Executive Summary Usage-Based Insurance Market :

Executive Summary Usage-Based Insurance Market :

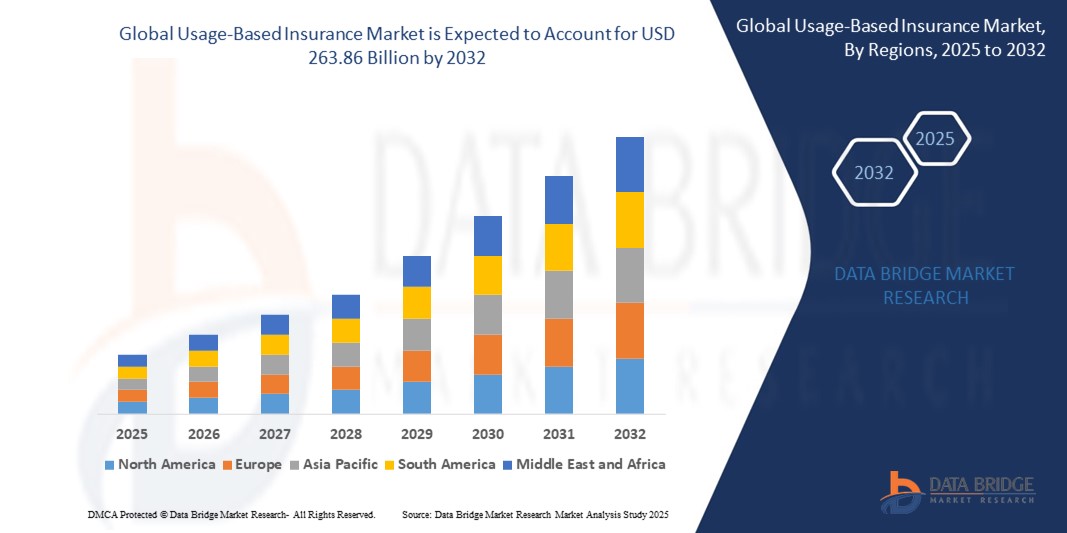

The global usage-based insurance market size was valued at USD 39.83 billion in 2024 and is expected to reach USD 263.86 billion by 2032, at a CAGR of 26.66% during the forecast period

A perfect combination of advanced industry insights, practical solutions, talent solutions and latest technology is utilized in this Usage-Based Insurance Market report which presents an excellent experience to the readers or end users. A comprehensive data of market definition, classifications, applications, engagements, market drivers and market restraints are key sections of this report and all of them are derived from SWOT analysis. The report also consists of historic data, present market trends, environment, technological innovation, upcoming technologies and the technical progress in the related industry. Usage-Based Insurance Market report saves valuable time as well as adds credibility to the work that has been done to grow your business.

Usage-Based Insurance Market research report is also full of strategic profiling of top players in the market, wide-ranging analysis of their core competencies, and their strategies such as new product launches, expansions, agreements, joint ventures, partnerships, and acquisitions which are applicable for the businesses. This market report comprises of an all-embracing research on the current conditions of the industry, potential of the market in the present and the future prospects from various angles. Usage-Based Insurance Market business report contains market research data which has been interpreted and categorized well that brings marketplace clearly into the focus.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Usage-Based Insurance Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-usage-based-insurance-market

Usage-Based Insurance Market Overview

**Segments**

- **By Package Type**: The market can be segmented into Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), and Manage-How-You-Drive (MHYD). PAYD involves calculating premiums based on the number of miles driven, PHYD involves analyzing driving behavior like speed, braking, and cornering, while MHYD combines elements of both miles driven and driving behavior.

- **By Vehicle Type**: Segmentation by vehicle type includes passenger vehicles, commercial vehicles, and electric vehicles. Different types of vehicles may have varying risk factors and usage patterns, thereby affecting the insurance premiums.

- **By Device Offering**: This segment includes insurance companies offering UBI through either the company's own telematics device or a mobile app-based solution. The choice of device offering can impact customer adoption and data collection methods.

