IMARC Group has recently released a new research study titled “Canada Payments Market Report by Mode of Payment (Point of Sale, Online Sale), End Use Industry (Retail, Entertainment, Healthcare, Hospitality, and Others), and Region 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Canada Payments Market Overview

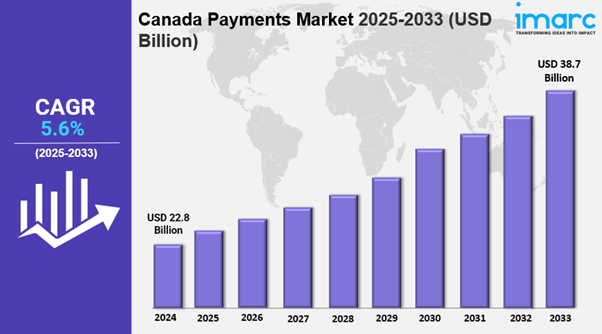

The Canada payments market size reached 22.8 Billion Transactions in 2024. Looking forward, IMARC Group expects the market to reach 38.7 Billion Transactions by 2033, exhibiting a growth rate (CAGR) of 5.6% during 2025-2033.

Canada Payments Market Size and Growth

Base Year: 2024

Forecast Years: 2025-2033.

Historical Years:2019-2024.

Market Size in 2024: 22.8 Billion.

Market Forecast in 2033: 38.7 Billion.

Market Growth Rate (2025-2033): 5.6%.

Canada Payments Key Market Highlights:

✔️ Strong growth supported by digitalization and cashless transactions

✔️ Rising adoption of mobile wallets, contactless payments, and QR code solutions

✔️ Expansion of e-commerce driving demand for secure and seamless payment methods

✔️ Increasing government initiatives to promote financial inclusion and digital banking

✔️ Growing use of blockchain and AI to enhance payment security and efficiency

Request for a sample copy of the report: https://www.imarcgroup.com/canada-payments-market/requestsample

Canada Payments Market Trends and Drivers:

The Canada payments market is expected to grow in the coming years because consumer behavior changes and new technologies introduce digital payments, contactless payments, mobile wallets, and e-commerce payments since these become more popular among merchants and consumers. This makes things more convenient to consumers and forces businesses into adopting new payment methods. Smooth and secure payment experiences drive demand within the payment industry's future.

The Canada payments market is projected to witness important growth in the coming years and will reach a tremendous value by 2025 on account of rising acceptance of digital payment in the country. The COVID-19 pandemic acted as an increase to the cashless payment as the trend of eCommerce shopping coupled with the rising usage of digital payment in the country has seen prominent changes and is expected to continue to drive growth. Canada has also been viewed as a leader in innovative payments.

There are several players in the Canada payments market trying to get more market share and compete with each other. The financial institutions are competing against fintech firms that offer new products. By 2025, it is expected that fintech companies will have taken a greater portion of the market as they are more flexible allowing for easier to use applications and services. There is also a trend of banks working with technology partners to create a more smooth approach to payments and the customer adventure.

The following trends will highly impact the Canada payments market in the future across the adoption of artificial intelligence (AI) and machine intelligence (ML) across the whole payment ecosystem, especially as they detect fraud, authorize, and process transactions, and as they develop new environmentally friendly payment methods. In 2025, consumers are expected to favor payment providers and methods that are environmentally responsible. The Canadian payment market will continue to evolve along technology, consumer demand, and regulatory changes.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=23898&flag=C

Canada Payments Market Segmentation:

Mode of Payment Insights:

- Point of Sale

- Card Payments

- Digital Wallet

- Cash

- Others

- Online Sale

- Card Payments

- Digital Wallet

- Others

The report has provided a detailed breakup and analysis of the market based on the mode of payment. This includes point of sale (card payments, digital wallet, cash, and others) and online sale (card payments, digital wallet, and others).

End Use Industry Insights:

- Retail

- Entertainment

- Healthcare

- Hospitality

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes retail, entertainment, healthcare, hospitality, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and Others.

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Website: imarcgroup.com

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302