IMARC Group has recently released a new research study titled “Mexico Catheters Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2026-2034” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

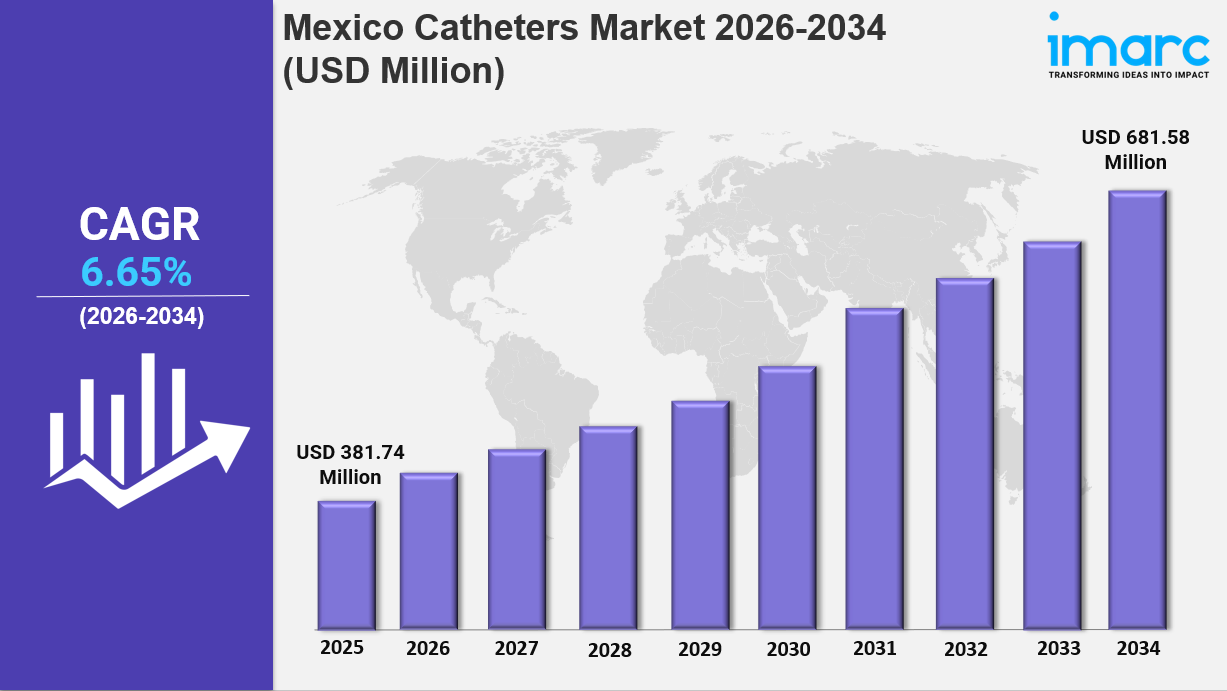

The Mexico catheters market size was valued at USD 381.74 Million in 2025 and is projected to reach USD 681.58 Million by 2034, exhibiting a CAGR of 6.65% from 2026 to 2034. Growth is driven by an aging population, rising cardiovascular diseases, diabetes, and chronic kidney conditions. Government healthcare infrastructure investments and minimally invasive surgical adoption are also key factors reshaping treatment protocols and increasing demand.

Study Assumption Years

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

Mexico Catheters Market Key Takeaways

- Current Market Size: USD 381.74 Million in 2025

- CAGR: 6.65% from 2026 to 2034

- Forecast Period: 2026-2034

- Cardiovascular catheters dominate with a 28% market share in 2025 due to the high prevalence of heart disease.

- Hospitals and clinics represent the leading end-user segment, with a 71% share in 2025, attributed to their advanced infrastructure and specialized personnel.

- The market features a competitive landscape including multinational corporations and regional distributors with strong distribution networks.

- Government initiatives, including the opening of new hospitals and clinics, drive increased medical device demand.

- Growing medical tourism in Mexico supports the demand for advanced catheter technologies.

