Financial crime continues to grow in scale and sophistication, putting immense pressure on financial institutions, regulators, and technology service providers. As threats evolve, the need for robust, agile, and technology-driven Financial Crime and Compliance (FCC) Operations Services has never been greater. QKS Group’s latest market research provides a comprehensive understanding of this landscape through meticulous examination of global trends, market dynamics, and the future outlook for both service vendors and end users. The report also features the SPARK Matrix Financial Crime and Compliance Operations Services analysis, which delivers an in-depth evaluation of leading vendors, their competitive strengths, and market positioning.

Comprehensive Market Landscape and Growth Opportunities

The FCC Operations Services market is witnessing both short-term and long-term growth opportunities driven by rising regulatory scrutiny, increasing digital transactions, and the global expansion of financial ecosystems. Organizations today face higher risks associated with money laundering, terrorist financing, fraud, sanctions violations, and other illicit activities. Consequently, the demand for advanced FCC capabilities is accelerating across banking, insurance, fintech, capital markets, and non-financial sectors.

QKS Group’s research highlights that regulatory bodies across the world are tightening compliance frameworks, requiring institutions to invest in enhanced monitoring, investigation, and reporting processes. These changes have triggered a notable shift toward outsourcing FCC operations to specialized service vendors that offer domain expertise, scalability, and advanced technology integration.

Supporting Vendors and Users with Strategic Insights

The report offers crucial insights for technology and service providers, helping them understand the existing market landscape, customer expectations, and areas of competitive differentiation. It equips vendors with the strategic information needed to design service offerings aligned with evolving regulatory requirements and industry needs.

For users, the study provides decision-making support to evaluate vendor capabilities, operational maturity, technology innovation, and global influence. This holistic perspective ensures that organizations can select partners capable of delivering long-term value and superior FCC outcomes.

