The world of finance is changing quickly, and accounts payable (AP) is no exception. For years, businesses relied on fragmented processes—manual invoices, disconnected systems, and time-consuming approvals. But in 2025, a new standard is emerging: centralized payment platforms. These platforms are reshaping how US businesses handle accounts payable services, making processes faster, more transparent, and more cost-efficient.

So, what’s driving this shift, and why are CFOs and finance leaders in the US increasingly adopting centralized AP solutions? Let’s dive in.

Why Centralization Matters in Accounts Payable

Traditional AP functions often involve multiple tools, manual data entry, and back-and-forth communication across departments. This fragmentation leads to:

-

Duplicate or late payments

-

High labor costs

-

Lack of visibility into liabilities

-

Errors in invoice approvals

-

Supplier dissatisfaction

By contrast, a centralized payment platform consolidates all AP tasks—invoice capture, validation, approvals, and payments—into one digital hub. The result is an efficient, secure, and scalable process. Businesses adopting accounts payable services through centralized platforms see fewer errors, stronger vendor relationships, and better cash flow control.

The Rise of Centralized Payment Platforms in the US

In recent years, finance leaders have faced mounting pressure to cut costs, increase compliance, and adapt to digital-first operations. According to industry surveys, over 70% of US businesses plan to digitize or outsource their AP operations within the next two years.

Why? Because centralized platforms deliver measurable improvements:

-

Automation-first design – Invoices are scanned, validated, and routed automatically.

-

Integration with ERP systems – Platforms sync with SAP, Oracle, and NetSuite.

-

Supplier portals – Vendors can track invoice statuses, reducing inquiries.

-

Real-time reporting – CFOs gain instant insights into outstanding liabilities.

What CFOs Expect from Accounts Payable Services Today

Modern CFOs aren’t just looking for cost savings. They want AP services that drive value. Their top priorities include:

-

Accuracy and Compliance

Errors in AP can lead to fines and strained vendor trust. Centralized platforms minimize risks by applying consistent rules and digital checks. -

Cash Flow Visibility

Real-time dashboards provide CFOs with up-to-date insights into payables, helping optimize working capital. -

Supplier Relationship Management

Late payments damage vendor trust. Centralized solutions ensure consistent, on-time payments. -

Scalability

Whether a business processes 1,000 or 100,000 invoices a month, the system should scale seamlessly. -

Data Security

With rising cyber threats, CFOs demand encryption, secure access, and compliance with financial regulations.

Benefits of Centralized Payment Platforms

Implementing centralized AP outsourcing offers clear advantages:

-

Efficiency Gains – Invoice cycle times drop from weeks to days.

-

Reduced Costs – Labor and error-related expenses are cut by up to 40%.

-

Transparency – CFOs and managers can track every invoice from submission to payment.

-

Improved Audit Readiness – Automated recordkeeping ensures compliance.

-

Enhanced Vendor Satisfaction – Suppliers enjoy quicker, more reliable payments.

For companies struggling with scattered AP processes, these benefits create a compelling case for outsourcing.

