In 2025, the U.S. business landscape is more competitive than ever. From startups to established corporations, companies are searching for smarter ways to cut costs, improve compliance, and focus on growth. One trend leading the charge? Offshore accounting & taxation services. But why are so many American businesses making the shift this year? Let’s explore the reasons and the results.

What Are Offshore Accounting & Taxation Services?

Put simply, offshore accounting & taxation services involve outsourcing your financial and tax-related tasks to qualified professionals outside the United States. This could include:

-

Bookkeeping and financial reporting

-

Corporate tax preparation and filing

-

Payroll processing

-

Accounts payable and receivable management

-

Tax compliance and advisory

By tapping into global talent pools—often in countries with lower labor costs and strong financial expertise—US companies can streamline operations without compromising quality.

Why Is 2025 a Turning Point for Offshore Accounting?

Several shifts in the global and domestic economy have made offshore solutions more attractive than ever:

-

Post-pandemic digitization – Cloud-based accounting platforms make remote collaboration seamless.

-

Talent shortages – Many US firms struggle to find skilled accountants locally.

-

Economic pressures – Rising wages and inflation make in-house teams more expensive.

-

24/7 operations – Offshore teams in different time zones allow round-the-clock productivity.

In short, the technology is ready, the talent is available, and the need for cost efficiency is urgent.

