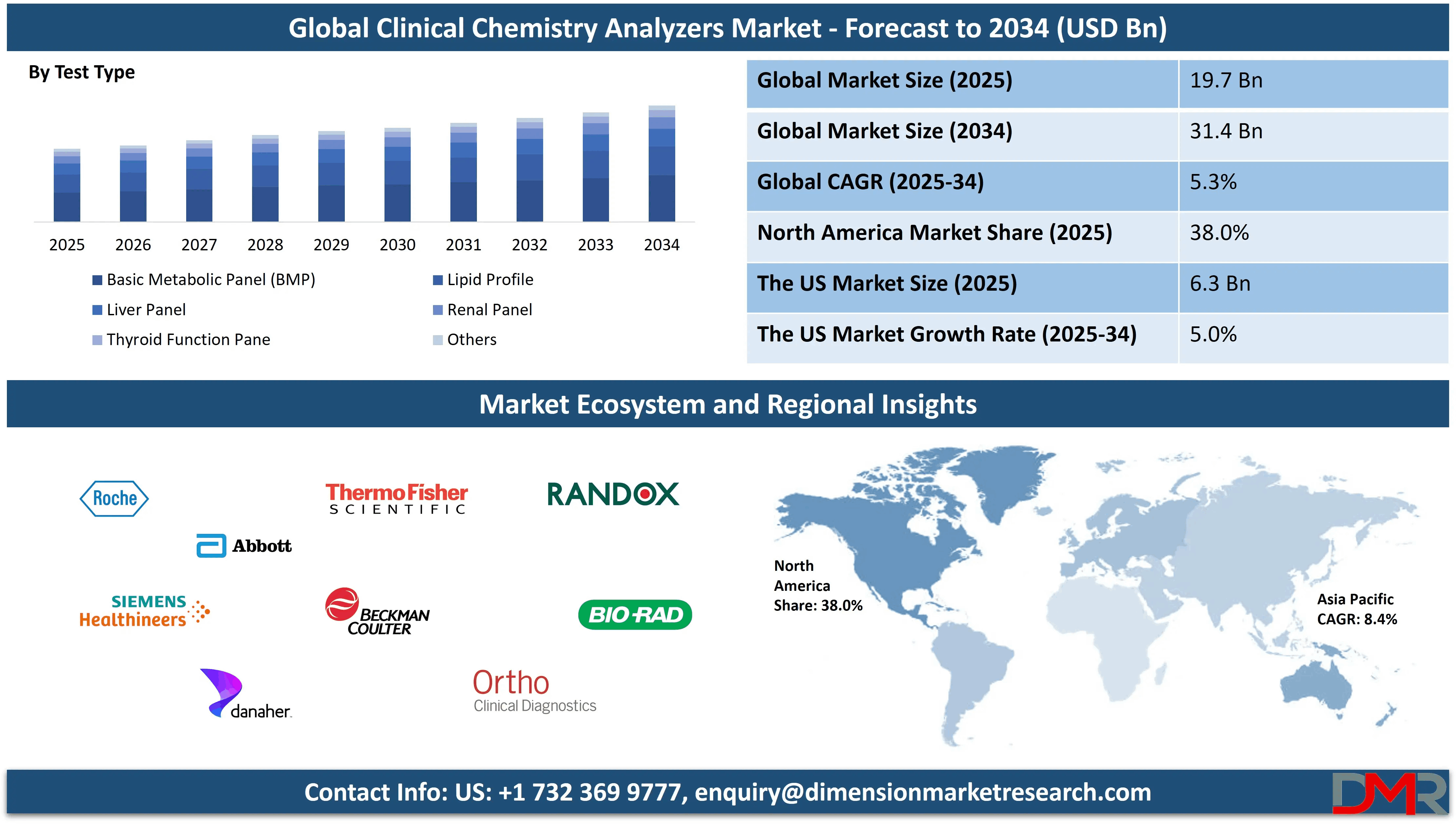

The global Clinical Chemistry Analyzers Market is experiencing significant expansion as healthcare systems worldwide prioritize efficient, accurate, and high-throughput diagnostic solutions. Projected to reach USD 19.7 billion in 2025 and grow to USD 31.4 billion by 2034 at a compound annual growth rate (CAGR) of 5.3%, this market is driven by rising demand for diagnostic testing, increasing chronic disease prevalence, and the growing adoption of automated biochemical analyzers across hospitals and laboratories. As the burden of diseases such as diabetes, cardiovascular disorders, and liver conditions continues to rise globally, clinical chemistry analyzers are playing a pivotal role in enabling early detection, effective disease management, and improved patient outcomes.

