IMARC Group, a leading market research company, has recently released a report titled "Offshore Drilling Market Report by Rig Type (Jackups, Semisubmersible, Drill Ships, and Others), Depth (Shallow Water, Deepwater and Ultra-deepwater), and Region 2025-2033." The study provides a detailed analysis of the industry, including the global offshore drilling market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Offshore Drilling Market Highlights:

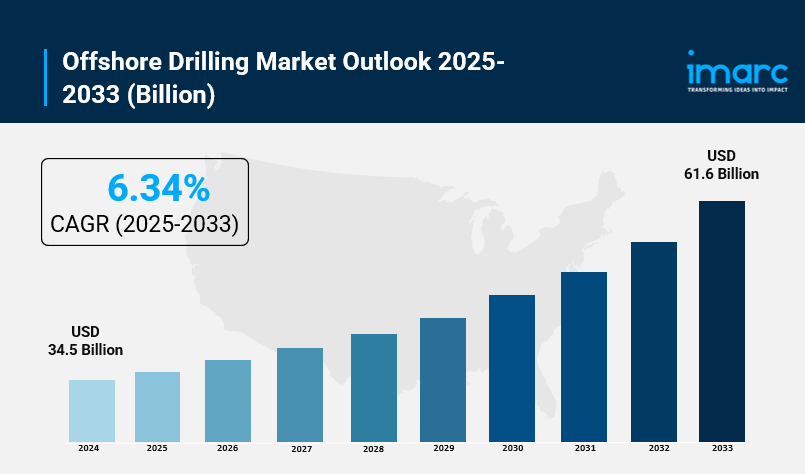

- Offshore Drilling Market Size: Valued at USD 34.5 Billion in 2024.

- Offshore Drilling Market Forecast: The market is expected to reach USD 61.6 billion by 2033, growing at an impressive rate of 6.34% annually.

- Market Growth: The offshore drilling market is projected to grow due to increasing energy demand and rising oil prices.

- Technological Advancements: Innovations in drilling technologies enhance efficiency and safety, driving market expansion.

- Investment Trends: Significant investments from oil and gas companies are aimed at expanding offshore exploration and production capabilities.

- Regulatory Environment: Stricter environmental regulations impact operational costs and project timelines in offshore drilling.

- Geographical Focus: Major offshore drilling activities are concentrated in regions like the Gulf of Mexico, North Sea, and offshore Brazil.

- Market Challenges: High operational costs and geopolitical tensions pose risks to market stability and growth.

- Future Outlook: The market is expected to witness a shift towards sustainable practices and renewable energy integration in the coming years.

Claim Your Free “Offshore Drilling Market” Insights Sample PDF: https://www.imarcgroup.com/offshore-drilling-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Focus on Ultra-Deepwater and High-Impact Discoveries:

The offshore drilling market is moving to deepwater and ultra-deepwater, where very large commercially viable fields, called "elephant fields", are available. The shallow water fields have been developed. The only place left for large scale capital investments in very remote and hostile waters are in Brazil's pre-salt area, the Guyana-Suriname basin, and in portions of the Gulf of Mexico. These fields have a greater cumulative field capital expenditure (CAPEX), and lower production costs over the decades as the field is productive, while delivering high value and high volume of hydrocarbons. This has resulted in a high demand for the most technically advanced drilling units, such as sixth and seventh generation drillships and high-powered semi-submersibles. A need for high-end subsea and well architecture means that technological complexity is paramount, which drives a need for specialist services and very high global day rates for high specification drilling units.

- Energy Security and Geopolitical Prioritization:

Global instability, such as potential interruptions in energy supply and international geopolitical conflict, has driven national energy policies away from environmental concerns and toward energy security and resilience agendas that prioritize securing long-term, reliable, domestic, or friendly-nation supplies of oil and gas to reduce dependence on politically or environmentally sensitive energy-exporting countries. Relatively stable offshore resources (mainly in the North Sea, Gulf of Mexico, and emerging plays offshore Africa) are often considered calculated national resources and utilized to hedge global portfolio risk. This geopolitical consideration often drives SOEs and major offshore asset operators to formulate early FIDs on large offshore projects. These reserves provide a high degree of long-term contracting visibility (and, to a lesser extent in the short to medium term, visibility on transition challenges) to drillers, enabling strong evaluations and sustained long-term investment into exploration and development asset acquisition.

- Decarbonization and the Integration of CCS:

The offshore drilling industry is dealing with the energy transition through improving decarbonisation and diversifying into other business lines such as Carbon Capture and Storage (CCS). In order to maintain their social license to operate and comply with regulatory emissions reduction targets, many oil and gas companies are electrifying their offshore drilling rigs through a direct connection to the shore or an offshore wind farm as an alternative to high-emission diesel. More importantly, depleted offshore gas reservoirs represent a favorable, geologically stable environment for safe storage of captured CO2, in which the use of offshore infrastructure, and skills and collaboration, could be broadened to redirect part of an oil and gas portfolio to directly support global decarbonization efforts. Focusing on reducing emissions from their existing activities, and developing CCS infrastructure, the offshore sector can position itself not just as a customary energy supplier, but also as an enabler of industrial-scale abatement.

Offshore Drilling Market Report Segmentation:

Breakup by Rig Type:

- Jackups

- Semisubmersible

- Drill Ships

- Others

Breakup by Depth:

- Shallow Water

- Deepwater and Ultra-deepwater

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia-Pacific dominates the global string inverter market, driven by China's massive solar capacity additions, India's aggressive renewable energy targets, and expanding solar installations across Southeast Asian nations seeking energy security and sustainability.

Who are the key players operating in the industry?

The report covers the major market players including:

- Archer Ltd.

- Baker Hughes Company

- Diamond Offshore Drilling Inc.

- Exxon Mobil Corporation

- KCA Deutag

- Nabors Industries Ltd.

- Noble Corporation plc

- Saipem SpA

- Schlumberger Limited

- Seadrill Limited

- Transocean Limited

- Weatherford International PLC

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=10185&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302