IMARC Group has recently released a new research study titled “Mexico Biofuel Market Size, Share, Trends and Forecast by Type, Feedstock, and Region, 2025-2033” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

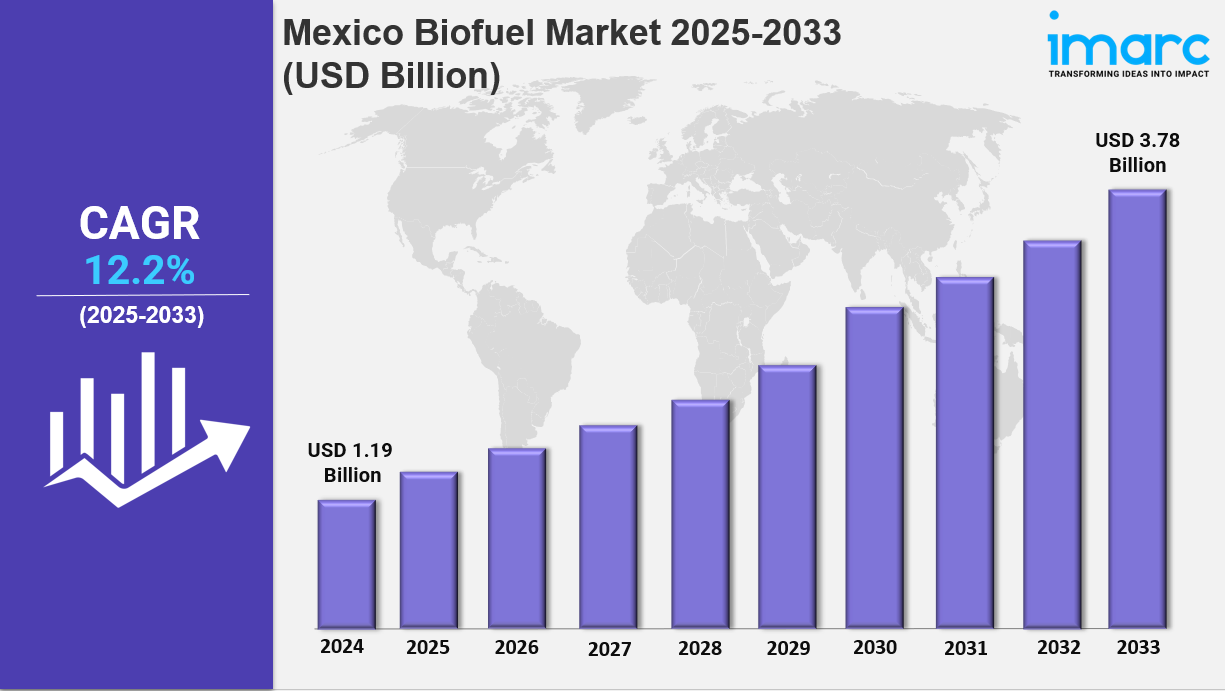

The Mexico Biofuel Market Size reached USD 1.19 Billion in 2024 and is forecasted to grow to USD 3.78 Billion by 2033, registering a CAGR of 12.2% over the 2025-2033 period. Drivers include supportive government policies, environmental concerns, energy independence demands, and technological advancements in biofuels. Growth in agriculture and international trade opportunities further boost market expansion.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Mexico Biofuel Market Key Takeaways

- Current Market Size: USD 1.19 Billion (2024)

- CAGR: 12.2% (2025-2033)

- Forecast Period: 2025-2033

- Mexico focuses heavily on biofuels like bioethanol for decarbonizing transportation, especially from surplus sugarcane.

- Policy initiatives encourage renewable fuels emphasizing a technology-neutral approach to reduce carbon intensity.

- The Clean Transportation Fuel Standard (CTFS) targets a 20% reduction in transportation fuel carbon intensity by 2030.

- Growing local industries and environment-driven strategies are propelling market expansion.

Sample Request Link: https://www.imarcgroup.com/mexico-biofuel-market/requestsample

Market Growth Factors

Mexico’s biofuel market growth is propelled by government policies promoting renewable energy usage to address rising environmental concerns and the increasing demand for energy independence. These policies support a shift towards cleaner fuels, particularly bioethanol derived from surplus sugarcane, which contributes significantly to lowering fossil fuel dependency and carbon emissions nationwide.

The country’s agricultural sector expansion facilitates raw material availability, such as sugar crops and coarse grains, essential for biofuel production. International trade opportunities also provide avenues for increasing biofuel production and consumption within Mexico and beyond. Moreover, technological innovations in biofuel processing enhance efficiency and market viability.

Strategic policy movements like the Clean Transportation Fuel Standard (CTFS) establish robust frameworks for industry growth. CTFS aims to reduce transportation fuel carbon intensity by 20% by 2030 and 30% by 2040 via technology-neutral standards, fostering biofuel adoption. These regulatory actions support Mexico’s commitment to sustainability while inviting growth across the biofuel value chain.

Market Segmentation

Type Insights:

- Biodiesel: Includes all biofuels derived from biological oils and fats used as diesel substitutes, supporting reduced emissions.

- Ethanol: Primarily produced from sugar crop surplus, ethanol is a leading biofuel focusing on sustainable transportation and lower carbon fuel alternatives.

- Others: Encompasses alternative biofuel types not categorized under biodiesel or ethanol; details not explicitly provided.

Feedstock Insights:

- Coarse Grain: Grains like maize serve as feedstock for bioethanol production, contributing to market volume.

- Sugar Crop: Sugarcane and related crops are pivotal for producing bioethanol, a major market segment in Mexico.

- Vegetable Oil: Oils extracted from various vegetables provide raw materials for biodiesel production.

- Others: Other feedstock categories employed for biofuel production, specifics not provided.

Regional Insights:

- Northern Mexico: A key regional market for biofuels, contributing to overall regional production and consumption.

- Central Mexico: Active in biofuel development and market consumption dynamics.

- Southern Mexico: Holds significance due to agricultural output feeding into biofuel production.

- Others: Additional regional markets included but unspecified in detailed metrics.

Regional Insights

Northern Mexico is a dominant region in the biofuel market alongside Central and Southern Mexico, reflecting diverse agricultural practices and production capacities. The segmentation includes Northern, Central, Southern Mexico, and others, but specific market share or CAGR data by region is not provided in the source. The regions collectively support the growing demand and production capabilities of Mexico’s biofuel industry.

Recent Developments & News

In November 2024, GE Aerospace announced plans to conduct tests using 100% biofuels at its Sustainable Aviation Fuel (SAF) laboratory in Mexico. This initiative aligns with GE’s broader objective to develop cleaner aviation solutions and foster sustainable aviation globally. The tests aim to validate biofuels' suitability for future commercial aircraft operations, marking a key step in advancing biofuel technology within Mexico.

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302