Sample Request Link: https://www.imarcgroup.com/mexico-catheters-market/requestsample

To get more information on this market, Request Sample

Mexico Catheters Market Growth Factors

Rising Prevalence of Cardiovascular and Chronic Diseases

Mexico is experiencing a significant increase in cardiovascular diseases, which account for nearly one-fourth of all deaths in the country. In 2024, approximately 192,518 fatalities were linked to cardiovascular conditions, making them the leading cause of mortality. High rates of hypertension, affecting around 29.4% of adults, along with widespread diabetes, are driving sustained demand for diagnostic and therapeutic catheter procedures. To meet this growing need, hospitals and specialty centers are expanding catheterization labs, enabling timely, minimally invasive treatments and improved management of chronic conditions.

Government Investments in Healthcare Infrastructure

The Mexican government is actively investing in healthcare infrastructure by constructing new hospitals, modernizing existing facilities, and upgrading surgical departments with advanced technologies. Institutions such as IMSS are central to these initiatives, expanding access to specialized care across multiple regions. These efforts support wider adoption of catheter-based procedures, enhance service delivery in underserved areas, and facilitate the integration of modern medical devices into routine clinical practice.

Demographic Shifts and an Aging Population

Mexico’s demographic transition—marked by declining birth rates and increased life expectancy—has led to a growing elderly population. In 2024, individuals aged 65 and above made up approximately 9.68% of the population, reaching a historic high. This aging demographic is driving greater demand for catheters due to higher rates of cardiovascular disease, urinary complications, and other chronic conditions requiring regular monitoring and minimally invasive interventions. Healthcare systems are adapting care models to meet the evolving needs of this expanding elderly population.

Mexico Catheters Market Segmentation

Breakup by Product Type:

- Cardiovascular Catheters

- Urology Catheters

- Intravenous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Others

Breakup by End User:

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Others

Breakup by Region:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Product Type Insights:

Cardiovascular catheters lead the market with a 28% share in 2025, reflecting the high burden of heart disease. They are critical for diagnostic coronary angiography and therapeutic interventions such as angioplasty and stent placement. Rising cardiovascular risk factors including hypertension (approx. 29.4% of adults) and diabetes sustain demand. Growing interventional cardiology capabilities and preference for minimally invasive cardiac procedures support continued growth.

End User Insights:

Hospitals and clinics dominate with a 71% share in 2025, due to their comprehensive infrastructure including catheterization laboratories, imaging equipment, and specialized medical staff. Mexico has around 3,587 hospitals with over 7,774 operating rooms, providing substantial catheter utilization capacity. Major public institutions like IMSS and ISSSTE and private hospitals enhance interventional capabilities via investments, with government initiatives further strengthening this segment.

Regional Insights:

- Northern Mexico: Significant market presence due to advanced healthcare infrastructure in industrial border cities, proximity to U.S. medical practices, well-developed hospital networks (e.g., Monterrey, Tijuana), and a growing medical tourism sector.

- Central Mexico: Anchored by Mexico City and metro areas, contains major hospitals, specialized centers, and tertiary care facilities, with nation-leading interventional cardiology programs driving demand.

- Southern Mexico: Emerging growth opportunities, though healthcare infrastructure is less advanced compared to other regions. Government initiatives improving healthcare access are gradually increasing catheter availability.

- Others: Contribute via evolving healthcare systems and regional medical centers, supported by federal programs bolstering infrastructure.

Regional Insights

Northern Mexico holds a significant position due to advanced healthcare infrastructure, industrial cities along the border, proximity to U.S. medical practices, and a growing medical tourism sector. Central Mexico, supported by Mexico City, commands substantial demand with major hospitals and advanced catheterization programs. These dynamics, complemented by government efforts in southern and other regions, drive catheter adoption nationwide.

Speak to an Analyst: https://www.imarcgroup.com/request?type=report&id=33402&flag=C

Recent Developments & News

In May 2025, Quasar Medical acquired Nordson MEDICAL’s design and development business, including its Tecate, Mexico facility. This acquisition expands Quasar’s global CDMO capabilities and strengthens its position in catheter and interventional device manufacturing by leveraging Nordson MEDICAL’s design expertise. In September 2025, Nordson Corporation confirmed divesting its contract-manufacturing design and development units to Quasar Medical, allowing Nordson MEDICAL to focus on proprietary medical-component portfolios while enhancing Quasar’s CDMO capabilities.

Key Players

- Sahajanand Medical Technologies (SMT)

- Bactiguard

- Quasar Medical

- Nordson MEDICAL

- Nordson Corporation

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302