These sophisticated instruments are essential tools in modern laboratory medicine. They perform a wide range of biochemical analyses, from testing blood glucose levels and electrolyte concentrations to monitoring liver enzymes and kidney function. Clinical chemistry analyzers are designed to handle large sample volumes with precision, ensuring reliability and speed in diagnostic workflows. Automation and integration with information management systems have revolutionized how laboratories operate, allowing clinicians to make faster and more accurate decisions. The shift from manual testing to automated and modular systems has enhanced efficiency, minimized human error, and reduced turnaround times in both clinical and research settings.

The market’s growth trajectory is strongly influenced by global trends in healthcare digitization and point-of-care testing. As healthcare systems adopt digital tools for patient management, clinical chemistry analyzers are becoming increasingly integrated into networked laboratory infrastructures. This integration facilitates real-time data sharing, remote result interpretation, and streamlined quality control processes, which are essential in large-scale diagnostic operations. The push toward precision medicine and personalized healthcare is further expanding the application scope of clinical chemistry analyzers, particularly in detecting biomarkers and monitoring therapeutic responses in chronic disease management.

Download a Complimentary PDF Sample Report: https://dimensionmarketresearch.com/report/clinical-chemistry-analyzers-market/request-sample/

Technological Innovations Driving Market Growth

Technological advancements have been instrumental in shaping the future of the clinical chemistry analyzers market. Automation and digitalization are at the core of innovation, with modern analyzers featuring advanced sensors, robotics, and software systems that allow for greater accuracy and efficiency. The introduction of integrated analyzers capable of performing multiple tests simultaneously has transformed laboratory workflows, minimizing manual intervention and optimizing resource utilization.

One of the most significant trends is the emergence of fully automated systems that integrate sample preparation, testing, and data analysis within a single platform. These systems reduce human error, ensure standardization across tests, and deliver faster turnaround times—a crucial advantage in high-volume hospital laboratories. The growing adoption of point-of-care analyzers in decentralized healthcare settings, such as clinics and emergency departments, is also expanding market opportunities by bringing diagnostic capabilities closer to patients.

Moreover, the integration of artificial intelligence (AI) and machine learning (ML) into analyzer software is improving data accuracy, predictive maintenance, and diagnostic interpretation. AI-based algorithms assist in detecting subtle variations in biochemical markers, enabling early identification of diseases that might otherwise go unnoticed. Additionally, the miniaturization of components and the development of portable chemistry analyzers are broadening access to diagnostics in remote and resource-limited settings, further boosting global adoption.

Market Drivers and Growth Opportunities

Several key factors are propelling the expansion of the global clinical chemistry analyzers market. The foremost driver is the rising prevalence of chronic and lifestyle-related diseases. Conditions such as diabetes, cardiovascular disorders, renal diseases, and liver dysfunctions require regular biochemical monitoring for diagnosis and treatment management. This has led to a surge in demand for clinical chemistry testing, both in hospitals and independent diagnostic laboratories.

An aging global population is another crucial factor contributing to the increasing volume of diagnostic tests. Older adults are more prone to chronic illnesses, necessitating frequent health assessments that rely heavily on clinical chemistry analyzers. The growing emphasis on preventive healthcare and early disease detection is further amplifying the need for rapid, accurate biochemical analysis.

The expansion of healthcare infrastructure in emerging economies presents significant growth opportunities for manufacturers. Countries in Asia-Pacific, Latin America, and the Middle East are investing in diagnostic modernization and healthcare automation, leading to the adoption of advanced laboratory instruments. In addition, increasing public and private healthcare expenditure and favorable government initiatives for early disease screening are accelerating market penetration in developing regions.

From a technological standpoint, the trend toward modular analyzer systems is driving flexibility and scalability. Laboratories can now configure their analyzers to match testing requirements, allowing for efficient handling of fluctuating workloads. The rise in telehealth services and remote diagnostics is also creating new opportunities, as data from clinical chemistry analyzers can be seamlessly integrated into digital health platforms for patient monitoring and consultation.

