integrating external threat intelligence with internal logistics data, businesses can proactively shift production schedules and inventory locations before localized crises escalate into global bottlenecks.

- Rapid Digital Transformation and Cloud Migration

The widespread adoption of cloud-based infrastructure and Big Data technologies is fundamentally expanding the accessibility of sophisticated analytics across the global industrial landscape. Modern cloud platforms provide the elastic scaling required to process the multi-petabyte data volumes generated by sensors, GPS trackers, and enterprise resource planning systems. Data indicates that cloud platforms currently account for approximately 63.5% of total market revenue, as they eliminate the high capital expenditure associated with on-premise hardware. This shift is particularly impactful for small and medium-sized enterprises (SMEs), which are leveraging cost-effective Software-as-a-Service (SaaS) models to gain competitive insights that were previously reserved for large corporations. Furthermore, the convergence of Internet of Things (IoT) devices with centralized analytics hubs enables real-time monitoring of cargo conditions and fleet performance. With 52% of operations leaders reporting that IoT-enabled capabilities have been highly effective in creating value, the push to digitize physical assets continues to propel market expansion.

- Intensifying E-commerce Complexity and Consumer Expectations

The global surge in e-commerce activity, with business-to-consumer revenue projected to reach 5.5 trillion USD, is placing unprecedented pressure on fulfillment networks and last-mile delivery. Consumers now demand hyper-fast delivery times and transparent tracking, forcing retailers to adopt real-time inventory algorithms to manage stock across multiple warehouses and storefronts simultaneously. Supply chain analytics are vital in this context for optimizing "cost-to-serve" at a granular level, helping companies understand the financial implications of every individual ship-to location and delivery pathway. High-volume retailers like Walmart are increasingly utilizing automated demand forecasting to predict product needs at the local level, thereby reducing overstocking and manual planning errors. The need to manage this omni-channel complexity—where 33.6% of market revenue is currently driven by the retail sector—forces a continuous investment in diagnostic tools that can identify inefficiencies in the picking, packing, and shipping lifecycle to protect narrow profit margins.

Key Trends in the Supply Chain Analytics Market

- Integration of Generative AI for KPI Reporting

Generative Artificial Intelligence (Gen AI) is revolutionizing how supply chain professionals interact with complex datasets by automating the creation of performance reports and strategic insights. Experts predict that by 2028, generative AI will be responsible for 25% of all key performance indicator (KPI) reporting within the logistics sector. Unlike traditional dashboards that require manual interpretation, Gen AI "agents" can synthesize vast amounts of procurement and demand data to answer natural language queries, such as identifying why a specific shipping route is experiencing repeated delays. Companies are currently piloting these tools to conduct contract risk analysis and support supplier negotiations, with half of all organizations expected to utilize AI-enabled contract tools within the next two years. This trend allows for a "human-in-the-loop" approach where managers focus on high-level decision-making while AI handles the labor-intensive task of error detection and invoice data extraction, significantly accelerating the speed of organizational change.

- Development of Digital Twin Control Towers

The emergence of digital twin technology—the creation of virtual, real-time replicas of physical supply chains—is becoming a cornerstone of modern logistics strategy. These digital models allow companies to simulate "what-if" scenarios, such as the impact of a major flood in Europe or a labor strike at a specific port, without risking real-world assets. Industry reports suggest that 55% of organizations are already using or testing AI-driven scenario planning and operational transparency tools to mitigate disruptions. A practical application of this trend is seen in the consumer packaged goods industry, where digital twins are used for "slotting bin optimization" to organize warehouse layouts based on predicted seasonal demand. By integrating real-time data from IoT sensors, these control towers provide unparalleled visibility deep into the value chain, often reaching Tier 4 suppliers and beyond. This allows Chief Supply Chain Officers to anticipate equipment failures or logistics bottlenecks days before they manifest physically.

- Focus on ESG Transparency and Scope 3 Compliance

Environmental, Social, and Governance (ESG) requirements are evolving from elective reporting to mandatory compliance, driving a significant trend in sustainability-focused analytics. Companies are now required to validate data on their partners' carbon footprints and ethical labor practices to meet "Scope 3" expectations, which cover the indirect emissions within the entire value chain. Leading organizations like Unilever are spearheading this movement by using analytics to integrate internal data with third-party datasets to monitor resource consumption and sustainability risks. This trend is supported by new international regulations, such as the Corporate Sustainability Due Diligence Directive, which forces brands to maintain high-fidelity records of their product origins. Advanced analytics platforms now offer carbon-credit-linked freight optimization and real-time spoilage monitoring in cold chains to reduce waste. Consequently, transparency is no longer just a compliance task but a competitive differentiator that builds consumer trust and ensures long-term access to global markets.

Leading Companies Operating in the Supply Chain Analytics Industry:

- Axway

- Capgemini SE

- International Business Machines Corporation

- Infor Inc (Koch Industries Inc.)

- Kinaxis Inc.

- Manhattan Associates Inc.

- Microstrategy Incorporated

- Oracle Corporation

- QlikTech International AB

- SAP SE

- SAS Institute Inc.

- Tableau Software LLC (Salesforce Inc.)

Supply Chain Analytics Market Report Segmentation:

By Component:

- Assays, Kits and Reagents

- Software and Services

Software leads the market due to its comprehensive capabilities in demand forecasting, supplier performance, procurement, inventory, and logistics optimization.

By Deployment Mode:

- On-premises

- Cloud-based

On-premises dominates as it offers greater data control, customization, security, and long-term cost benefits for sensitive or latency-critical operations.

By Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises hold the largest share, leveraging analytics to optimize complex supply chains, improve efficiency, and meet ESG compliance.

By Industry Vertical:

- Automotive

- Food and Beverages

- Healthcare and Pharmaceuticals

- Manufacturing

- Retail and Consumer Goods

- Transportation and Logistics

- Others

Manufacturing leads the segment, utilizing analytics for demand prediction, inventory optimization, production scheduling, and logistics efficiency.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America dominates, driven by advanced tech adoption, strong e-commerce growth, and a robust ecosystem of supply chain innovators.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302