Anti-Money Laundering Solution market research includes a detailed analysis of the global market regarding short-term and long-term growth opportunities, market trends, and future market outlook. This research provides strategic information for technology vendors to better understand the existing market, supporting their growth strategies; and for users to evaluate different vendors’ capabilities, competitive differentiation, and market position.

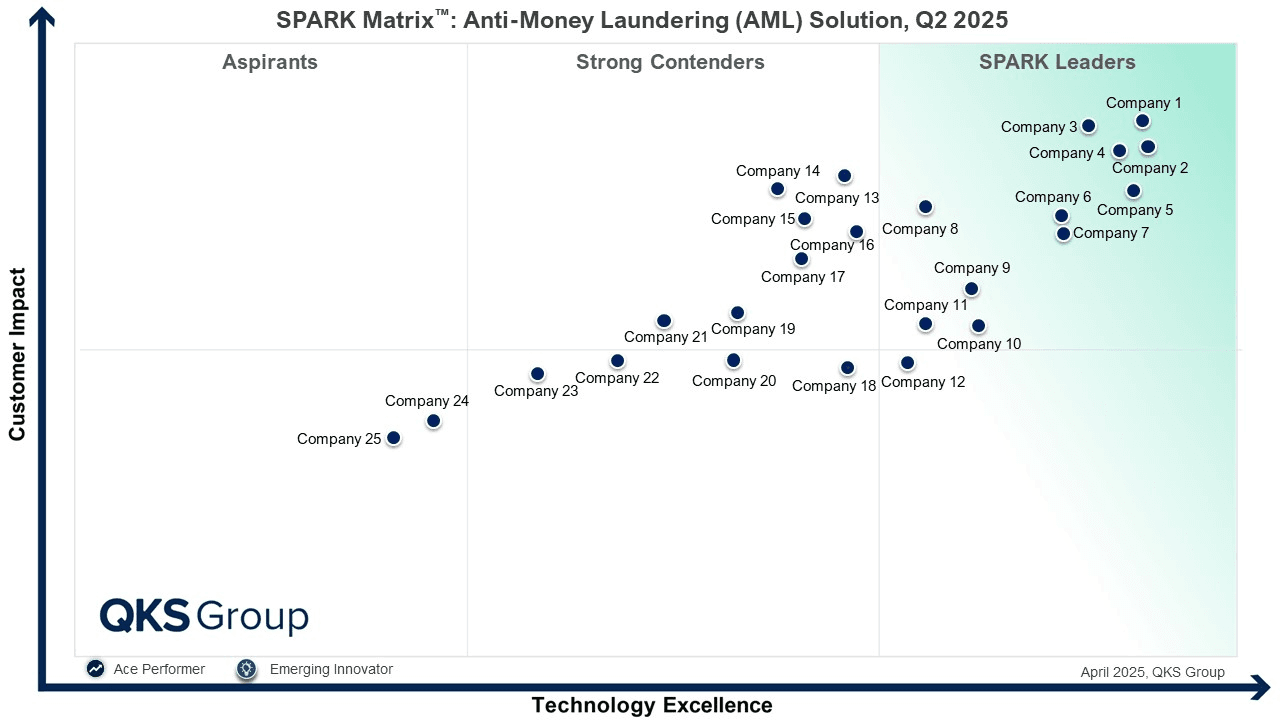

The research includes detailed competition analysis and vendor evaluation with the proprietary SPARK Matrix analysis. SPARK Matrix includes ranking and positioning of leading Anti-Money Laundering Solution vendors, with a global impact. The SPARK Matrix includes an analysis of vendors, including Azentio, ComplyAdvantage, Dow Jones, Eastnets, Experian, Featurespace (Acquired by Visa), Feedzai, Fiserv, Fourthline, GBG Plc, IMTF, Kiya.ai, LexisNexis Risk Solutions, FOCAL by Mozn, Napier AI, Nasdaq Verafin, NICE Actimize, Oracle, Pelican, Quantexa, SAS, SymphonyAI, ThetaRay, Tookitaki, and Vneuron.

A comprehensive Anti-Money Laundering (AML) solution is one that enables banks, FIs and non-banking institutions in end-to-end management including, detection, prevention, and reporting of financial crime risk and regulatory compliance. A comprehensive AML solution supports key capabilities including Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD), sanctions and PEP screening, adverse media analysis, transaction surveillance, dynamic risk scoring, and end-to-end case management with regulatory reporting. Robust solutions offer API-first, cloud-native architecture that facilitate integration with core systems and external data providers. Modern AML solutions leverage advanced technologies such as machine learning, behavioral analytics, fuzzy logic, natural language processing and others to identify anomalies, reduce false positives, and enable real-time decision-making. By automating data ingestion, screening, and alert triage processes, these solutions streamline compliance operations and improve investigative efficiency. Microservices-based deployment, low-code/no-code configurability, and embedded feedback loops support model adaptability and operational flexibility. Enhanced explainability, auditability, and jurisdiction-specific rule management ensure readiness for global regulatory requirements. Additionally, integrated dashboards and reporting capabilities provide real-time insights for compliance teams and auditors, enabling proactive risk management across jurisdictions, channels, and customer segments.”