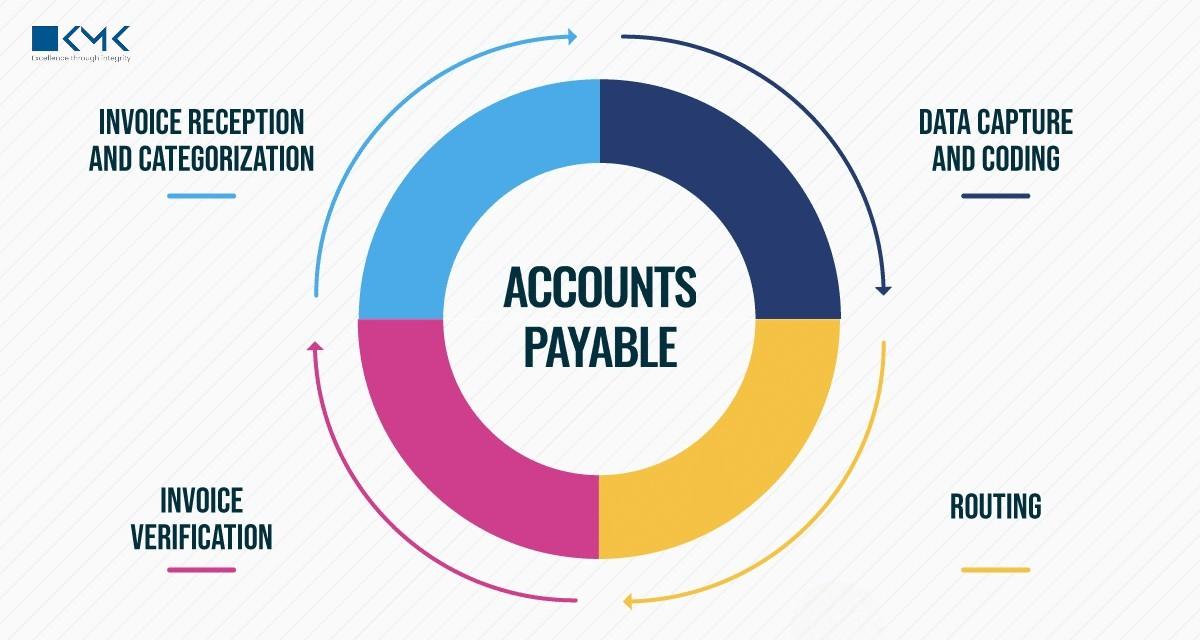

How Centralized AP Services Work

Centralized platforms follow a structured, tech-driven process:

-

Invoice Capture – Paper and digital invoices are scanned or uploaded into the system.

-

Validation & Matching – AI matches invoices against purchase orders to flag discrepancies.

-

Approval Workflow – Digital workflows route invoices to the right approvers automatically.

-

Payment Execution – Payments are made via ACH, wire, or card—all within one platform.

-

Analytics & Reporting – CFOs receive insights into trends, bottlenecks, and savings opportunities.

This streamlined flow eliminates redundant steps and ensures standardization across all business units.

Trends Shaping AP Services in 2025

CFOs evaluating centralized AP platforms also look at future trends:

-

AI-Driven Insights – Predictive analytics flag cash flow risks before they happen.

-

Blockchain for Payments – Providing secure, tamper-proof transaction records.

-

Self-Service Supplier Portals – Giving vendors autonomy to upload invoices and track payments.

-

Cloud-Based Flexibility – Enabling remote finance teams to collaborate seamlessly.

-

Sustainability Goals – Going paperless aligns with ESG strategies.

These advancements make AP a strategic driver of business resilience.

Real-Life Example: The Mid-Sized IT Firm

Consider a mid-sized IT company in the US processing 20,000 invoices annually. Their manual AP system caused delays, duplicate payments, and high labor costs. After outsourcing to a centralized platform:

-

Invoice approval time dropped by 65%.

-

Duplicate payments were eliminated.

-

Supplier inquiries fell by 50%, thanks to a self-service portal.

-

The CFO gained real-time dashboards for cash flow forecasting.

This case demonstrates how AP outsourcing can transform finance operations into a competitive advantage.

How to Select the Right AP Service Provider

Choosing the right accounts payable services partner requires careful evaluation. CFOs should ask:

-

Does the provider integrate with our ERP and accounting systems?

-

What security protocols are in place to protect sensitive data?

-

Can the platform scale as our business grows?

-

How transparent is reporting and analytics?

-

What support is available for suppliers?

By asking these questions, CFOs can ensure the AP partner is not just a vendor but a strategic ally.

Final Thoughts

In 2025, centralized payment platforms aren’t just a trend—they’re becoming the new standard in US AP services. By consolidating fragmented workflows into a single digital hub, businesses gain efficiency, accuracy, and visibility.

For CFOs, this transformation isn’t about reducing paperwork—it’s about turning AP into a strategic lever for growth. Partnering with the right provider of accounts payable services empowers companies to streamline operations, improve vendor trust, and achieve long-term financial resilience.

As the market evolves, one thing is clear: centralization is the future of accounts payable, and businesses that adopt it today will lead tomorrow.