Introduction

Semaglutide, a groundbreaking medication primarily used for managing type 2 diabetes and obesity, has gained significant traction in Sweden. As a glucagon-like peptide-1 (GLP-1) receptor agonist, it helps regulate blood sugar levels and promotes weight loss, making it a preferred choice among patients and healthcare providers.

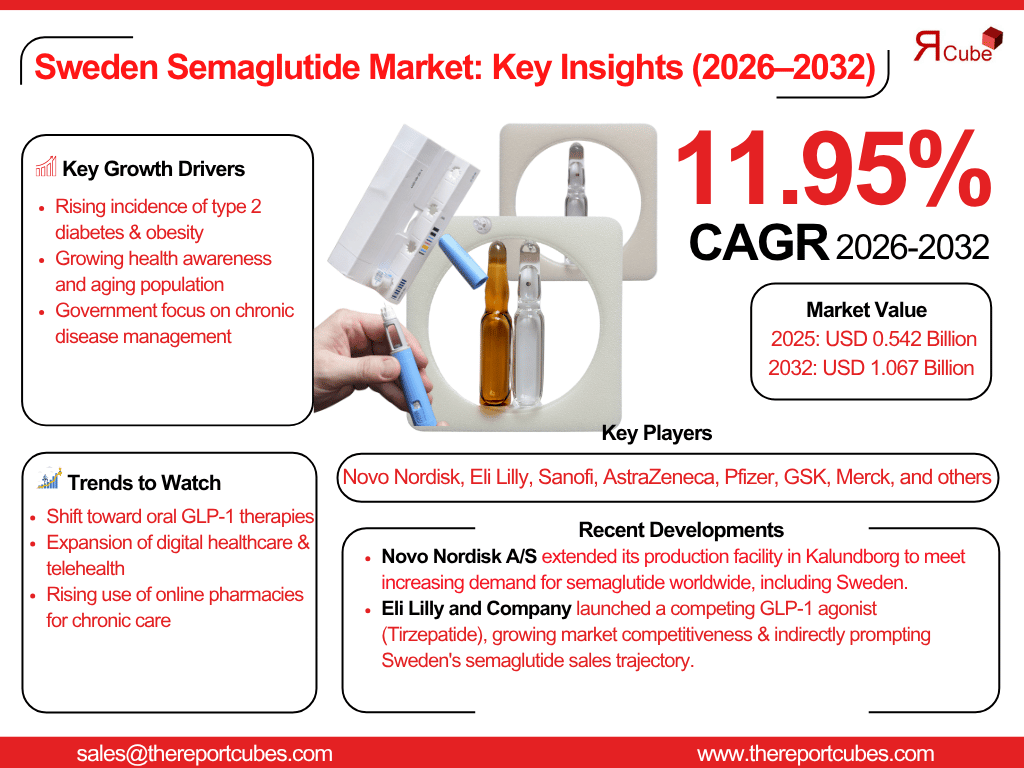

The Sweden Semaglutide Market is poised for substantial growth, with projections indicating a CAGR of 11.95% from 2026 to 2032. According to a study by Report Cube, the market was valued at USD 0.542 billion in 2025 and is expected to reach USD 1.067 billion by 2032. This growth is driven by increasing diabetes prevalence, rising obesity rates, and advancements in drug formulations.

In this article, we will explore the key factors influencing the Sweden Semaglutide Market, including market trends, regulatory landscape, competitive dynamics, and future opportunities.

Market Overview and Key Drivers

- Rising Diabetes and Obesity Rates

Sweden, like many developed nations, faces a growing burden of type 2 diabetes and obesity. According to the Swedish National Diabetes Register, over 500,000 people live with diabetes, and obesity rates continue to climb. Semaglutide, marketed under brands like Ozempic (for diabetes) and Wegovy (for obesity), has become a crucial treatment option due to its dual benefits.

- Increasing Awareness and Healthcare Investments

The Swedish government and healthcare providers are actively promoting better diabetes management and weight loss solutions. Public health campaigns and insurance coverage for GLP-1 drugs have made Semaglutide more accessible, fueling market expansion.

- Advancements in Drug Formulations

Novo Nordisk, the leading manufacturer of Semaglutide, has introduced oral and injectable versions, improving patient compliance. The development of higher-dose formulations (like Wegovy for obesity) has further broadened its application.

- Strong Pharmaceutical Presence

Sweden hosts several global pharmaceutical companies, ensuring a steady supply of Semaglutide. The presence of robust clinical research and regulatory approvals has strengthened market credibility.

Market Segmentation

The Sweden Semaglutide Market can be segmented based on:

- By Product Type

- Ozempic (Injectable Semaglutide) – Primarily for type 2 diabetes.

- Wegovy (Higher-dose Injectable Semaglutide) – Approved for chronic weight management.

- Rybelsus (Oral Semaglutide) – A convenient tablet form for diabetes patients.

- By Application

- Type 2 Diabetes Treatment – Largest market share due to high diabetic population.

- Obesity Management – Rapidly growing segment with Wegovy’s approval.

- By Distribution Channel

- Hospital Pharmacies – Major procurement point for injectable Semaglutide.

- Retail Pharmacies – Increasing demand due to oral Semaglutide availability.

- Online Pharmacies – Gaining popularity for prescription refills and convenience.

Competitive Landscape

The Sweden Semaglutide Market is dominated by Novo Nordisk, the original developer of Semaglutide. However, competition is emerging with biosimilars and alternative GLP-1 drugs. Key players include:

- Novo Nordisk (Market leader with Ozempic, Wegovy, and Rybelsus)

- Eli Lilly (Competing with Tirzepatide, a dual GLP-1/GIP agonist)

- Sanofi (Exploring next-gen GLP-1 therapies)

- Local Swedish Pharmaceutical Companies (Collaborating on generic versions)

Novo Nordisk maintains dominance through continuous R&D, strong branding, and partnerships with Swedish healthcare providers.

Regulatory and Reimbursement Scenario

Sweden’s strict regulatory framework ensures drug safety and efficacy. The Medical Products Agency (MPA) oversees approvals, and Semaglutide is widely covered under Sweden’s national health insurance, making it affordable for patients.

However, high costs and supply chain challenges remain barriers. The Swedish government is working on price negotiations and local production incentives to improve accessibility.

Future Outlook (2026-2032)

- Market Expansion with New Indications

Research is ongoing for Semaglutide’s use in cardiovascular diseases, NASH (liver disease), and Alzheimer’s, which could further boost demand.

- Growth of Telemedicine and Digital Health

Sweden’s advanced digital healthcare system supports telemedicine prescriptions and remote monitoring, enhancing Semaglutide adoption.

- Potential for Biosimilars

As patents expire, biosimilar versions of Semaglutide may enter the market, reducing costs and increasing competition.

- Increasing Export Opportunities

Sweden’s pharmaceutical industry may leverage its strong research infrastructure to export Semaglutide to neighboring Nordic and EU markets.

Conclusion

The Sweden Semaglutide Market is on a strong growth trajectory, driven by rising diabetes and obesity cases, increased healthcare investments, and drug innovation. With a projected CAGR of 11.95%, the market is set to double from USD 0.542 billion (2025) to USD 1.067 billion by 2032.

For patients, this means better access to cutting-edge treatments, while investors and pharmaceutical companies can expect lucrative opportunities in Sweden’s evolving healthcare landscape.

As research expands Semaglutide’s applications and digital healthcare improves distribution, Sweden is poised to remain a key player in the European GLP-1 market.