- **By End-User**: The market can be further segmented into individual car owners and fleet owners. Individual car owners may opt for UBI for personal vehicles, while fleet owners may use it for their commercial vehicles to track usage and improve operational efficiency.

**Market Players**

- **Progressive Corporation**: As one of the pioneers in UBI, Progressive offers Snapshot, a program that tracks driving behaviors and provides potential discounts based on safe driving.

- **Allstate Corporation**: Allstate's Drivewise program rewards safe drivers with cashback and discounts on premiums by monitoring driving habits through a telematics device or mobile app.

- **State Farm Mutual Automobile Insurance Company**: State Farm's Drive Safe & Save program offers personalized insurance rates based on driving behaviors monitored through a mobile app or OnStar system.

- **Metromile**: Metromile offers pay-per-mile insurance, where customers pay based on the number of miles driven, making it a popular choice for low-mileage drivers.

- **TomTom Telematics**: TomTom provides telematics solutions for UBI, enabling insurance companies to collect and analyze driving behavior data efficiently.

The global usage-based insurance market is witnessing significant growth due to increasing adoption of telematics technology, rising awareness about driver safety, and the need for personalized insurance solutions. The segmentation based on package type, vehicle type, device offering, and end-user provides insights into the diverse market trends and opportunities. Market players such as Progressive Corporation, Allstate Corporation, State Farm Mutual Automobile Insurance Company, Metromile, and TomTom Telematics are leading the innovation in UBI offerings. These companies are leveraging telematics data and customer-centric approaches to provide tailored insurance packages and promote safer driving practices among consumers. The competitive landscape is expected to intensify as more players enter the market with advanced telematics solutions and value-added services for customers.

The global usage-based insurance market is characterized by a dynamic landscape driven by technological advancements, changing consumer preferences, and regulatory developments. One key trend shaping the market is the increasing integration of artificial intelligence and machine learning algorithms in telematics systems to analyze driving patterns more accurately and offer personalized insurance premiums. As insurers strive to differentiate their offerings in a competitive market, they are focusing on enhancing customer engagement through mobile apps, gamification elements, and rewards programs based on safe driving behavior. These initiatives not only promote road safety but also help in establishing long-term customer relationships and loyalty.

Another aspect influencing the market is the shift towards connected car ecosystems and smart mobility solutions. With the proliferation of Internet of Things (IoT) devices and the advent of 5G technology, insurers are exploring opportunities to partner with automakers and technology providers to leverage real-time data from vehicles for risk assessment and claims management. This trend aligns with the broader industry movement towards digitalization and data-driven decision-making, enabling insurers to offer value-added services such as predictive maintenance, emergency roadside assistance, and stolen vehicle recovery.

Moreover, the rise of usage-based insurance for electric vehicles presents a lucrative growth opportunity for market players. As consumers increasingly adopt electric mobility for its environmental benefits and cost savings, insurers are designing UBI programs tailored to the specific needs and characteristics of electric cars. Factors such as battery performance, charging habits, and driving range are being incorporated into risk assessment models to offer competitive premiums and promote sustainability in the transportation sector.

Furthermore, regulatory initiatives focusing on data privacy and cybersecurity pose challenges for the UBI market. Insurers are required to comply with stringent laws and regulations governing the collection, storage, and sharing of telematics data to protect consumers' personal information and prevent unauthorized access. As data protection measures become more complex and comprehensive, insurers need to invest in robust cybersecurity frameworks and transparent data governance practices to ensure compliance and earn consumer trust.

In conclusion, the global usage-based insurance market is poised for continued growth and innovation driven by technological advancements, changing consumer preferences, and regulatory dynamics. Market players that can navigate these complexities, leverage data analytics effectively, and deliver compelling value propositions to customers are likely to succeed in this dynamic and evolving landscape. As the market evolves, collaboration among insurers, technology companies, and regulatory bodies will be essential to shape the future of usage-based insurance and promote safer, more sustainable mobility solutions globally.The usage-based insurance market continues to evolve and expand driven by various factors such as technological advancements, changing consumer preferences, and regulatory developments. One key trend that is reshaping the market is the incorporation of artificial intelligence and machine learning algorithms into telematics systems. By utilizing these advanced technologies, insurers are able to analyze driving patterns with greater accuracy, leading to the provision of more personalized insurance premiums. This not only enables insurers to attract and retain customers but also promotes safer driving practices among policyholders, ultimately reducing the risk of accidents and claims.