Market Segmentation Overview

The clinical chemistry analyzers market is segmented based on product type, test type, end-user, and region. By product type, the market includes fully automated analyzers, semi-automated analyzers, and reagents. Fully automated analyzers dominate the market due to their widespread adoption in large hospital laboratories and diagnostic centers, offering high throughput and reliability. Reagents also represent a significant portion of market revenue, as recurring demand ensures a consistent revenue stream for manufacturers.

In terms of test type, the market encompasses basic metabolic panels, electrolyte panels, liver function tests, lipid profiles, and renal panels, among others. Basic metabolic and lipid profile tests account for the majority of testing volume, reflecting the high global prevalence of cardiovascular and metabolic disorders.

End-users of clinical chemistry analyzers include hospitals, diagnostic laboratories, research institutions, and academic centers. Hospitals remain the largest segment due to the sheer volume of tests performed daily and the need for real-time results in clinical decision-making. Independent diagnostic laboratories are also experiencing strong growth, driven by outsourcing trends and the increasing popularity of preventive health check-ups.

Purchase the report for comprehensive details: https://dimensionmarketresearch.com/checkout/clinical-chemistry-analyzers-market/

Regional Analysis

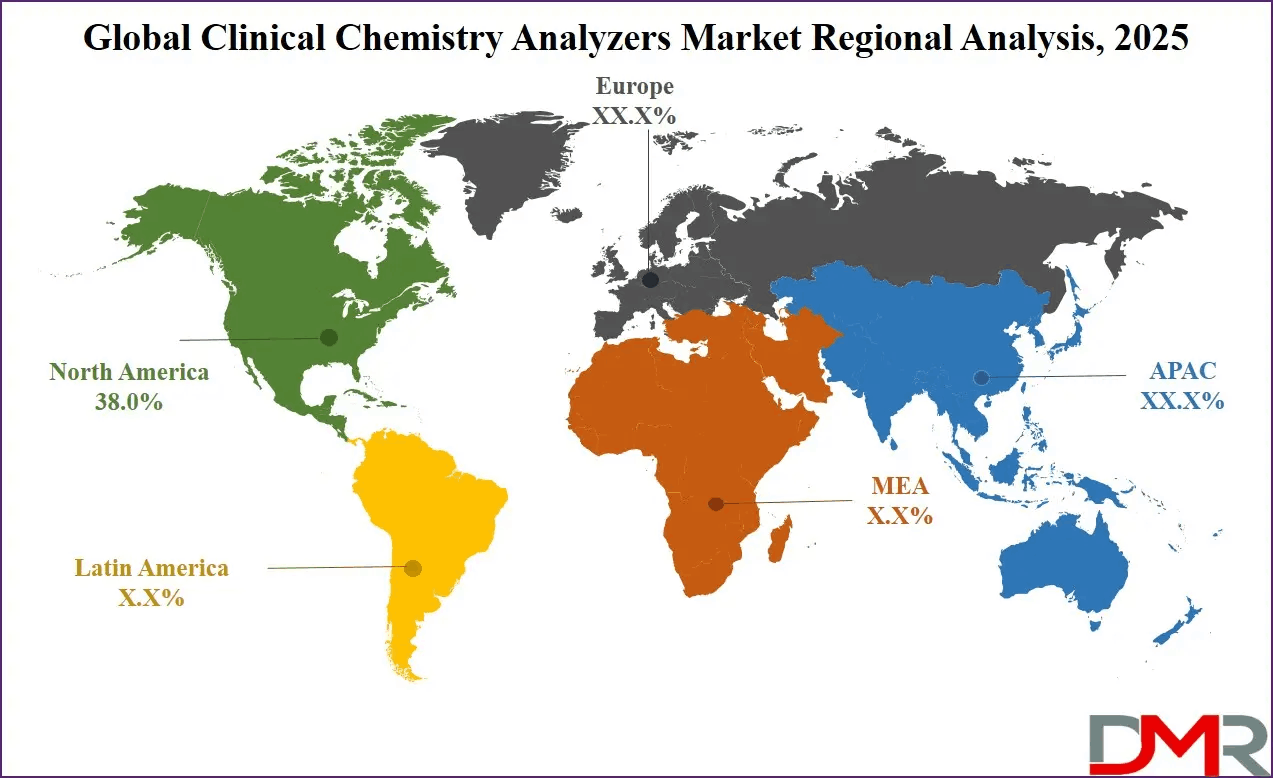

North America is expected to dominate the global clinical chemistry analyzers market, holding approximately 38.0% of total market revenue in 2025. The region’s strong position is attributed to its advanced healthcare infrastructure, high diagnostic testing volume, and widespread adoption of automation technologies in laboratories. The United States leads this regional growth, with an extensive network of hospitals, research institutions, and clinical laboratories that rely heavily on biochemical analyzers for disease detection and chronic condition management.

Favorable reimbursement policies and a robust presence of key industry players further strengthen the market in North America. The region’s focus on innovation, particularly in laboratory automation and digital health integration, continues to enhance diagnostic accuracy and operational efficiency. The ongoing expansion of personalized medicine and precision diagnostics also drives demand for advanced analyzer systems capable of detecting a wide range of biochemical markers.

Europe follows closely, driven by its strong public healthcare systems, aging population, and investments in diagnostic innovation. Countries such as Germany, France, and the United Kingdom are at the forefront of adopting advanced clinical chemistry technologies. Meanwhile, the Asia-Pacific region is poised for the fastest growth, fueled by rising healthcare spending, growing awareness of preventive healthcare, and the establishment of new diagnostic centers. Emerging markets like India and China are rapidly upgrading laboratory capabilities, offering lucrative opportunities for market players.

