Overview of the Petroleum Coke Market

The petroleum coke market is a significant segment of the global energy and materials industry, primarily driven by the increasing demand for energy and the growth of various industrial applications. Petroleum coke, a byproduct of crude oil refining, is used in various sectors, including aluminum, steel, and power generation.

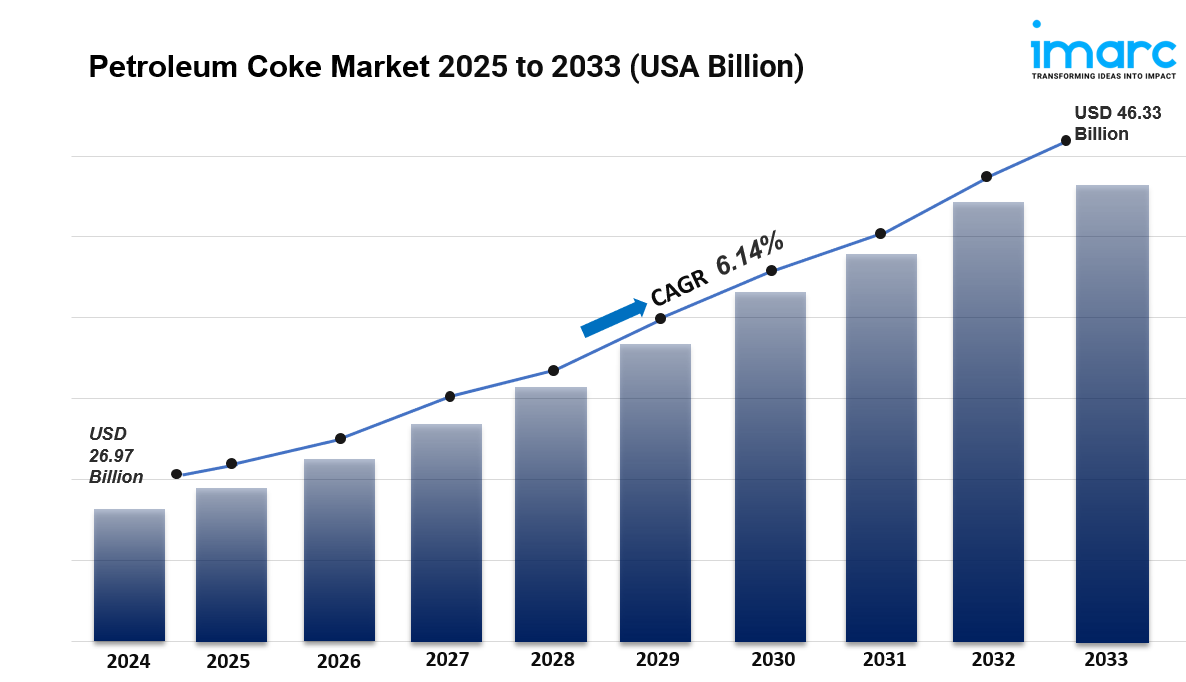

The global petroleum coke market size was valued at USD 26.97 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 46.33 Billion by 2033, exhibiting a CAGR of 6.14% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 45.1% in 2024. The market growth is driven by the increasing demand from the aluminum industry, the expanding power generation sectors, and the rising use of petroleum coke as a cost-effective fuel alternative in various industries. Collectively, these factors are increasing the petroleum coke market share across the globe.

Key Trends

- Growing Demand in Aluminum Production:

- The aluminum industry is a major consumer of petroleum coke, particularly in the production of anodes used in the smelting process. The expanding aluminum sector, driven by automotive and construction industries, is boosting demand.

- There is a rising trend towards the use of petroleum coke in cleaner technologies. Industries are investing in technologies that enhance the efficiency of petroleum coke usage while reducing emissions.

- North America and Asia-Pacific are leading regions in the petroleum coke market. North America benefits from abundant oil reserves and a strong refining industry, while Asia-Pacific is witnessing rapid industrialization and urbanization.

- Fluctuations in crude oil prices significantly influence petroleum coke prices. The market is sensitive to geopolitical factors and changes in oil supply and demand.

- Stricter environmental regulations are pushing companies to explore alternative materials and improve the efficiency of petroleum coke usage to comply with emission standards.

Market Dynamics

- Drivers:

- Increased industrialization and urbanization in emerging economies.

- Growing demand for aluminum and other industrial applications.

- Technological advancements in refining processes.

- Challenges:

- Environmental concerns related to carbon emissions from petroleum coke combustion.

- Competition from alternative materials and energy sources.

- Economic fluctuations affecting crude oil prices.

- Opportunities:

- Innovations in cleaner production technologies.

- Expansion of the petroleum coke market in developing countries.

- Strategic partnerships and collaborations among industry players to enhance market reach.

Request for a sample copy of this report: https://www.imarcgroup.com/petroleum-coke-market/requestsample

AI Impact on the Petroleum Coke Market:

Artificial intelligence is quietly transforming how petroleum coke is produced, managed, and utilized across the refining industry. While the changes might not grab headlines, they're delivering meaningful improvements in efficiency, quality, and environmental performance.