Another significant development in the market is the increasing integration of connected car ecosystems and smart mobility solutions. With the rise of IoT devices and the advancement of 5G technology, insurers are leveraging real-time data from vehicles to assess risks more effectively and manage claims efficiently. Partnerships with automakers and technology providers are enabling insurers to explore new avenues for value-added services like predictive maintenance and emergency roadside assistance, enhancing the overall customer experience and driving market growth.

Furthermore, the adoption of usage-based insurance for electric vehicles presents a promising opportunity for market players. As the shift towards electric mobility gains momentum, insurers are tailoring UBI programs to cater to the unique characteristics of electric cars, including factors like battery performance and driving range. By incorporating these specific metrics into risk assessment models, insurers can offer competitive premiums to electric vehicle owners, fostering sustainability in the transportation sector and aligning with global trends towards environmental consciousness.

However, amidst the market opportunities, challenges related to data privacy and cybersecurity are becoming increasingly significant. With stringent regulations governing the collection and handling of telematics data, insurers are required to implement robust cybersecurity measures to safeguard consumer information and ensure compliance with data protection laws. Building transparent data governance practices and investing in cybersecurity frameworks are crucial steps for insurers to maintain consumer trust and meet regulatory requirements in an environment of evolving data privacy regulations.

In conclusion, the global usage-based insurance market is poised for continued growth and innovation as market players leverage technology, respond to changing consumer preferences, and address regulatory complexities. By embracing AI and machine learning, expanding into connected car ecosystems, catering to the needs of electric vehicle owners, and prioritizing data privacy and cybersecurity, insurers can position themselves for success in a competitive and dynamic market landscape. Collaboration among industry stakeholders will be key to shaping the future of usage-based insurance and driving advancements in safer, more sustainable mobility solutions globally.

The Usage-Based Insurance Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-usage-based-insurance-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Radical conclusions of the report:

- Industry overview with a futuristic perspective

- Analysis of production costs and analysis of the industrial chain

- Full regional analysis

- Benchmarking the competitive landscape

- Usage-Based Insurance Market Growth Trends: Current and emerging

- Technological developments and products

- Comprehensive coverage of market factors, restraints, opportunities, threats, limitations, and outlook for the Market

- SWOT Analysis, Porter's Five Forces Analysis, Feasibility Analysis, and ROI Analysis

Browse More Reports:

Global Data Centre Rack Server Market

Europe Automated Material Handling Market

Global Sustainable Plastic Market

Asia-Pacific Underactive Bladder Market

Global Remote Monitoring and Control System Market

Global Blood Collection Market

Global Swine Feed Additives Market

Global Fabry Disease Drug Market

Middle East and Africa Medical Device Testing Market

Europe Insulin Delivery Devices Market

Europe Nucleic Acid Therapeutics, Sport Food Additives and Skin Care Market

Global Sexually Transmitted Diseases (STDs) Antimicrobial Medication Market

Europe Electrosurgery Equipment Market

Middle East and Africa Commercial Seaweed Market

Global Antiphospholipid Antibody Syndrome Market

Global Haemophilus Influenzae Infection Market

Global Face Transplants Market

Asia-Pacific Video Measuring System Market

Global Specialty Paper Market

Global Sleeve Labels Market

Global Sputum Test Market

Global Liposome Drug Delivery Market

Asia-Pacific Digital Payment Market

Asia-Pacific Health Screening Market

North America Nucleic Acid Therapeutics, Sport Food Additives and Skin Care Market

Global Ribbed Phenolic Cap Market

Asia-Pacific Craniomaxillofacial Implants Market

Global Instant Meals Market

Global Small Kitchen Appliances Market

Global Cytokine Release Syndrome Drug Market

North America Pharmaceutical Isolator Market

Global Medical Coatings Market

Global Natural Refrigerants Market

Global Private Network Services Market

Global Liquid Packaging Carton Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com