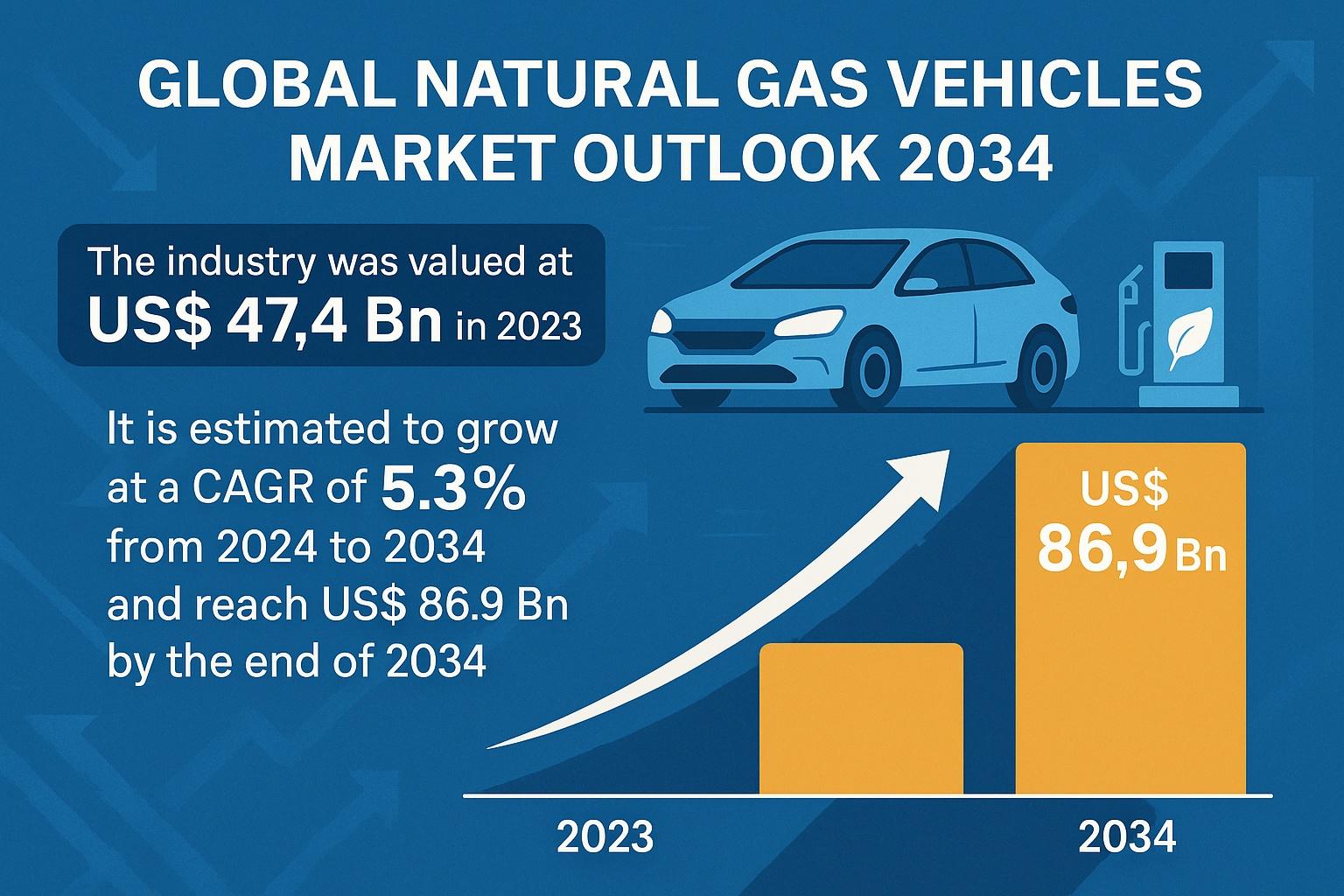

The global natural gas vehicles (NGVs) market is entering a phase of steady expansion, supported by tightening emission regulations, increased adoption of hybrid electric vehicles, and rapid enhancements in natural gas production and refueling infrastructure. Valued at US$ 47.4 Bn in 2023, the market is projected to grow at a CAGR of 5.3% from 2024 to 2034, ultimately reaching US$ 86.9 Bn by 2034. As governments and manufacturers worldwide align with sustainability goals and explore alternatives to gasoline and diesel, natural gas-powered vehicles are emerging as an efficient, low-emission solution for multiple vehicle segments.

Market Overview

Natural Gas Vehicles (NGVs) operate using natural gas as their primary fuel, typically in the form of Liquefied Petroleum Gas (LPG) or Compressed Natural Gas (CNG). These fuels offer significant benefits in terms of emissions and vehicle performance. LPG is known to extend engine life and reduce noise and vibration, while CNG provides noticeable advantages over conventional fuels such as gasoline and diesel by reducing operating costs and greenhouse gas emissions.

