Aviation Fuel Market Overview:

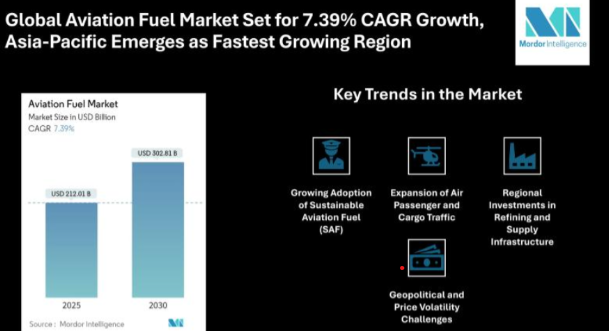

The aviation fuel market is valued at USD 212.01 billion in 2025 and is projected to reach USD 302.81 billion by 2030, registering a 7.39% CAGR during the forecast period. Growth in the market is supported by the rebound in global passenger travel, expanding air cargo demand, and the steady adoption of sustainable aviation fuel. Among all regions, Asia-Pacific is expected to emerge as the fastest-growing market, driven by rising air travel, expanding airport infrastructure, and strong airline fleet expansion.

Explore the full report for in-depth insights and market forecasts:https://www.mordorintelligence.com/industry-reports/global-aviation-fuel-market-industry?utm_source=gracebook

Aviation Fuel Market Key Trends:

Growing Adoption of Sustainable Aviation Fuel (SAF)

One of the most notable trends in the aviation fuel market is the rising demand for SAF. Airlines are under pressure to meet emission reduction targets, and governments worldwide are incentivizing biofuels and synthetic fuels. Strategic partnerships between energy companies and aviation players are ensuring large-scale SAF production capacity.

Expansion of Air Passenger and Cargo Traffic

The resurgence of global travel following pandemic-related disruptions has boosted jet fuel consumption. Low-cost carriers and full-service airlines are both expanding routes, while e-commerce growth is fueling a surge in air cargo operations. This dual demand from passengers and freight is supporting stable fuel demand across regions.

Regional Investments in Refining and Supply Infrastructure

Airports and regional governments are investing in dedicated storage and blending facilities for aviation fuels, especially in Asia-Pacific and the Middle East. These regions are witnessing growth not only from passenger travel but also from becoming major transit hubs for global cargo.

Geopolitical and Price Volatility Challenges

Fuel price fluctuations remain a challenge, influenced by crude oil supply, OPEC+ decisions, and regional geopolitical tensions. Airlines are increasingly using hedging strategies to manage fuel costs, while suppliers focus on stabilizing long-term contracts.

Gain strategic clarity across global and local markets-download the Japanese edition for region-specific insights: https://www.mordorintelligence.com/ja/industry-reports/global-aviation-fuel-market-industry?utm_source=gracebook

Aviation Fuel Market Segmentation

The aviation fuel market is segmented by fuel type, application, and geography. Each segment plays a distinct role in shaping overall market dynamics.

By Fuel Type

Conventional Aviation Fuel (Jet A, Jet A-1, JP-5, JP-8)

Sustainable Aviation Fuel (Biofuels, Synthetic Fuels, Hydrogen-based fuels)

Others (Avgas, specialty fuels)

By Application

Commercial Aviation (passenger airlines, cargo airlines, charter services)

Military Aviation (defense aircraft, combat jets, naval aviation)

General Aviation (private jets, recreational aircraft, helicopters)

By Geography

North America - Strong SAF adoption in the US and Canada, supported by regulatory mandates and airline pledges.

Europe - Stringent emission regulations, with major airports enabling SAF supply.

Asia-Pacific - Fastest-growing market driven by passenger expansion in China, India, and Southeast Asia.

Middle East & Africa - Regional hubs like UAE and Qatar focusing on aviation infrastructure.

Latin America - Increasing fuel consumption supported by growth in both domestic and international routes.

Aviation Fuel Market Key Players:

The aviation fuel market features a mix of global oil & gas companies, specialized fuel providers, and renewable fuel producers. Leading firms are entering joint ventures and agreements with airlines to expand SAF supply.

ExxonMobil Corporation - A global supplier of jet fuels, expanding SAF research and production.

Chevron Corporation - Strong refining capabilities and active investments in renewable fuel technologies.

Shell plc - Among the leading players in SAF development, with multiple supply agreements across airports.

BP plc - Partnering with airlines to integrate SAF in regular supply chains.

TotalEnergies SE - Expanding production and blending of aviation biofuels across Europe.

Gazprom Neft PJSC - Supplying aviation fuels across Russia and regional markets.

Indian Oil Corporation Ltd. - One of the leading suppliers in Asia, with ongoing SAF pilot projects.

Neste Oyj - A frontrunner in biofuel production, actively scaling SAF capacity.

These players are focusing on infrastructure investment, supply chain resilience, and long-term agreements with airlines to strengthen their presence in a competitive market.

Browse More Details on Energy and Power Research: https://www.mordorintelligence.com/market-analysis/energy-power?utm_source=gracebook

Conclusion: Outlook for the Aviation Fuel Market

The aviation fuel market stands at a crossroads where traditional fuel demand remains strong while sustainability initiatives redefine the long-term trajectory. Passenger recovery, growing cargo operations, and regional airport expansions are ensuring steady growth opportunities. At the same time, the industry's push toward carbon neutrality by 2050 is accelerating the adoption of SAF, biofuels, and synthetic alternatives.

Discover the key trends and market forces pushing aviation fuel demand from USD 212.01 billion in 2025 to over USD 302.81 billion by 2030.