SPARK Matrix Evaluation and Competitive Benchmarking

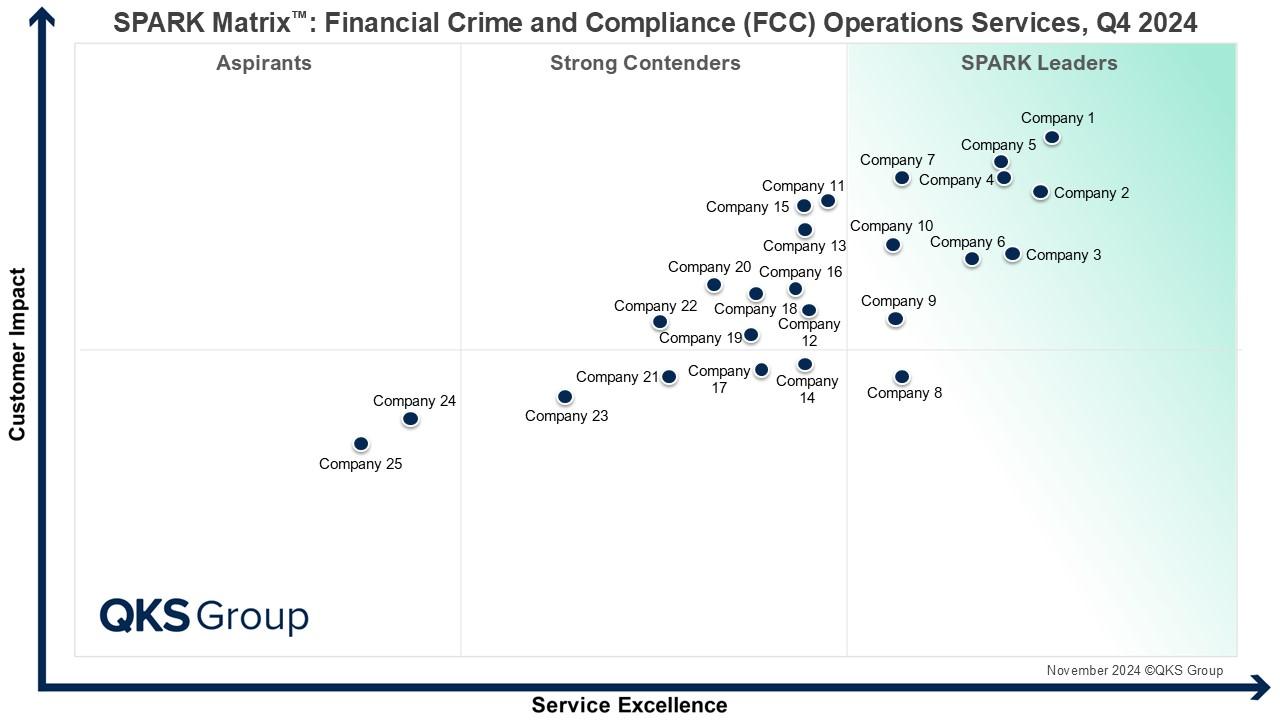

A key component of QKS Group’s research is the proprietary SPARK Matrix Financial Crime and Compliance Operations Services analysis, which assesses and ranks vendors based on technology excellence, customer impact, and overall market performance. Leading global companies included in the SPARK Matrix evaluation are:

- TCS

- Deloitte

- Accenture

- EY

- Infosys

- Wipro

- Cognizant

- Capgemini

- PwC

- Tech Mahindra

- KPMG

- Genpact

- Concentrix

- Atos

- WNS

- Mphasis

- EXL

- Sutherland Global Services

- NTT Data Corporation

These vendors play a vital role in shaping the global FCC operations landscape through innovations in analytics, automation, AI-based risk detection, case investigation, and compliance workflows.

AI, ML, and Predictive Analytics Transforming FCC Operations

The adoption of artificial intelligence (AI), machine learning (ML), and intelligent analytics has become a defining trend in modern FCC operations. These technologies are enhancing the accuracy and speed of detecting suspicious activities, reducing false positives, and enabling early identification of emerging threats.

Predictive analytics empowers institutions to forecast high-risk behaviors, identify anomaly patterns, and take preventive action before financial losses occur. AI-driven models are also improving customer risk scoring, sanctions screening, fraud detection, and transaction monitoring processes.

In addition, automation is streamlining repetitive tasks, enabling compliance analysts to focus on more complex investigations. As digital ecosystems expand, this technology-driven approach will be essential for maintaining agility and precision.

Cross-Border Collaboration and Regulatory Evolution

Financial crimes are increasingly cross-border in nature, prompting regulators to enhance information-sharing frameworks and cooperative enforcement. Global collaboration among regulatory bodies, law-enforcement agencies, and financial institutions is becoming central to risk mitigation.

At the same time, regulatory requirements are growing more complex, demanding adaptive and proactive compliance strategies. Institutions must continuously update their operational models, technology infrastructure, and talent structures to remain compliant amid rapidly shifting expectations.

Talent, Technology, and the Future of FCC Operations

While technology is revolutionizing FCC operations, specialized talent remains equally important. The market is witnessing rising demand for compliance analysts, AML experts, investigation specialists, data scientists, and AI model validators. Institutions are increasingly adopting hybrid operating models that combine human expertise with digital intelligence.

In the years ahead, investment in both technology and skilled talent will be critical. Organizations that successfully balance these elements will be better equipped to mitigate risks, ensure regulatory compliance, and stay resilient in a complex financial environment.

Conclusion

The global FCC Operations Services market is undergoing a transformative shift driven by technology innovation, evolving regulations, and the growing threats associated with financial crime. QKS Group’s detailed research and vendor benchmarking offers indispensable guidance for stakeholders across the ecosystem. With the rise of AI, predictive analytics, and collaborative regulatory efforts, the future of FCC operations promises greater efficiency, accuracy, and adaptability. Vendors and institutions that embrace this transformation will gain a significant competitive advantage in safeguarding the financial system.

#FinancialCrimeCompliance #FCCOperations #RiskManagement #ComplianceServices #SPARKMatrix