In refining operations, AI-powered systems are optimizing the coking process itself. These intelligent systems analyze real-time data from multiple sources—temperature sensors, pressure gauges, feedstock characteristics—and make instant adjustments to maximize yield and quality. The result? Refineries are producing more consistent petroleum coke while reducing waste and energy consumption.

Segmental Analysis:

Analysis by Type:

- Fuel Grade Coke

- Calcined Coke

Fuel grade coke dominates the market, capturing 50.9% share. Its strong performance reflects widespread adoption in power generation and energy-intensive industries. The material's high calorific value—typically ranging from 8,000 to 8,500 kcal/kg—makes it an attractive alternative to conventional fuels. Power plants, particularly in emerging economies where energy demand is surging, rely heavily on fuel-grade coke. Cement manufacturers also favor this grade because it provides consistent energy output for their kilns, helping maintain stable production schedules. The segment's dominance is reinforced by the ongoing expansion of energy infrastructure in developing regions, where reliable and economical fuel sources are essential for supporting rapid industrialization.

Analysis by Application:

- Power Plants

- Cement Kilns

- Steel

- Aluminum

- Fertilizer

- Others

Aluminum leads the application segment with a commanding 37.81% market share. This dominance stems from the material's critical role in producing carbon anodes for aluminum smelting. Calcined petroleum coke is particularly essential here—its high carbon content and minimal impurities make it indispensable for maintaining efficient, cost-effective aluminum production. The global push toward lightweight materials in automotive and construction applications is driving aluminum demand higher, which in turn boosts petroleum coke consumption. India's primary aluminum production, for instance, grew 1.2% year-over-year in recent quarters, reflecting broader industry trends. What makes this segment particularly resilient is aluminum's recyclability and versatility, which align well with sustainability initiatives while maintaining strong industrial demand.

Analysis by Device:

- Asia Pacific

- Europe

- North America

- Latin America

- Middle East and Africa

Asia-Pacific commands 45.1% of the global market, driven by the region's manufacturing intensity and energy requirements. The region's dominance isn't accidental—it reflects fundamental economic trends including rapid urbanization, infrastructure development, and industrial expansion. China and India are at the forefront, with their cement, steel, and power generation sectors consuming massive quantities of petroleum coke. The region's extensive refining capabilities ensure steady supply, while growing domestic demand keeps the market dynamic. North America holds strong as well, with the United States accounting for 69% of the regional market. The U.S. position is unique because while domestic consumption is significant, the country's role as a major exporter shapes global trade patterns. Saudi Arabia's construction sector, with over 5,200 active projects worth USD 819 billion, illustrates how regional development drives petroleum coke demand across multiple applications.

Request Customization: https://www.imarcgroup.com/request?type=report&id=2592&flag=E

Leading Players of Petroleum Coke Market:

According to IMARC Group's latest analysis, prominent companies shaping the global petroleum coke landscape include:

- Aminco Resources

- BP p.l.c

- Chevron Corporation

- DYM Resources

- Indian Oil Corporation Ltd.

- Marathon Petroleum LP

- Petroleum Coke Industries Company

- Phillips 66 Company

- Reliance Industries Limited

- Renelux Commodities PC

- Valero

These leading providers are expanding their footprint through strategic partnerships, enhanced production capabilities, and advanced operational platforms to meet growing industrial, manufacturing, and energy demands in emerging applications like clean energy transitions, advanced materials, and sustainable manufacturing.

Blog URL: https://www.imarcgroup.com/insight/petrochemical-segments-driving-global-market-growth

Key Developments in Petroleum Coke Market:

- January 2025: ExxonMobil announced a 20% expansion of its petroleum coke production capacity at U.S. refineries to meet rising demand from cement and power generation sectors. The company produced 12 million tons of petcoke using advanced coking technologies, reflecting confidence in long-term market growth and the material's continued relevance in industrial applications.

- 2024 Development: The calcined petroleum coke segment witnessed increased investments in advanced calcination processes and improved product grades. Industry players are emphasizing responsible sourcing and sustainable production methods, responding to customer demands for materials that meet both performance and environmental standards. These developments are helping position petroleum coke as a viable option in transitioning energy markets.

- 2024 Market Trend: The surge in electric vehicle adoption and renewable energy infrastructure expansion drove significant investments in petroleum coke mining and processing. Companies are actively exploring new applications for petroleum coke in battery production supply chains and advanced materials manufacturing, diversifying the traditional market beyond conventional fuel applications.

- Ongoing Development: Major refineries are implementing AI-powered closed-loop neural network technologies specifically designed for optimizing petroleum coke production. These systems enable real-time process adjustments, improve product consistency, and reduce energy consumption during the coking process. The technology represents a significant step forward in making petroleum coke production more efficient and environmentally responsible.

- Market Innovation: Digital twins and emissions detection systems are being deployed across refineries to optimize crack spreads and maximize margins between input feedstocks and output products including petroleum coke. This technological advancement allows operators to rapidly adjust to changing market conditions and maintain profitability even during volatile periods in crude oil markets.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Speak To An Analyst: https://www.imarcgroup.com/request?type=report&id=2592&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302