7 Reasons US Companies Are Choosing Offshore Accounting & Taxation in 2025

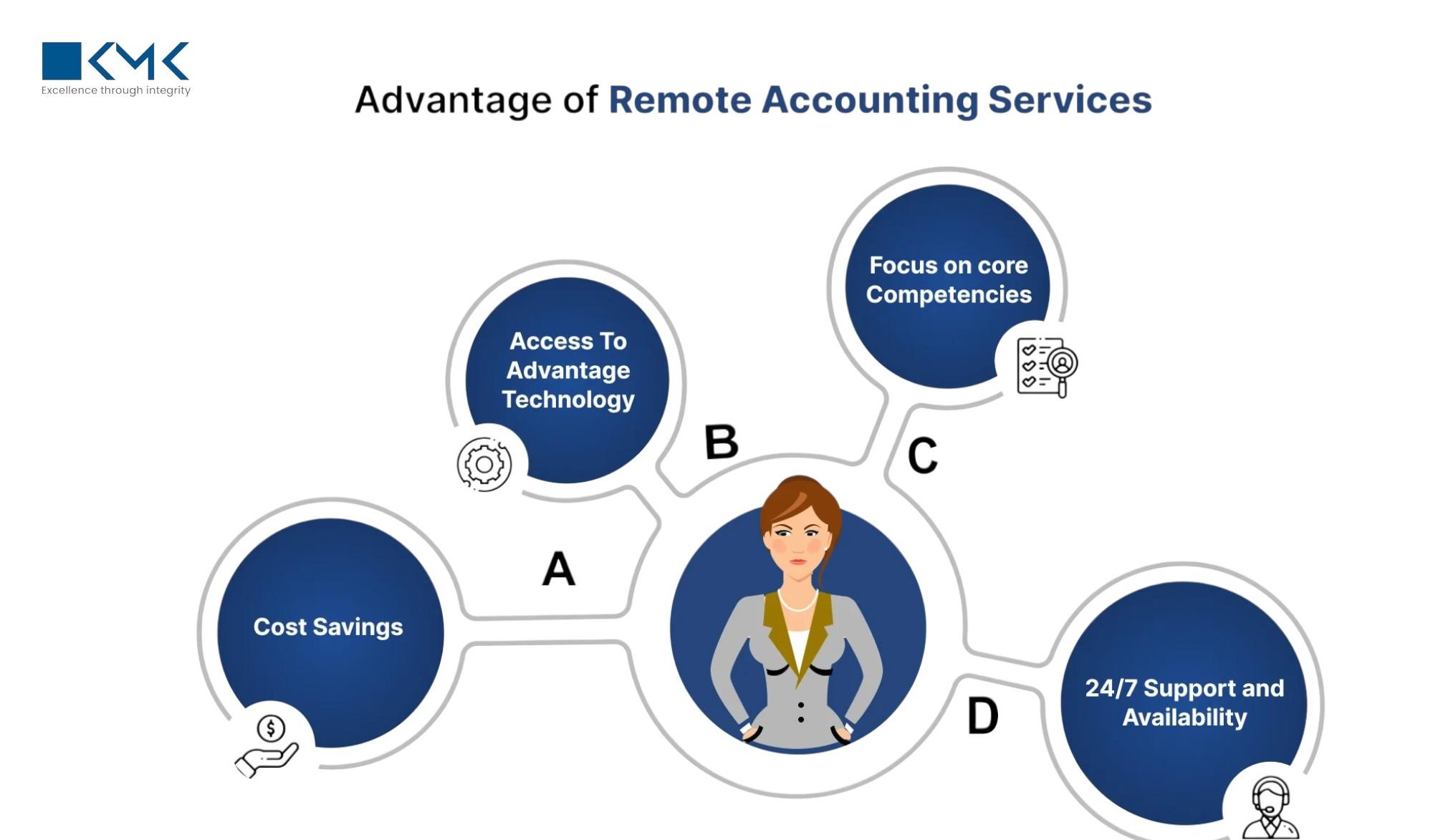

1. Significant Cost Savings

Hiring and retaining in-house accountants can be costly—especially with salaries, benefits, and training expenses. Offshore accounting & taxation services provide access to skilled professionals at a fraction of the cost, without compromising on accuracy or compliance.

2. Access to Global Expertise

Top offshore firms employ certified accountants and tax specialists who stay updated on both U.S. GAAP and IRS regulations. This ensures compliance and minimizes costly mistakes.

3. Scalability on Demand

Need more support during tax season or year-end closing? Offshore providers offer flexible scaling, so you pay for what you need—no more, no less.

4. Time Zone Advantage

Imagine sending tasks at the end of your workday and receiving completed reports the next morning. Offshore teams in countries like India or the Philippines turn time differences into a productivity booster.

5. Focus on Core Business

By outsourcing time-consuming accounting and tax work, business leaders can focus on strategic growth, customer relationships, and innovation.

6. Enhanced Data Security

Contrary to outdated perceptions, reputable offshore providers use advanced encryption, multi-factor authentication, and secure cloud platforms to protect sensitive financial data.

7. Technology Integration

Offshore accounting isn’t just about labor—it’s about leveraging automation tools, AI-based tax compliance systems, and real-time reporting dashboards that many offshore providers already have in place.

Common Misconceptions About Offshore Accounting & Taxation

"Offshore means low quality."

Not true many offshore teams have advanced degrees, CPA certifications, and extensive experience with US tax laws.

"It’s risky for data security."

When you work with reputable providers who follow international compliance standards like ISO 27001 and GDPR, security is often stronger than in-house setups.

"It’s only for big companies."

Small and mid-sized businesses benefit just as much, often gaining the resources they need to compete with larger competitors.

How Offshore Services Improve Tax Compliance in 2025

With ever-changing tax regulations, compliance is a challenge for US firms. Offshore accounting & taxation services bring:

-

Expert interpretation of IRS updates

-

Accurate and timely filings

-

Reduced audit risk

-

Proactive tax planning to lower liabilities

By ensuring compliance, companies avoid penalties while optimizing tax strategies.

Questions US Businesses Should Ask Before Choosing an Offshore Partner

To get the best results, ask potential providers:

-

What certifications and training do your accountants have?

-

How do you ensure compliance with US accounting and tax laws?

-

What security measures protect my financial data?

-

Can you integrate with my current accounting software?

-

What is your track record with US-based clients?

These questions help ensure you choose a partner that’s reliable, compliant, and aligned with your business goals.

Real-World Example: A Mid-Sized US Firm’s Transformation

A Boston-based consulting firm reduced its annual accounting costs by 40% after partnering with an offshore provider. Not only did they save money, but they also gained:

-

Faster monthly financial reporting

-

On-demand tax advisory services

-

More time for the leadership team to focus on client acquisition

This story is becoming increasingly common in 2025 as companies discover the operational and financial advantages of going offshore.

The Future of Offshore Accounting for US Businesses

As AI, automation, and cloud platforms continue to evolve, offshore accounting & taxation services will become even more efficient. The ability to combine human expertise with advanced tech means businesses can expect:

-

Real-time financial insights

-

Predictive tax planning

-

Seamless multi-country compliance

In the next few years, the question won’t be if companies use offshore accounting—it will be how much of their financial operations they outsource.

Final Thoughts

In 2025, offshore accounting & taxation services are no longer just a cost-cutting tool they’re a strategic advantage. By reducing expenses, improving compliance, and leveraging global talent, US companies are positioning themselves for sustainable growth. If your business is looking to save money, improve accuracy, and gain financial agility, exploring offshore solutions could be your smartest move this year.