IMARC Group has recently released a new research study titled “North America Power Inverter Market Size, Share, Trends and Forecast by Type, Application, End-Use Sector, and Country, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

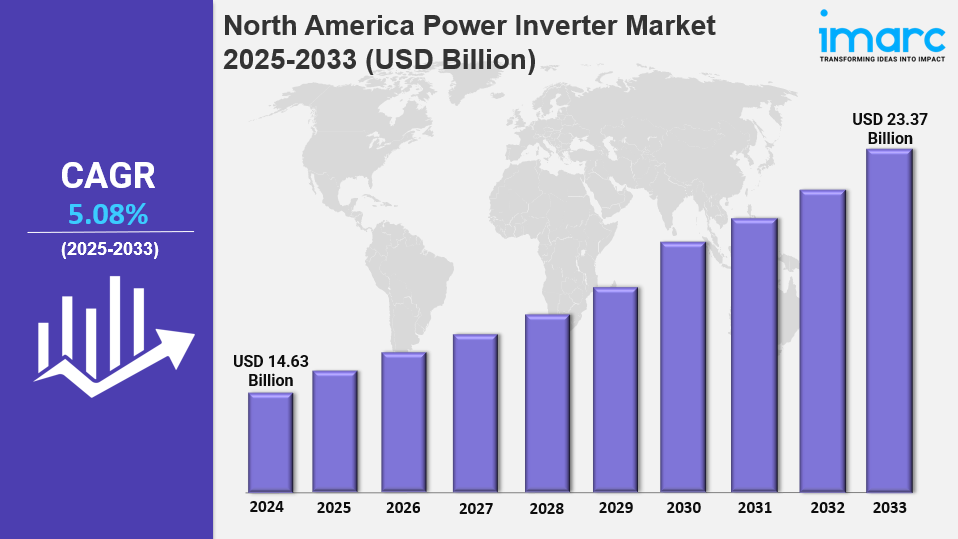

The North America power inverter market share was valued at USD 14.63 Billion in 2024 and is expected to reach USD 23.37 Billion by 2033, growing at a CAGR of 5.08% during the forecast period 2025-2033. The market expansion is driven by rising demand for renewable energy systems, energy storage solutions, electric vehicle infrastructure, rapid technological advancements, and government incentives promoting energy efficiency. Innovations such as microinverters, hybrid systems, and smart technology are further propelling growth.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

North America Power Inverter Market Key Takeaways

- Current Market Size: USD 14.63 Billion in 2024

- CAGR: 5.08% (2025-2033)

- Forecast Period: 2025-2033

- The market growth is fueled by increasing adoption of renewable energy systems, energy storage, and electric vehicle infrastructure.

- Technological advancements like microinverters and hybrid inverters enhance market appeal.

- Government incentives and policies in North America strongly support clean energy adoption.

- Motor drives represent the largest application segment, driven by industrial energy-efficiency demands.

- The utility sector stands as the largest end-use segment due to renewable energy integration into power grids.

Sample Request Link: https://www.imarcgroup.com/north-america-power-inverter-market/requestsample

North America Power Inverter Market Growth Factors

The North America power inverter market is expanding primarily due to the growing adoption of renewable energy systems such as solar and wind power. In 2023, the U.S. installed a record 31 gigawatts (GW) of solar capacity, a 55% increase from 2022, bringing total installed capacity to 161 GW. This capacity meets roughly 5% of the country’s electricity demand and fuels demand for inverters that convert direct current (DC) from solar panels and wind turbines to alternating current (AC) for use. Government incentives, subsidies, and tax benefits make solar energy more affordable, while falling prices of solar panels and wind turbines have encouraged residential and commercial users to switch to renewable energy.

Energy storage solutions are another critical growth driver, enabling users to store excess electricity generated from solar and wind for later use, especially in areas with inconsistent sunlight or wind. Effective management of energy storage systems relies heavily on power inverters to regulate energy storage and discharge. The International Energy Agency projects that energy storage capacity must increase six-fold by 2030 to reach 1,500 GW, which will significantly boost power inverter demand.

The increasing popularity of electric vehicles (EVs) strongly influences market growth by driving demand for EV charging infrastructure. In 2023, the U.S. registered 1.4 million new electric cars, a 40% increase from 2022. This growth necessitates inverters to convert electricity for EV chargers efficiently. Concurrently, government initiatives across North America offer tax credits, rebates, and incentives for energy-efficient upgrades, fostering greater adoption of power inverters. Mexico's unique energy market plan balances state and private electricity providers, while the U.S. government’s clean energy goals support renewable investments, further stimulating market expansion.

Technological advancements in inverter design, including grid-tied, hybrid, and microinverters, enhance efficiency, compactness, and capacity. Microinverters improve solar system performance by allowing individual panel operation. Smart inverter technology offering remote monitoring and real-time diagnostics improves usability and efficiency, contributing to market growth.

To get more information on this market, Request Sample

North America Power Inverter Market Segmentation

Breakup by Type:

- <5KW

- 5KW to 95KW

- 100KW to 495KW: This segment leads the market, favored for commercial and industrial solar installations for offering balanced efficiency, cost-effectiveness, and scalability.

- Above 500KW

Breakup by Application:

- Motor Drives: Dominant segment driven by demand for energy-efficient motor control in industries like HVAC, pumps, conveyor belts, and machinery.

- UPS

- Rail Traction

- Wind Turbines

- EVs/HEVs

- Solar PVs

- Others

Breakup by End-Use Sector:

- Utility: Largest segment driven by renewable energy integration into the grid and demand for large-scale inverters for power generation and grid stability.

- Residential

- Commercial and Industrial

Regional Insights

The United States dominates the North America power inverter market due to its significant investments in renewable energy infrastructure and technological advancement. The U.S. had 161 GW of installed solar capacity by 2023 and leads in energy storage and electric vehicle infrastructure developments. Government incentives coupling tax credits and renewable energy mandates have further accelerated the market. The country’s emphasis on carbon emission reduction and grid resilience ensures continuous investment in advanced inverter technologies, making it the largest regional market within North America.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=1686&flag=C

Recent Developments & News

- December 2024: Enphase Energy launched the Busbar Power Control software that enables larger solar and energy storage systems without upgrading home electricity panels, enhancing power efficiency and system design flexibility.

- December 2024: SolarEdge Technologies shipped the SolarEdge Home Battery 'USA Edition' with 9.7kWh storage, completing its range of U.S.-made solar and storage products eligible for the Domestic Content Bonus Credit.

- September 2024: GE Vernova Inc. introduced a 6 MVA, 2000-volt direct current utility-scale inverter, aiming to reduce solar energy costs and promote renewables in North America.

- September 2024: Sineng Electric completed its first shipment of power conversion systems to the U.S. for a 140.8MW/140.8MWh Texas energy storage project, marking its North American entry.

- September 2024: Solis launched two new string inverter models, S5-GC125K-US (125 kW) and S5-GC60K-LV-US (60 kW), offering up to 98.5% efficiency with features for reliability and wide temperature range.

Key Players

- Enphase Energy

- SolarEdge Technologies

- GE Vernova Inc.

- Sineng Electric

- Solis

Competitive Landscape

The market research report covers a comprehensive competitive landscape analysis including market structure, key player positioning, winning strategies, competitive dashboards, and company evaluation quadrants. Detailed profiles of all major companies have been provided.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302