Technological advancements have also played a vital role in strengthening the adoption of NGVs. Traditionally, CNG-powered vehicles faced challenges such as reduced power output and limited driving range due to lower compression ratios. However, the development of dual-fuel diesel–CNG engines now allows vehicles to operate efficiently on both fuels, combining increased performance with lower emissions. This innovation is encouraging wider adoption across passenger vehicles, commercial fleets, and heavy-duty trucks.

Analyst Viewpoint

According to industry analysts, the strongest push for NGV adoption comes from the global regulatory shift toward low-emission mobility. Governments across major economies have enforced stringent emission standards to curb nitrogen oxides (NOx), carbon monoxide (CO), carbon dioxide (CO₂), and particulate matter (PM10) emissions. The transportation sector, responsible for a significant portion of global emissions, is experiencing rapid transformation as policymakers encourage cleaner fuel technologies.

Natural gas—being safer, cost-efficient, and significantly cleaner than conventional fuel—has emerged as a vital bridge in the transition toward fully electrified mobility. This regulatory landscape, paired with the growing preference for hybrid electric vehicles powered by CNG, is accelerating market adoption. Analysts also highlight the entry of CNG-powered two-wheelers, which offer high mileage and low emissions, as a promising growth segment that will reshape markets such as India and Southeast Asia.

Drivers Linked to Market Growth

- Stringent Emission Regulations

Urbanization and industrialization have dramatically increased transportation demand, contributing to higher greenhouse gas emissions. In the U.S., transportation emissions increased 1.6% in 2023 compared to 2022. This rising environmental burden has prompted governments to implement strict emission standards.

Countries such as the U.S. and China, which represent the largest vehicle markets, are mandating advanced emission controls. The U.S. Environmental Protection Agency (EPA) issued new standards in March 2024 for light- and medium-duty vehicles beginning in model year 2027. These regulations reinforce the adoption of lower-emission fuel technologies, directly contributing to NGV market expansion.

- Growing Sales of Hybrid Electric Vehicles

A major driver of NGV market growth is the increasing adoption of Hybrid Electric Vehicles (HEVs), many of which can run on compressed natural gas. According to the U.S. Department of Energy, over 175,000 vehicles in the U.S. run on natural gas, and in 2021, natural gas accounted for 4% of transportation energy. HEV sales in the U.S. increased by 53% in 2023 compared to 2022, highlighting a clear trend toward hybrid mobility.

HEVs offer an attractive balance: they alleviate range anxiety associated with pure electric vehicles while enabling reduced emissions through natural gas-compatible powertrains. This synergy is propelling NGV adoption globally.

Regional Outlook

Asia Pacific Leads Global Market Share

Asia Pacific emerged as the leading regional market in 2023, driven largely by expanded natural gas production and a rapidly developing CNG ecosystem. India, for example, produced 34,450 MMSCM of natural gas in FY 2022–2023, strengthening domestic supply chains.

Governments in the region are aggressively expanding CNG refueling infrastructure. India plans to increase its number of CNG stations from 6,000 to over 17,700 by 2030, creating one of the world’s largest natural gas mobility networks. China, Japan, and Southeast Asian countries are also investing heavily in natural gas distribution and vehicle adoption.

Competitive Landscape

The natural gas vehicles market is highly competitive, with global automotive giants and specialized natural gas technology providers strengthening their presence. Key players include:

- FAW Group

- Stellantis

- Ford Motor Company

- General Motors

- Great Wall Motor

- Honda Motor Co., Ltd.

- Hyundai Motor Group

- Mahindra & Mahindra

- Nissan Motor Co., Ltd.

- SAIC Motor

- Suzuki Motor Corporation

- Tata Motors Limited

- Toyota Motor Corporation

- Volkswagen Group

- Westport Fuel Systems Inc.

- Landi Renzo S.p.A.

- Tomasetto Achille Spa

Several of these companies are focusing on aftermarket CNG kits, offering consumers a cost-effective transition away from petrol and diesel.

Recent Developments

- April 2024: Great Wall Motor partnered with Eaton to deploy an Electromechanical Actuation System (EMAS) for its HEVs to increase efficiency through early intake valve closing.

- 2023: Tata Motors launched the Altroz iCNG, featuring innovative twin CNG tanks positioned below the boot floor, enhancing storage without compromising trunk space.

These innovations represent a trend toward improved powertrain efficiency and consumer convenience.

Conclusion

The global Natural Gas Vehicles market is on a clear upward trajectory, fueled by regulatory mandates, hybrid vehicle penetration, and substantial infrastructure investments. With its cost efficiency, safety profile, and significantly lower emissions compared to traditional fuels, natural gas serves as a strong transitional alternative in the global shift toward cleaner mobility.

As nations strive to reduce transportation-related emissions and consumers seek affordable, eco-friendly mobility solutions, NGVs will continue to play a crucial role in the automotive landscape through 2034 and beyond.