Latin America and the Middle East & Africa are also witnessing gradual adoption, with improvements in healthcare infrastructure and increased availability of advanced medical devices.

Challenges and Future Outlook

Despite its promising growth trajectory, the clinical chemistry analyzers market faces several challenges. High equipment costs, particularly for fully automated systems, can limit adoption among small laboratories and healthcare facilities in developing regions. Maintenance and calibration requirements, along with reagent costs, also add to operational expenses.

However, these challenges are being mitigated by technological innovations and strategic collaborations between healthcare providers and manufacturers. The introduction of cost-effective, compact analyzers suitable for mid-sized labs and point-of-care testing is helping bridge accessibility gaps. Additionally, cloud-based laboratory information management systems (LIMS) are improving workflow efficiency and enabling remote monitoring of test performance.

Looking ahead, the market is expected to witness a strong transition toward smart analyzers integrated with AI-driven analytics. These next-generation systems will not only deliver diagnostic results but also provide insights into disease trends and patient risk profiles. The convergence of data analytics, automation, and connectivity will redefine how laboratories operate, ensuring accuracy, speed, and scalability in diagnostic testing.

Frequently Asked Questions (FAQs)

1. What is the size of the global clinical chemistry analyzers market?

The global market is projected to reach USD 19.7 billion in 2025 and grow to USD 31.4 billion by 2034, expanding at a CAGR of 5.3%.

2. What are the major drivers of market growth?

Rising chronic disease prevalence, growing demand for diagnostic testing, healthcare automation, and advancements in laboratory technology are key market drivers.

3. Which region holds the largest share of the clinical chemistry analyzers market?

North America leads the market with an estimated 38.0% share in 2025, driven by advanced healthcare infrastructure and high diagnostic testing volumes.

4. What types of analyzers are most commonly used?

Fully automated analyzers dominate the market due to their speed, accuracy, and efficiency, particularly in high-volume diagnostic laboratories.

5. How is technology shaping the future of the market?

AI integration, automation, cloud connectivity, and miniaturized point-of-care analyzers are transforming diagnostics by enhancing accuracy, reducing turnaround time, and improving accessibility.

Summary of Key Insights

The global clinical chemistry analyzers market is on a robust growth path, driven by rising diagnostic demand, chronic disease prevalence, and technological innovation. With a projected market value of USD 31.4 billion by 2034, the industry is embracing automation, AI, and integration to deliver faster, more accurate, and data-driven diagnostics. North America remains the dominant region due to its advanced infrastructure and high adoption rate, while Asia-Pacific emerges as a fast-growing market with expanding healthcare investments. The future of this industry lies in smart, connected, and patient-centered diagnostic ecosystems that enhance global healthcare efficiency and outcomes.